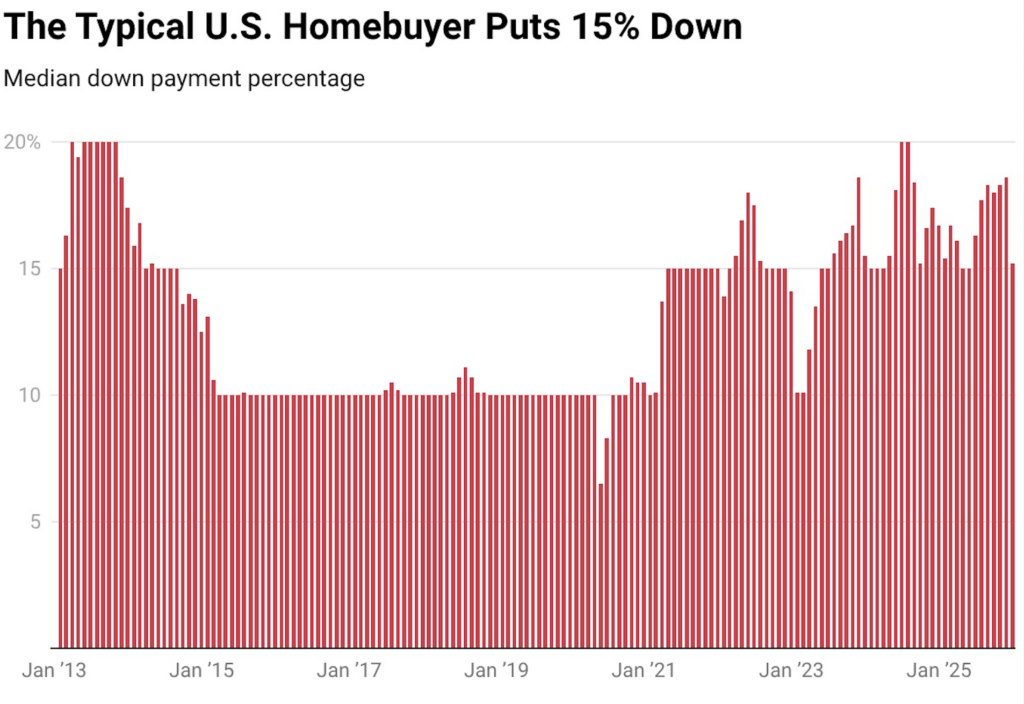

In December, the average down payment for a U.S. homebuyer dropped 1.5% year-over-year (YoY) to $64,000, the first decrease in five months, according to a recent Redfin report. Although down payments decreased in dollar terms in December, the median home sale price increased marginally (by 0.5%), in part because the average homeowner contributed a less portion of the purchase price than they did the previous year. In percentage terms, the average homebuyer contributed 15.2% of the buying price, down from 16.7% in the previous year.

It’s important to note that although mortgage rates have decreased recently, they are still more than twice as low as they were during the epidemic. At approximately 6.09%, the average 30-year fixed mortgage rate is currently slightly below the lowest level since 2022. As a result, monthly mortgage payments have decreased, potentially attracting more homebuyers this year.

Key Findings:

- The median down payment was highest in San Francisco ($400,310), San Jose, CA ($360,000) and Anaheim, CA ($270,800). It was lowest in Virginia Beach, VA, ($8,700) Cleveland ($25,025) and Cincinnati ($25,143). Virginia Beach has the highest share of homebuyers taking out VA loans, which require little to no down payment.

- In Orlando, FL, the median down payment fell 23.9% YoY—the largest decline among the metros Redfin analyzed. Next came Cincinnati (-22.6%) and Atlanta (-18.9%). The biggest increases were in Cleveland (31.7%), Providence, RI (20.4%) and Baltimore (20%).

- The median down payment percentage was highest in San Francisco (25%), San Jose, CA, (23.9%) and Anaheim, CA (21.4%). It was lowest in Virginia Beach, VA (3%), Atlanta (8.4%) and Las Vegas (8.4%).

- The median down payment percentage fell most in Orlando (-6.3 ppts), Charlotte, NC (-4.4 ppts) and Anaheim, CA (-3.6 ppts). It rose most in Chicago (4.9 ppts), Milwaukee (3.7 ppts) and Cleveland (3 ppts).

Metro-Level Highlights — December 2025

| U.S. Metro Area | Median down payment ($) | YoY change in median down payment ($) | Median down payment (%) | YoY change in median down payment (%) |

|---|---|---|---|---|

| San Francisco | $400,310 | 4.7% | 25.0% | -2.0 ppts |

| San Jose, CA | $360,000 | -4.7% | 23.9% | -1.1 ppts |

| Anaheim, CA | $270,800 | -5.0% | 21.4% | -3.6 ppts |

| New York, NY | $183,900 | 2.2% | 20.0% | 0.0 ppts |

| Oakland, CA | $177,600 | -11.2% | 20.0% | 0.0 ppts |

| Los Angeles, CA | $166,000 | -8.1% | 20.0% | 0.0 ppts |

| San Diego, CA | $153,126 | -9.9% | 20.0% | 0.0 ppts |

| Seattle, WA | $146,000 | -9.1% | 20.0% | 0.0 ppts |

| New Brunswick, NJ | $113,875 | 9.3% | 20.0% | 0.0 ppts |

| Newark, NJ | $105,000 | 16.7% | 20.0% | 0.0 ppts |

“Down payments may be falling in part because Americans are seeking out more affordable homes due to high prices, elevated mortgage rates and economic uncertainty,” said Sheharyar Bokhari, Principal Economist at Redfin. “Sellers typically prefer buyers who make large down payments because it signals financial stability, but sellers don’t have much say in today’s market. Buyers hold the negotiating power because there are more homes for sale than people who want to buy them.”

Top 10 metros with the highest median down payment:

- San Fransisco

- San Jose, CA

- Anaheim, CA

- West Palm Beach, FL

- Seattle, WA

- San Diego

- Sacramento, CA

- Oakland, CA

- Newark, NJ

Top 10 metros with the lowest median down payment:

- Virginia Beach, VA

- Cleveland

- Cincinnati

- Philadelphia

- Atlanta

- Columbus, Ohio

- Tampa, FL

- Jacksonville, FL

- Warren, MI

- Las Vegas

Note: The data in this report is from a Redfin analysis of county records across 38 of the most populous U.S. metropolitan areas. December 2025 is the most recent month for which data is available. Down payment data is limited to home purchases for which buyers took out a mortgage.