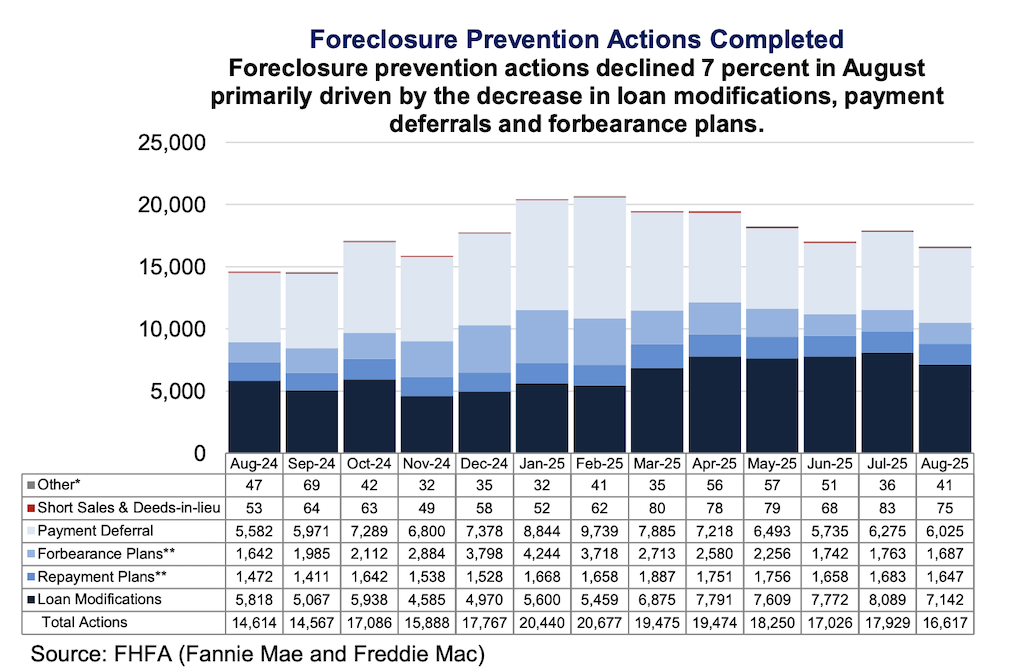

According to a new report from the Federal Housing Finance Agency (FHFA), in August 2025, the Enterprises completed 16,617 foreclosure prevention activities, totaling 7,248,350 since the conservatorships began in September 2008. Permanent loan modifications have accounted for about 39% of these measures. Since the conservatorships started in September 2008, there have been 2,803,269 permanent loan modifications, including an estimated 7,142 in August 2025.

In August, only term extensions accounted for almost 35% of loan modifications. Sixty-five percent of all loan modifications made during the month involved principal forbearance. After completing a forbearance plan, the number of borrowers who were granted payment deferrals fell from 6,275 in July to 6,025 in August 2025.

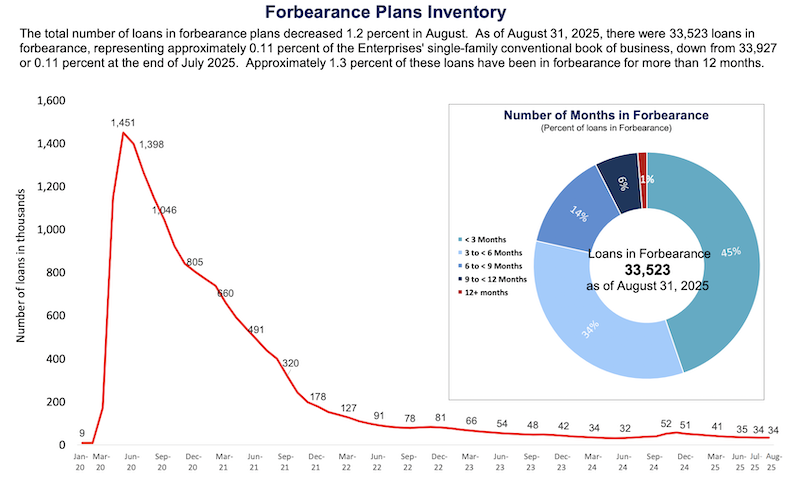

Between July and August of 2025, the number of initiated forbearance plans dropped from 8,030 to 7,781. From 33,927 at the end of July to 33,523 at the end of August 2025, the overall number of loans in forbearance also dropped, accounting for roughly 0.11% of all loans serviced and 6.2% of all delinquent loans.

Foreclosure Prevention Actions, Refi Trends, Mortgage Performance & More

Foreclosure starts fell 4% to 7,745 in August 2025, while third-party and foreclosure sales dropped marginally to 1,088. Due to comparatively lower mortgage rates in July compared to the highs in May and June, the overall volume of refinances increased in August 2025. The average interest rate on a 30-year fixed-rate mortgage dropped to 6.59% in August from 6.72% in July as mortgage rates continued to decline.

After reaching as high as 82% over the previous three years, cash-out refinances as a percentage of refinances fell from 65% in July to 63% in August 2025.

To read the full report, click here.