Home sellers are returning to the market, but buyers are hesitant, according to a recent Zillow market report. In May, new property listings exceeded sales, allowing buyer competition and price rise to slow—and more price relief is expected.

“Rate lock’s hold seems to be loosening—homeowners who may have put off listing their homes are done waiting. But just as more choices sprang up for sale, buyers turned on cruise control,” said Orphe Divounguy, Zillow Senior Economist. “Inflation has hit younger households hardest, and stubbornly high rates have pushed a mortgage out of reach for many first-time buyers. That has cooled competition for houses. If these trends hold, we’re likely to see price growth flatten or tick down over the next year.”

May 2024 Market Report Highlights

- Home values climbed month over month in all 50 of the nation’s largest metro areas in May. Gains were biggest in Buffalo (2.1%), Pittsburgh (1.9%), Cleveland (1.8%), San Jose (1.8%), and Hartford (1.7%).

- The smallest monthly appreciation was in Austin (0.2%), Tampa (0.3%), San Antonio (0.3%), Orlando (0.3%), and New Orleans (0.4%).

- Home values are up from year-ago levels in 46 of the 50 largest metro areas. Annual price gains are highest in San Jose (12.7%), Hartford (11.6%), San Diego (11.1%), Los Angeles (8.9%), and Boston (8.3%).

- Home values are down from year-ago levels in three major metro areas. The largest drops were in New Orleans (-5.9%), Austin (-4.1%), and San Antonio (-2.2%).

- The typical mortgage payment is up 11.3% from last year and has increased by 115.3% since pre-pandemic.

Inventory, New Listings and Pending Sales Overview

- New listings increased by 7.9% month over month in May.

- There were 12.6% more new listings compared to last year.

- New listings are still 23.3% lower than pre-pandemic levels.

- Inventory (the number of listings active at any time during the month) in May increased by 7.4% from last month.

- There were 22.1% more listings active in May compared to last year.

- Inventory levels are 33.8% lower than pre-pandemic levels for the month—the smallest deficit in more than three years.

- Newly pending sales held steady in May from the prior month.

- Newly pending sales decreased by 4.2% from last year.

- Median days to pending, the typical time from initial list date to pending status for homes that went under contract during a month, is at 13 days in May, which is unchanged from April.

- Median days to pending increased by three days from last year.

Buyers and Sellers Butt Heads as Inventory Jumps

Sellers’ new listings increased by 8% from April to May, and are now 13% higher than last year’s record low. The effects of “rate lock”—when homeowners keep their existing homes and low-interest mortgages—are diminishing over time. According to a Zillow study of recent sellers, the vast majority (about 80%) were inspired by life events such as marriage or having a child, rather than perfect financial conditions.

However, buyers aren’t matching sellers’ enthusiasm; sales in May were 6% lower than last year. This helped to refill the housing inventory, with the number of homes on the market increasing 22% from last year’s near-record low level. Inventory is still 34% below pre-pandemic levels, but this is the smallest gap in almost three years.

New listings increased the most annually in the West Coast and coastal South, particularly in San Diego, Seattle, Charlotte, Raleigh, and the San Francisco Bay Area. Total inventory increased the greatest in big Florida areas, where strong new building has helped replenish the coffers. Buyers observed more listings month after month in all major markets except Miami.

Housing Competition and Price Appreciation Continue to Ease

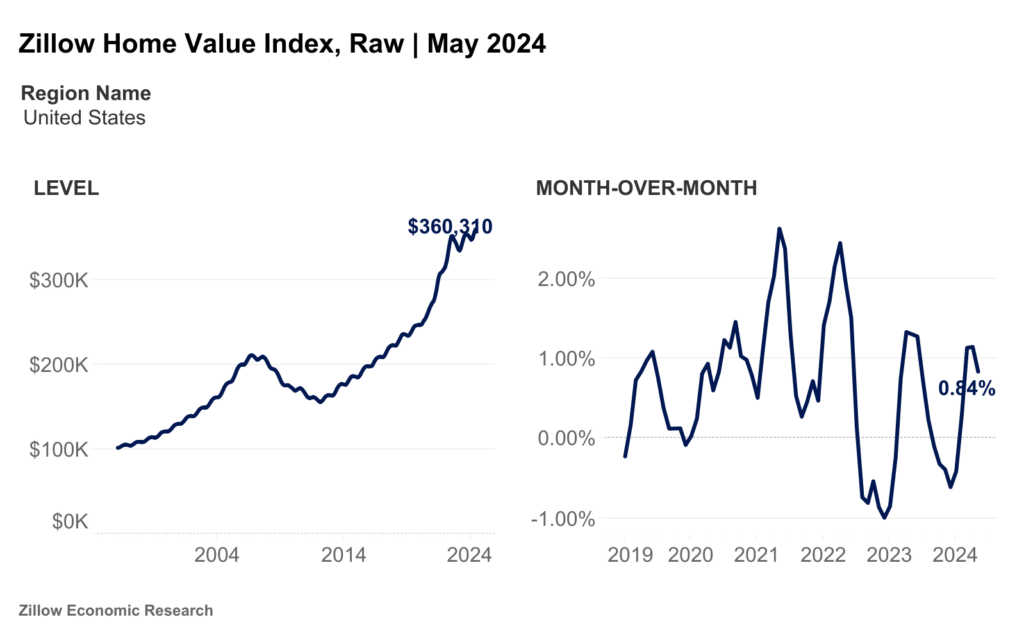

As a result, buyer competition decreased in May, and home price appreciation slowed. Typical home value growth decreased from 4.4% year-over-year in April to 3.9% in May, which remains a robust, normal rate, while monthly appreciation fell from 1.2% in April to 0.8% in May. Home values have risen dramatically—more than 45%—since before the outbreak.

Year-over-year, prices have declined in New Orleans, Austin, and San Antonio, while the Northeast and coastal California have seen the most gain. Renters who are trying to save for a down payment may see some relief in the coming year. Zillow predicts that property values will rise 0.4% in 2024 before falling 1.4% through May 2025.

So, what does this mean for buyers and sellers?

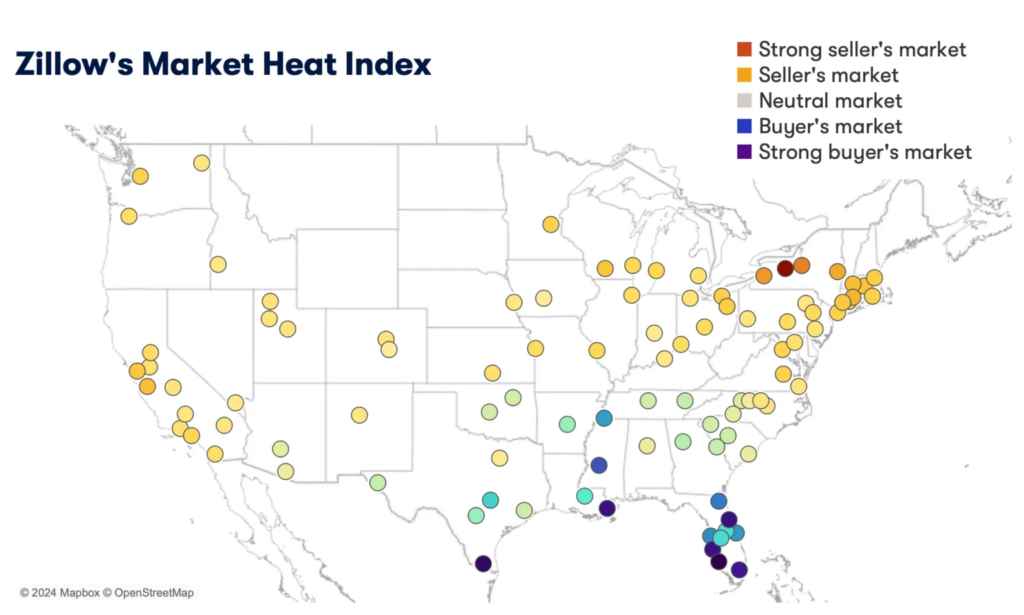

According to Zillow’s market heat index, the country is becoming more friendly to buyers and is heading toward “neutral” zone, but sellers continue to have a modest advantage. The top sellers’ markets among the 50 major metro areas are Buffalo, Hartford, and San Jose. New Orleans, Miami, Jacksonville, and Memphis are all geared toward buyers, providing those in the market an advantage in negotiations.

In May, nearly one-quarter of all properties for sale in the country had their prices reduced, the greatest percentage in the previous six years for this time of year. There’s a significant probability that purchasers might get a lingering property for less than the asking price. This situation makes experienced agents even more important to both buyers and sellers, as they can identify and negotiate deals for buyers while accurately pricing and marketing properties for sellers.

To read the full report, including more data, charts, and methodology, click here.