Some Americans embrace the notion that building new housing is a so-called silver bullet solution for the housing affordability crisis, but according to a new study by Cotility, new construction isn’t the only way to increase housing supply.

For years, Cotility said, analysts have held out hope that the aging baby boomer generation would trigger a “Silver Tsunami” — a huge wave of homes unlocked and returned to the market.

New data from Cotality suggests the Tsunami may, instead, hit the beach as a gentle, rolling wave. Cotility pointed out that inheritance has always played a role in the real estate economy, and recently that role has grown.

According to Cotality’s unmatched database of property deeds, a record 340,000 homes across the United States were transferred through inheritance in the 12 months ending in August. With resales falling, 7% of all property transfers were hand-me-downs — the highest share that Cotality has ever recorded.

Baby boomers are the demographic group born between 1946 and 1964, named for the significant increase in births following World War II, a period known as the “baby boom.” Boomers, therefore, range in age from roughly 62 to 80.

The median age, the age that divides the population in half, has been increasing steadily. In 2024, the median age rose to about 39.1 years, higher than at any time in U.S. history. And, the number of Americans 65 and older continues to grow, while the number of children under 18 has fallen or grown more slowly, according to Census data.

From 2023 to 2024, the 65+ group grew by about 3.1%, while the under-18 population declined slightly. The proportion of residents 65 and older rose from roughly 12.4% in 2004 to about 18% in 2024.

The trend of homeowners keeping property in the family is most pronounced in California, where the tax system rewards keeping homes in the family, easing the transfer from longtime owners to their heirs. In California, property tax increases over 2% per year are prohibited, regardless of the change in the market value of the home.

Cotility said that tax exemption can be inherited by children and grandchildren on the first $1M of inherited real estate value, given that the property is used as a primary residence and continuously lived in.

Beneficiaries Incentivized to Keep Properties

Clearly, these laws create a significant financial incentive for beneficiaries to hold onto an inherited home and use it as a primary residence, effectively locking potential supply out of the open market, Cotility said.

Almost 60,000 California properties were inherited in 2025, accounting for 18% of all property transfers, another record-breaking number. For the first time ever in California, that is more than double the number of new homes sold, Cotility said.

At first look, Cotility said the increase in inheritances seems to validate the “Silver Tsunami” hypothesis. But the firm’s deeper analysis of U.S. Census data reveals that such optimism might be unfounded.

Today’s seniors actually are holding onto their houses longer, effectively freezing the anticipated flow of supply, Cotility said.

The firm said that the Baby Boomer generation is the largest group of seniors in the nation on record, and they own a historic number of houses. At age 65, people born in 1948 owned 50% more houses than those born just 10 years earlier at the same age, Cotility said.

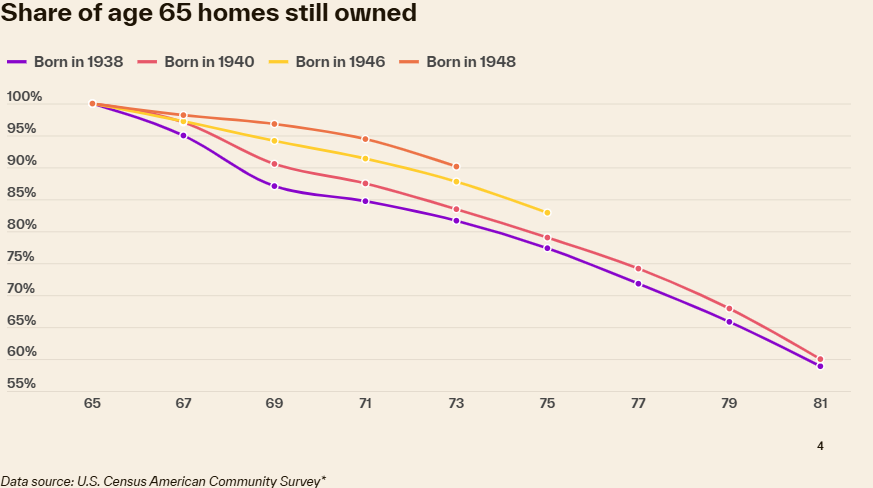

They are more likely to age in place. Cotility said that more than 22% of homeowners born in 1938 left their homes between the ages of 65 and 75, while that rate falls sharply for homeowners born in 1946 — only 17% of whom left their homes during the same 10-year period of life.

Cotility said that aging in place slows the natural cycle of downsizing, moving in with family, and ultimately passing homes to the next generation. And that delays the long-predicted wave of housing supply from arriving on the open market.

In many cases, Cotility said, those homes will skip the open market entirely.