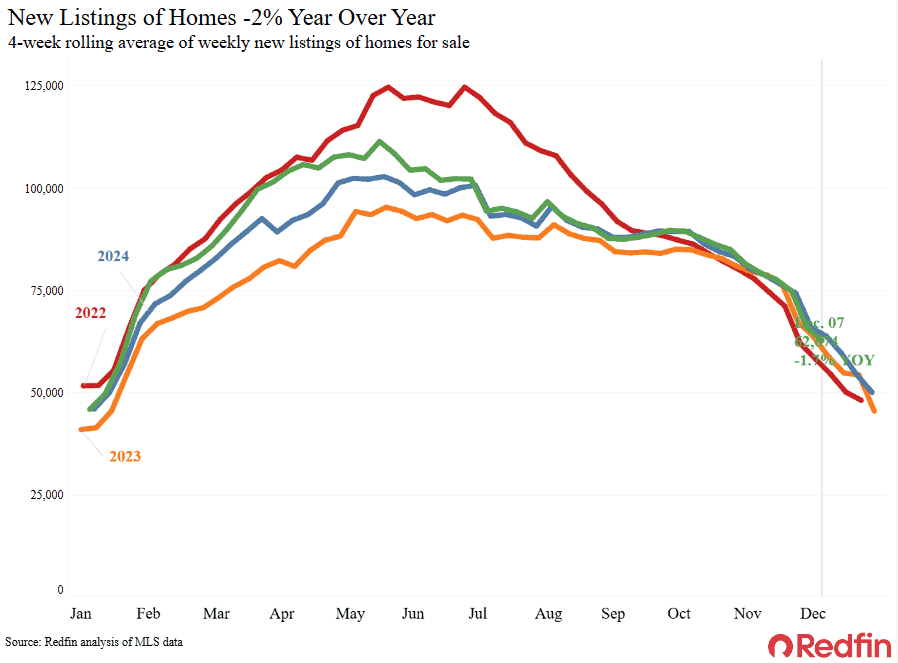

During the four weeks ended December 7, new listings of U.S. homes for sale decreased 1.7% year-over-year (YoY), the largest decrease in more than two years, according to a recent report from Redfin.

Prospective home sellers are retreating in part because it’s the end of the year, which is usually a sluggish season for the housing market, and in part because they’re responding to weak demand for homes. The largest fall in 10 months has occurred in pending home sales, which are down 4.1% from a year ago. The average home that enters into a contract takes approximately 51 days to sell, which is about a week longer than it did the previous year.

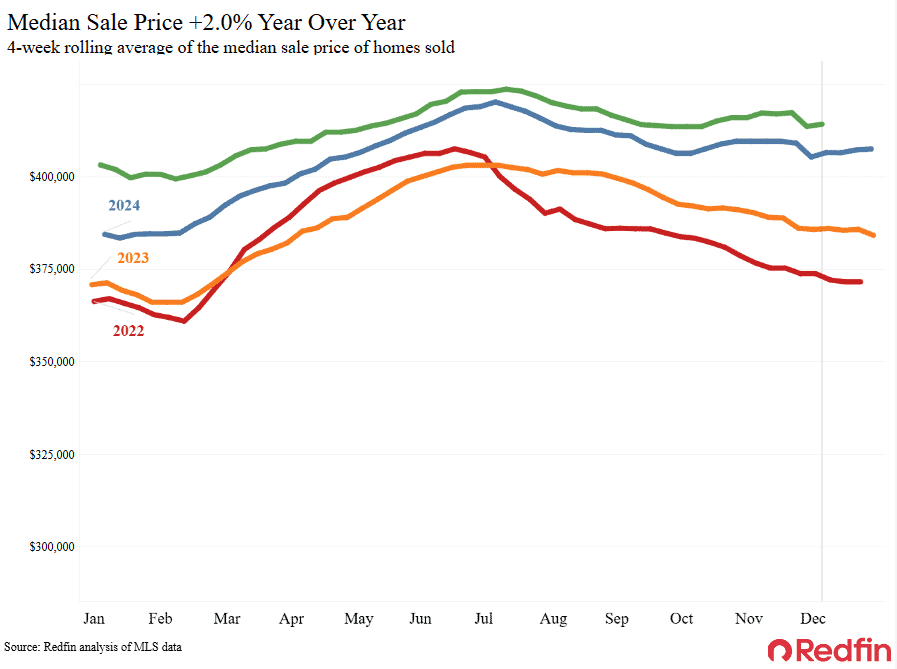

Due to the high cost of housing and general economic uncertainties, prospective purchasers have been reluctant for several months. Due in part to tightening supplies, prices have increased despite tepid demand, with the median home-sale price up 2%. Even while the weekly average mortgage rate has dropped to its lowest point in more than a year, it is still much more than 6%.

“Some would-be sellers are sitting tight because the market is flat,” said Josh Felder, a Redfin Premier agent in San Francisco. “That’s partly because we’re heading into the normal seasonal slowdown, and partly because prospective sellers and house hunters are watching and waiting to see what’s going to happen next year with rates, the stock market and tariffs. Some homeowners will put their home on the market in 2026 when they have a better idea of how the economy will shape up.”

Key Findings — National

| U.S. Highlights: Four weeks ending December 7, 2025 | |||

| Metrics | Four weeks ending Dec. 7, 2025 | YoY Change | Notes |

| Median sale price | $389,123 | 2% | |

| Median asking price | $382,535 | 2.6% | |

| Median monthly mortgage payment | $2,430 at a 6.19% mortgage rate | -0.7% | Lowest level of 2025 |

| Pending sales | 63,959 | -4.1% | Biggest decline in 10 months |

| New listings | 62,674 | -1.7% | Biggest decline of 2025 |

| Active listings | 1,127,934 | 4.6% | Smallest increase since Jan. 2024 |

| Months of supply | 4.6 | +0.3 pts. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions |

| Share of homes off market in two weeks | 24.9% | Down from 27% | |

| Median days on market | 51 | +6 days | |

| Share of homes sold above list price | 21.8% | Down from 25% | |

| Average sale-to-list price ratio | 98.2% | Down from 98.5% | |

Note: Redfin’s national metrics include data from 400+ U.S. metro areas and are based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision.

Metro-Level Highlights — National

Top five metros with biggest YoY increases in median sale price:

- Detroit (12.6%)

- Pittsburgh (11.6%)

- Cleveland (9.6%)

- New Brunswick, NJ (8.4%)

- Nassau County, NY (8.4%)

Overall, the U.S. median sale price declined in 15 metros.

Top five metros with biggest YoY decreases in median sale price:

- Dallas (-5.1%)

- Fort Worth, Texas (-4.9%)

- Jacksonville, FL (-4.8%)

- Seattle (-4.5%)

- Sacramento, CA (-4.4%)

Top five metros with biggest YoY increases in pending sales:

- West Palm Beach, FL (15.2%)

- Miami (9.3%)

- Virginia Beach, VA (7.8%)

- Boston (7.6%)

- Phoenix (3.3%)

Top five metros with biggest YoY decreases in pending sales:

- San Jose, CA (-30.1%)

- Houston (-18.6%)

- Tampa, FL (-16.8%)

- Denver (-15%)

- Oakland, CA (-13.4%)

Top five metros with biggest YoY increases in new listings:

- Boston (10.2%)

- Philadelphia (8%)

- Minneapolis (6.9%)

- Montgomery County, PA (5.9%)

- Baltimore (5.5%)

Top five metros with biggest YoY decreases in new listings:

- San Antonio (-22.8%)

- Tampa, FL (-19.3%)

- Jacksonville, FL (-15.8%)

- Fort Lauderdale, FL (-13.7%)

- West Palm Beach, FL (-11.8%)

Note: Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.