The Fannie Mae Home Purchase Sentiment Index (HPSI) declined 2.5 points to 69.4 in May, as the component evaluating consumer views toward homebuying circumstances fell sharply, reaching an all-time survey low. This month, only 14% of consumers said it was a good time to buy a property, down from 20% the previous month, while 67% said it was a good time to sell.

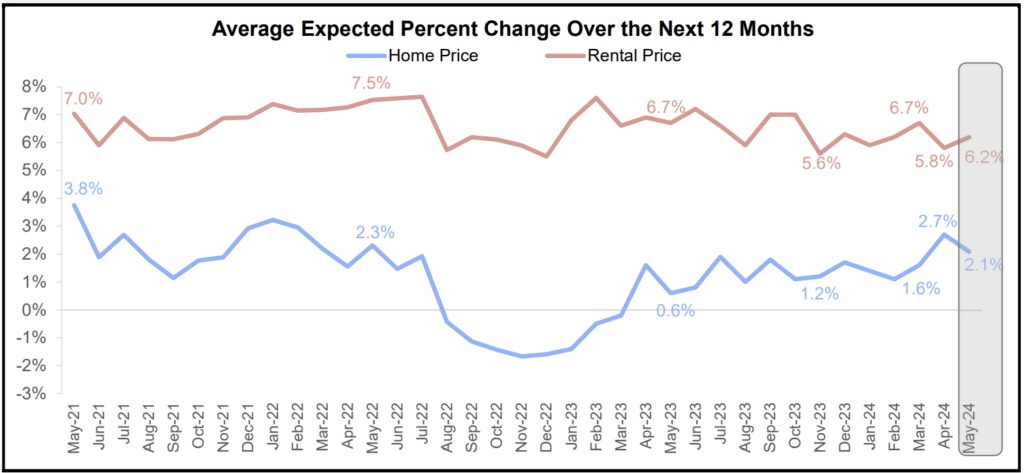

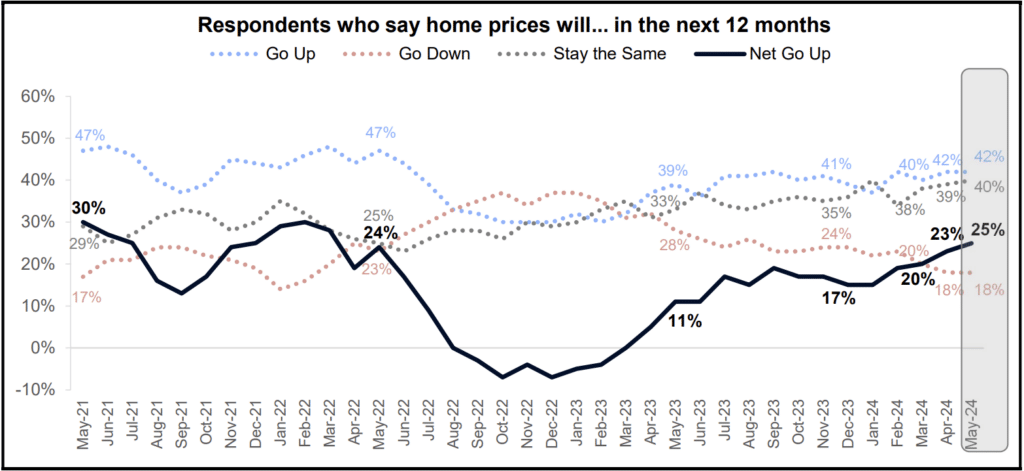

Meanwhile, consumers predict affordability will remain difficult for the foreseeable future, with respondents expecting home prices and mortgage rates to rise over the next year. Among the survey’s good findings: An increasing number of respondents—currently 20%—reported that their household income is much higher than it was a year ago.

“Consumer sentiment toward housing declined from its recent plateau, as an increasing share of consumers struggle to find the positives in the current housing market,” said Doug Duncan, Fannie Mae Senior VP and Chief Economist. “While many respondents expressed optimism at the beginning of the year that mortgage rates would decline, that simply hasn’t happened, and current sentiment reflects pent-up frustration with the overall lack of purchase affordability. This is most clearly evidenced by our ‘good time to buy’ component falling to a new survey low this month. On the other hand, homeowners’ perception of home-selling conditions declined only slightly and remains largely positive after a steady increase over the last few months. This suggests to us that, despite the so-called ‘lock-in effect,’ some homeowners may increasingly want or need to sell their homes for a myriad of non-financial reasons, which may lead to an increase in listings in the near future. As our latest forecast notes, we expect improvements to housing inventory will lead to slightly increased sales activity through the end of the year.”

Home Purchase Sentiment Index — Component Highlights

Fannie Mae’s Home Purchase Sentiment Index (HPSI) decreased 2.5 points in May to 69.4. Further, the HPSI is up 3.8 points compared to the same time last year.

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home decreased from 20% to 14%, while the percentage who say it is a bad time to buy increased from 79% to 86%. As a result, the net share of those who say it is a good time to buy decreased 13 percentage points month-over-month.

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home decreased from 67% to 64%, while the percentage who say it’s a bad time to sell increased from 32% to 35%. As a result, the net share of those who say it is a good time to sell decreased 6 percentage points month-over-month.

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months remained unchanged at 42%, while the percentage who say home prices will go down remained unchanged at 18%. The share who think home prices will stay the same increased from 39% to 40%. As a result, the net share of those who say home prices will go up in the next 12 months increased 2 percentage points month-over-month.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 26% to 25%, while the percentage who expect mortgage rates to go up decreased from 33% to 31%. The share who think mortgage rates will stay the same increased from 40% to 42%. As a result, the net share of those who say mortgage rates will go down over the next 12 months remained unchanged month over month.

- Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 76% to 75%, while the percentage who say they are concerned increased from 23% to 24%. As a result, the net share of those who say they are not concerned about losing their job decreased 1 percentage point month-over-month.

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago increased from 17% to 20%, while the percentage who say their household income is significantly lower remained unchanged at 12%. The percentage who say their household income is about the same decreased from 70% to 67%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago increased 3 percentage points month-over-month.

Overall, three out of six HPSI components decreased this month (Buying Conditions, Selling Conditions, and Job Loss Concern). Two HPSI components increased this month (Change in Household Income and Home Price Outlook), while Mortgage Rate Outlook remained unchanged.

To read the full report, including more data, charts, and methodology, click here.