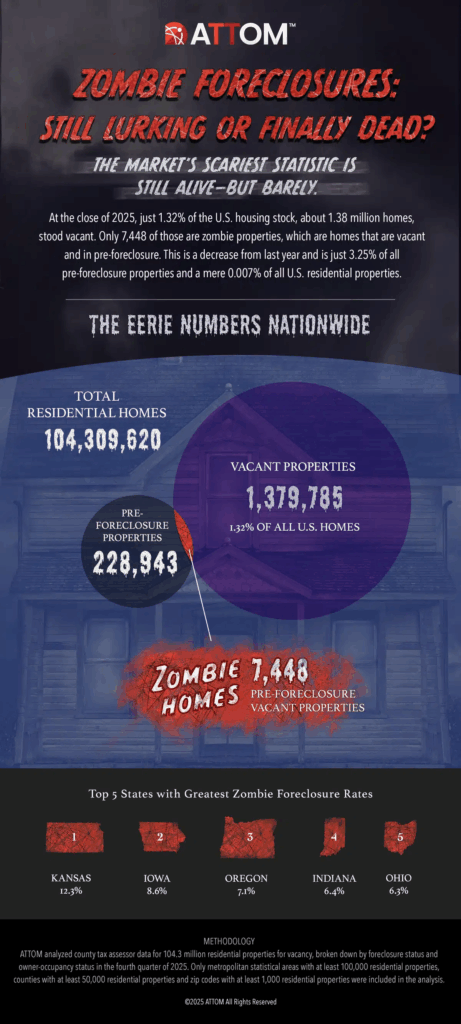

According to ATTOM’s fourth-quarter 2025 Vacant Property and Zombie Foreclosure Report, 1.4 million homes, or 1.32% of all residential properties in the U.S., were unoccupied. Due to the nation’s ongoing high housing demand, that was a modest decrease from the 1.33% national vacancy rate in the previous quarter.

Note: The analysis compares monthly updated vacancy statistics with publicly documented real estate data gathered by ATTOM, such as owner-occupancy status, equity, and foreclosure status.

According to the analysis, during Q4, 228,943 residential homes across the country were in the foreclosure process. Approximately 7,448 homes, or 3.25% of them, were “zombie” properties—that is, residences whose owners had abandoned them before the foreclosure process was over. This was a decrease from the previous quarter’s zombie rate of 3.38%t.

“These continuously low vacancy rates that the nation has held steady at around 1.4% for nearly four years, show that record high prices haven’t dampened the demand for homes,” said Rob Barber, CEO of ATTOM. “It’s a good sign for local housing markets that even as we’ve seen foreclosure filings increase, the rate of homes in foreclosure that are abandoned is going down.”

Measuring Zombie Trends Nationwide

In 21 states and the District of Columbia, the number of zombie properties increased from quarter to quarter, albeit the increases were slight, with some jurisdictions seeing as little as one new zombie property.

Oregon saw the largest quarter-over-quarter increases in zombie properties among states with at least 50 zombie properties, rising 37.8% to 51 zombie properties in Q4; Nevada saw a 31.1% increase to 59; Georgia saw a 15.6% increase to 74; Ohio saw a 9% increase to 606; and Arizona saw a 6.3% increase to 68.

Those with the largest quarter-over-quarter drops in zombie properties were:

- Oklahoma (down 23% to 57)

- Indiana (down 12.7% to 219)

- California (down 12.3% to 272)

- Michigan (down 11.3% to 63)

- Iowa (down 9.3% to 107)

East Coast Trends Vary

The states with the highest overall home vacancy rates in Q4 were Oklahoma (2.4%); Kansas (2.3%); Alabama (2.2%); Missouri (2.1%); and West Virginia (2.1%).

The lowest overall vacancy rates were in New Hampshire (0.3%); Vermont (0.4%); New Jersey (0.5%); Idaho (0.5%); and Connecticut (0.5%).

In 56% (75) of the 133 metropolitan statistical regions in the survey with at least 100,000 homes and 100 properties in foreclosure, zombie property rates were lower than the national rate of 3.25%.

In Q4, institutional investor-owned homes had a somewhat higher chance of being unoccupied than other types of properties. Compared to the national average of 3.3%t, 3.5% of the 880,347 investor-owned properties in the country were vacant.

About 64.6% (1,452) of the 2,247 ZIP codes with at least 1,000 homes and 25 in pre-foreclosure during the fourth quarter in ATTOM’s survey had zombie property rates lower than the 3.25% national average.

According to ATTOM’s fourth-quarter 2025 report, some 1.32% of residential properties in the U.S. were unoccupied, a modest decrease from 1.33% the quarter before. Additionally, the percentage of zombie foreclosures decreased somewhat, from 3.38% in Q3 to 3.25% in Q4, which equates to around 7,448 homes. Most states had a fall in zombie foreclosure and vacancy rates, with Florida, Indiana, and California seeing the biggest drops, while Ohio, Nevada, and Oregon saw just slight rises.

To read more, click here.