In 2025, just 28 out of every 1,000 (2.8%) U.S. residences were sold, which is the lowest turnover rate in at least 30 years, according to a recent report from Redfin.

The 2.8% turnover rate this year is the lowest since at least the early-mid 1990s, according to Redfin’s analysis, which looked at the years 2012–2025. Sales of existing homes were comparable to those of this year, but there were fewer properties available, which resulted in a higher turnover rate.

This year’s turnover rate (2.77%) was somewhat lower than last year’s (2.78%), when sales of existing homes hit their lowest point since 1995. Compared to the middle of the pandemic purchasing frenzy in 2021 (44 of every 1,000) and the final pre-pandemic year in 2019 (40 of every 1,000), there were 37.7% and 31.2% fewer homes sold this year, respectively.

The reason for the historically low rates of home turnover is:

- Affordability challenges have kept many buyers on the sidelines. Home prices are near record highs, and borrowing costs remain elevated, causing the number of sellers to far outweigh the number of buyers.

- Sellers are unwilling to give up their low mortgage rates. More than 70% of mortgaged U.S. homeowners have a rate below 5%, well below the current rate of 6.17%. While the share of mortgages above 6% is at a 10-year high, many homeowners are still rate-locked and unwilling to sell.

- Economic uncertainty has made buyers cautious. Concerns about job security, inflation, and broader instability caused many would-be movers to delay major purchases, further slowing the pace of transactions.

“America’s housing market is defined right now by caution,” said Chen Zhao, Redfin’s Head of Economics Research. “Buyers are walking away from deals more often, sometimes due to affordability issues and sometimes because they’re re-evaluating whether now is the right moment to commit. Others aren’t even shopping, waiting instead for prices or mortgage rates to come down. On the other side, many sellers are staying put—either because they’re locked into low rates or unwilling to accept offers below expectations. When both sides hesitate, sales naturally fall to historic lows.”

Measuring Nationwide Turnover by Metro

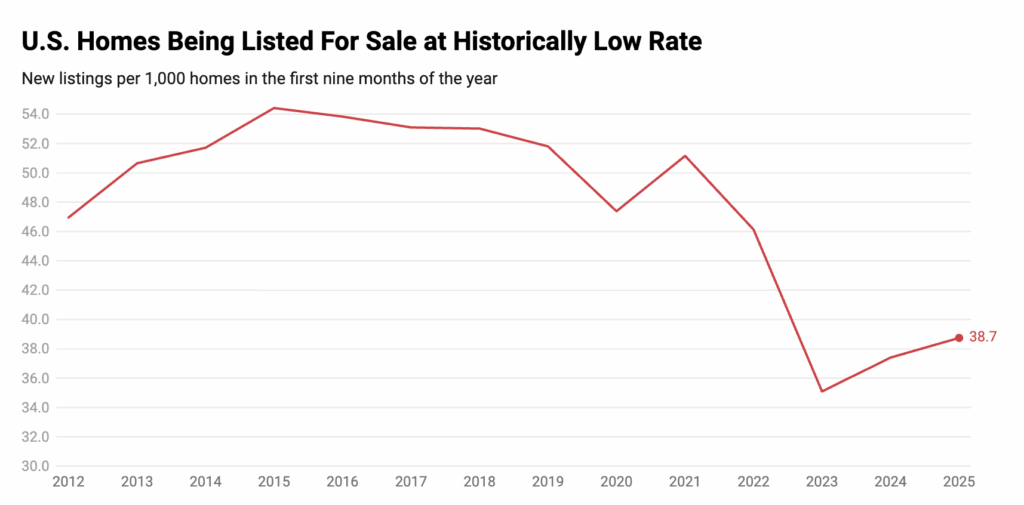

In the first nine months of the year, the percentage of residences advertised for sale increased slightly to 3.9%, or 39 out of every 1,000 properties. Just slightly higher than last year’s 3.7% and 2023’s record low of 3.5%, it was the third-slowest rate of homes being listed in records dating back to 2012. This year’s rate is 24.3% lower than that of 2021 (51 listings per 1,000 houses) and 25.2% lower than that of 2019 (52 listings per 1,000 homes) prior to the pandemic.

In the first nine months of the year, the percentage of residences advertised for sale increased slightly to 3.9%, or 39 out of every 1,000 properties. Just slightly higher than last year’s 3.7% and 2023’s record low of 3.5%, it was the third-slowest rate of homes being listed in records dating back to 2012.

This year’s rate is 24.3% lower than that of 2021 (51 listings per 1,000 homes) and 25.2% lower than that of 2019 (52 listings per 1,000 homes) prior to the pandemic.

| Home Sales Per 1,000 Homes (Jan-Sept 2025) | ||

| Sales Turnover Rate | New Listings Rate | |

| Single Family Homes | 29.9 (+0.6% YoY) | 41.1 (4.1% YoY) |

| Condos/Townhouses | 22.2 (-3.3% YoY) | 33.1 (2.3% YoY) |

While the rate for single-family homes increased by 0.6% annually, the sales turnover rate for condos and townhouses decreased by 3.3%. According to Redfin data, there were an estimated 72.3% more condo sellers than buyers nationally in August, demonstrating how difficult it is to sell condos this year. In the first nine months of the year, almost 41 out of every 1,000 single-family homes were offered for sale, compared to about 33 out of every 1,000 condos and townhouses.

With over 35 out of every 1,000 homes sold in the first nine months of the year, Virginia Beach, VA, led the list of the 50 most populated U.S. metro areas with the greatest turnover rate.

| Major U.S. Metros With Highest Turnover Rates (Jan-Sept 2025) | |||

| Rank | Metro | Sales per 1,000 Homes | YoY Change |

| 1 | Virginia Beach, VA | 35.2 | +5.3% |

| 2 | West Palm Beach, FL | 32.6 | -8.8% |

| 3 | Tampa, FL | 31.2 | -13.7% |

| 4 | Indianapolis | 30.3 | +1.4% |

| 5 | Atlanta | 30.1 | -4.6% |

West Palm Beach, FL (32.6 sales per 1,000 homes), Tampa, Florida (31.2 sales per 1,000 homes), Indianapolis (30.3 sales per 1,000 homes), and Atlanta (30.1 sales per 1,000 homes) were the following metro areas with the greatest turnover rate this year. Since the pandemic’s peak, demand in the Sun Belt has considerably decreased, and sales rates are still rapidly declining in many of the region’s metropolitan cities.

Among the top 50 metro areas, San Antonio’s turnover rate decreased the most, to 24 sales per 1,000 residences, a decrease of -26.9% from the previous year. Charlotte, NC (-19.9%), Jacksonville, FL (-17.3%), Miami (-16.7%), and Orlando, FL (-16.1%) followed. San Francisco (+2.6%), Indianapolis (+1.4%), and Virginia Beach, VA (+5.3%) were the only three big metro areas with higher turnover rates than the previous year.

The “Big Apple” Sees Lowest Turnover Rate

With only about 10 out of every 1,000 properties selling in the first nine months of the year, New York had the lowest turnover rate among the top 50 metro areas.

| Top Five Major U.S. Metros With Lowest Turnover Rates (Jan-Aug 2025) | |||

| Rank | Metro | Sales per 1,000 Homes | YoY Change |

| 1 | New York | 10.3 | -4.0% |

| 2 | Los Angeles | 11.5 | -8.6% |

| 3 | San Francisco | 13.2 | +2.6% |

| 4 | San Jose, CA | 14.8 | -6.2% |

| 5 | Anaheim, CA | 15.5 | -4.9% |

The next six California metro areas were Los Angeles (11.5 sales per 1,000 homes), San Francisco (13.2 sales per 1,000 homes), and San Jose, California (14.8 sales per 1,000 homes).

Proposition 13, a state statute that limits property-tax rise and offers homeowners a significant financial incentive to stay in their houses, is partially responsible for California’s low housing turnover. It’s important to note that some of California’s housing stock may become available in the future thanks to the higher SALT cap rate.

To read more, click here.