It’s often believed that baby boomers had an easier time becoming homeowners than later generations. However, a sizable portion of today’s baby boomers are renters. According to a study by LendingTree, some 18.6% of baby boomers—roughly 12 million of them—are opting to rent rather than buy a home. Although it’s the lowest percentage of renters among all generations, boomers who reside in coastal cities like New York or Los Angeles have a significantly higher percentage.

Key Findings:

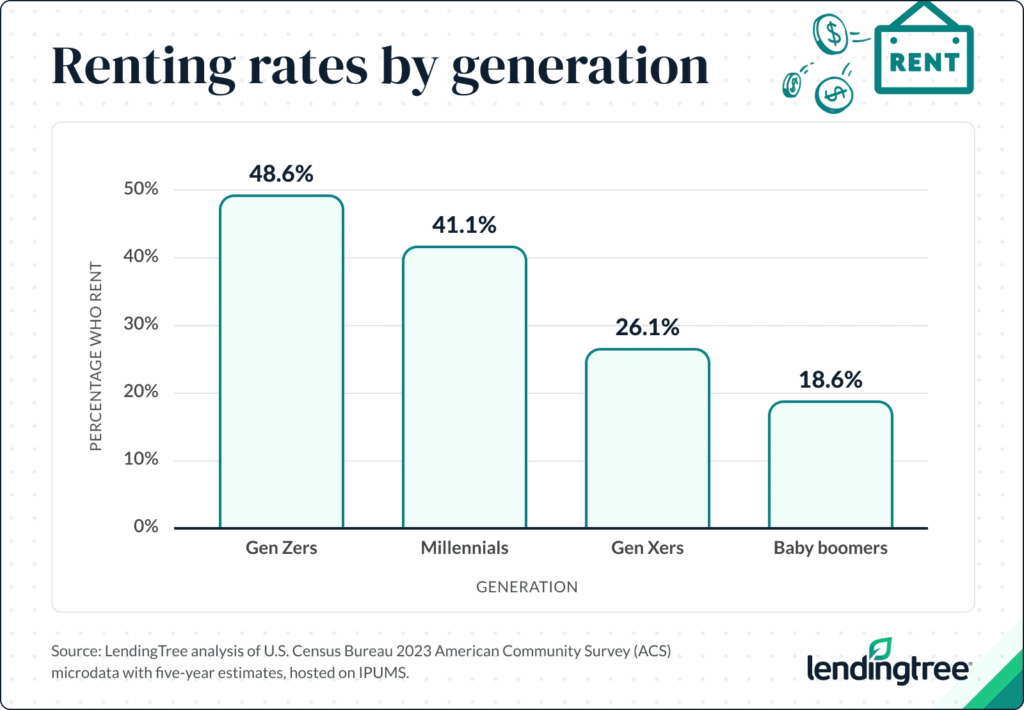

- Some 12 million baby boomers—or 18.6% of the generation—rent. That rate is far lower compared with Gen Zers (48.6%), millennials (41.1%) and Gen Xers (26.1%). Among baby boomers who rent, 55.2% are women.

- Nearly 1 in 3 baby boomers (32.3%) rent in New York and Los Angeles—the highest by metro. Las Vegas ranks third, with 26.5% of baby boomers renting.

- Baby boomers in Ogden, Utah (11.0%), are the least likely to rent. Palm Bay, FL (11.5%), and Provo, Utah (11.8%), follow with low boomer rental rates. Four of the 10 locations with the lowest rental rates among baby boomers are in Florida.

- Nationally, the share of baby boomers renting fell 8.9%, from 20.5% in 2018 to 18.6% in 2023. The share dropped the most in Cape Coral, FL (30.8%), North Port, Fla. (29.4%), and Stockton, CA (28.4%). In contrast, the share grew the most in New Haven, CT (11.2%), Bridgeport, CT (5.5%), and Omaha, NE. (3.4%).

As of 2023, slightly more than one in six baby boomers—roughly 12 million, or 18.6% of the generation—rented rather than owned a home, according to a LendingTree study of the most recent statistics available from the U.S. Census Bureau. (The research’s baby boomers, who were born between 1946 and 1964, ranged in age from 59 to 77 in 2023.)

This percentage of renters is lower than it is in other generations:

- Gen Zers (born after 1996; ages 18 to 26 in 2023): 48.6%

- Millennials (born between 1981 and 1996; ages 27 to 42 in 2023): 41.1%

- Gen Xers (born between 1965 and 1980; ages 43 to 58 in 2023): 26.1%

“I think a lot of boomers rent simply because of the convenience,” says Matt Schulz, Chief Consumer Finance Analyst at LendingTree and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” “They want to be able to call someone if the pipes burst or if the air conditioning goes out. They don’t want to mess with mowing the lawn and pulling weeds. Renting makes a lot of things in life easier.”

Boomers may also be renting because they don’t require as much space as they once did. In fact, 56.4% of boomers who rent live alone, according to the LendingTree study. In contrast, 9.6% live with family and 14.4% live with a spouse. When it comes to renting, boomer women exceed men (55.2% versus 44.8%). For some boomers, downsizing makes sense regardless of household dynamics.

“Instead of paying to keep the big house they raised their family in, many have likely cashed out, moved into a rental and are using the profits from that home sale to make their retirement years a little more comfortable financially,” said Schulz.

The “Concrete Jungle,” “City of Angels,” See Highest Baby Boomer Rent Rates

Baby boomers rent at significantly higher rates in some metro areas. Nearly one in three baby boomers (32.3%) rent in New York and Los Angeles, which are tied for first place in the US. With little more than a quarter (26.5%) of boomers renting, Las Vegas comes in third. Four more Californian cities—Fresno, San Francisco, San Diego, and San Jose—rank four through seven in the top ten, followed by Miami, New Haven, CT, and Reno, NV.

Ten of the top 23 metro areas are in California, which has a particularly high number of boomer renters. These metro areas have rent rates that are higher than the national average of 18.6%, ranging from 32.3% in Los Angeles to 20.1% in Oxnard.

According to Schulz, the reason why some areas are better for boomers to rent rather than own is probably due to cost.

“It’s crazy expensive to buy a home in places like LA and New York. Just a down payment can be outrageous,” he said. “For those boomers who want to live in a big city, especially a big coastal city, renting may be the only reasonable option.”

Those who have mortgage payments may find this to be particularly true. According to a recent LendingTree study, the cost differential between renting and owning a house with a mortgage was greatest in the metro regions of San Francisco, Bridgeport, CT, and New York in 2023 (all of which are in the top 20 boomer rental cities). Renting instead of owning would save people in such locations more than $1,300 a month.

Renting is generally more common in places where property prices are higher. According to a Redfin analysis from the fourth quarter of 2024, the only two metro areas in the country where the majority of households are renters are New York (51.9%), followed by Los Angeles (51.5%). The fact that those cities were at the top of our boomer rental list is no accident. For comparison, the median price at which homes were sold in September 2025 in Los Angeles was $1.1 million, while in New York City it was $745,000.

If renting enables them to avoid expensive property taxes, even boomers with completely paid-off mortgages may find financial advantages. According to recent LendingTree property tax analysis, this cost is significant in most of the top 10 cities where boomers rent. According to the report, the top ten metro areas with the highest median property taxes were New York, San Jose, San Francisco, Los Angeles, and San Diego. Although property taxes in Las Vegas are relatively modest, they rose by 13.6% between 2021 and 2023.

Boomers in Small-City Utah Least Likely to Rent

Conversely, in several urban areas, boomers’ rental rates are significantly cheaper. Ogden, Utah, has the lowest percentage of boomer renters, with slightly more than one in ten (11.0%) boomers not owning their homes. Similar low numbers are found in Palm Bay, Florida (11.5%) and Provo, Utah (11.8%).

Apart from Palm Bay, three other Florida metro areas with the lowest boomer rental prices are Cape Coral, North Port, and Deltona.

Renting tends to be less prevalent in places where homes are more affordable, just as there is a correlation between high property prices and high rental rates for the metro areas at the top of the list. For instance, just 15.5% of households rent in Cape Coral, Florida, where the median sales price in September 2025 was $350,000 (as opposed to the national median sales price of $435,295). Similarly, the rental rate is lower at 22.3% in North Port, Florida, where the median sales price was $347,350.

The lowest two cities had low median home sales prices in September 2025: $390,500 in Ogden, Utah, and $365,000 in Palm Bay, FL. The average effective property tax rate in Utah, which has two of the three metro areas with the lowest boomer rental rates, is 0.55%, the eighth-lowest in the country. Although there is considerable fluctuation in rates based on the county, Florida’s property taxes are likewise lower than the national average.

To read more, click here.