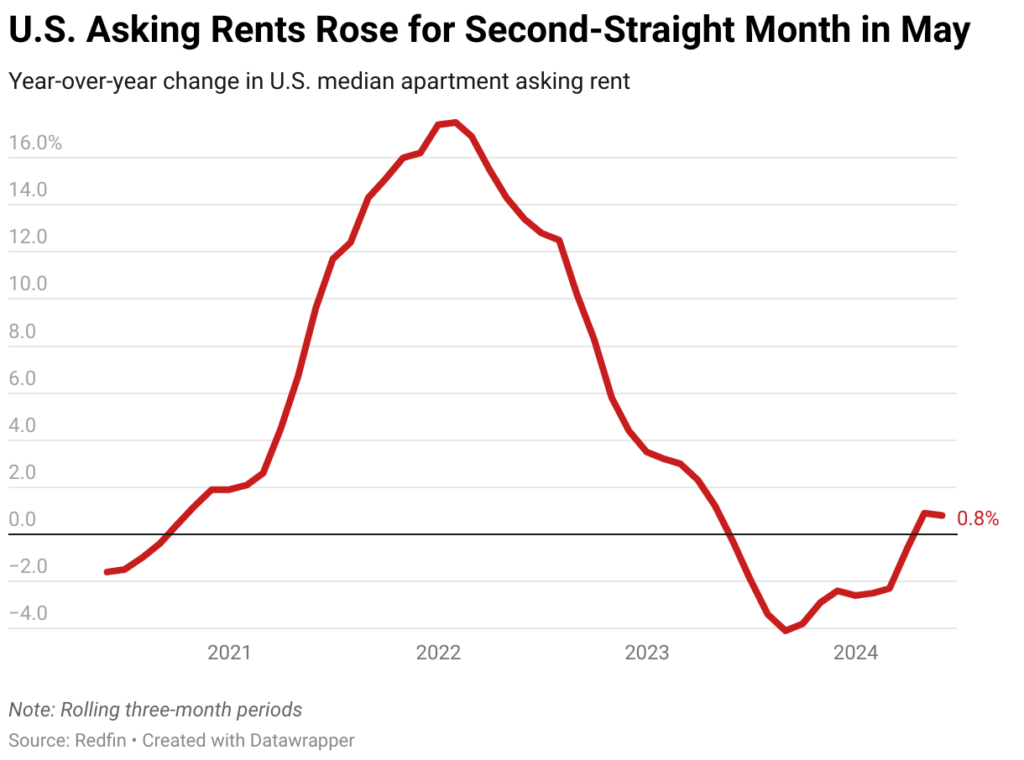

The median asking rent in the U.S. rose 0.8% year-over-year in May to $1,653, representing the highest level since October 2022, according to a new Redfin survey. This is the second straight increase—rents rose 0.9% year-over-year (YoY) in April—after 11 months of declines, while rents rose 0.5% month-over-month (MoM).

Per the report, apartment prices are closely related to unit supply. Multifamily construction increased during the pandemic moving frenzy, lowering rent prices as building owners competed for renters. While multifamily development starts have dipped below their 10-year historical average, there is still a backlog of new units entering the market each month, limiting how much prices can rise.

“Demand from young renters remains high, as many of them are opting to stay put rather than contend with an increasingly unaffordable homebuying market,” said Sheharyar Bokhari, Senior Economist for Redfin. “But so far, rent price growth has been limited because there are enough new apartments to meet demand, even in the busiest time of year for the rental market.”

Additionally, Redfin revealed that for the past three quarters, the rental vacancy rate has remained at approximately 6.6%. That is the greatest level since 2021, though the vacancy rate is no longer increasing as it was during the pandemic.

While asking rents increased in May, they remain stable compared to recent years; they jumped as much as 17.5% year-over-year during the epidemic before falling as much as 4.1% this summer. Still, the median asking rent in May was just $47 lower (-2.8%) than the record high of $1,700 set in August 2022, presenting affordability issues for some tenants.

Metro-Level Summary: May 2024 (By Lowest Asking Rents)

1. Houston

- Median asking rent: $1,275

- MoM change: 0.2%

- YoY change: 6.8%

2. Cincinnati

- Median asking rent: $1,372

- MoM change: 2.4%

- YoY change: 10.9%

3. Detroit

- Median asking rent: $1,403

- MoM change: 1%

- YoY change: 3.9%

4. Indianapolis

- Median asking rent: $1,447

- MoM change: -0.7%

- YoY change: 7.2%

5. Pittsburgh

- Median asking rent: $1,450

- MoM change: 3.7%

- YoY change: -2.4%

6. Charlotte, NC

- Median asking rent: $1,519

- MoM change: 1.1%

- YoY change: -3.8%

7. Jacksonville, FL

- Median asking rent: $1,520

- MoM change: -1.7%

- YoY change: -10.1%

8. Las Vegas

- Median asking rent: $1,527

- MoM change: 1.7%

- YoY change: 5.3%

9. Dallas

- Median asking rent: $1,529

- MoM change: -1.1%

- YoY change: -1.3%

10. Phoenix

- Median asking rent: $1,541

- MoM change: 0.4%

- YoY change: -5.5%

Rents Post Double-Digit Gains in Washington, D.C., Dropping in Sun Belt Region

In May, the median asking rent in Washington, D.C. increased by 11.1% year-over-year, the largest increase among the 33 major U.S. metropolitan regions examined by Redfin. Four additional metros witnessed double-digit increases: Cincinnati (10.9%), Chicago (10.8%), Virginia Beach (10.3%), and Minneapolis (10.3%). The most significant asking rent decreases occurred in Jacksonville, FL (-10.1%), San Diego (-8.7%), Austin, Texas (-7.2%), Seattle (-5.9%), and Phoenix (-5.5%).

Rents are lowering in the Sun Belt in part because the region has built more apartments than other parts of the country (such as the Midwest and Northeast) to fulfill demand caused by the pandemic’s inflow of new residents. However, the epidemic housing bubble is now in the rearview mirror, and property owners are confronting vacancies, leading rents to drop.

Meanwhile, rents are rising in many Midwest metros because the region simply isn’t developing enough apartments. The Midwest is also the most cheap region to reside in, which helps to boost demand at a time when housing affordability is tight throughout the U.S.

To read the full report, including more data, charts, and methodology, click here.