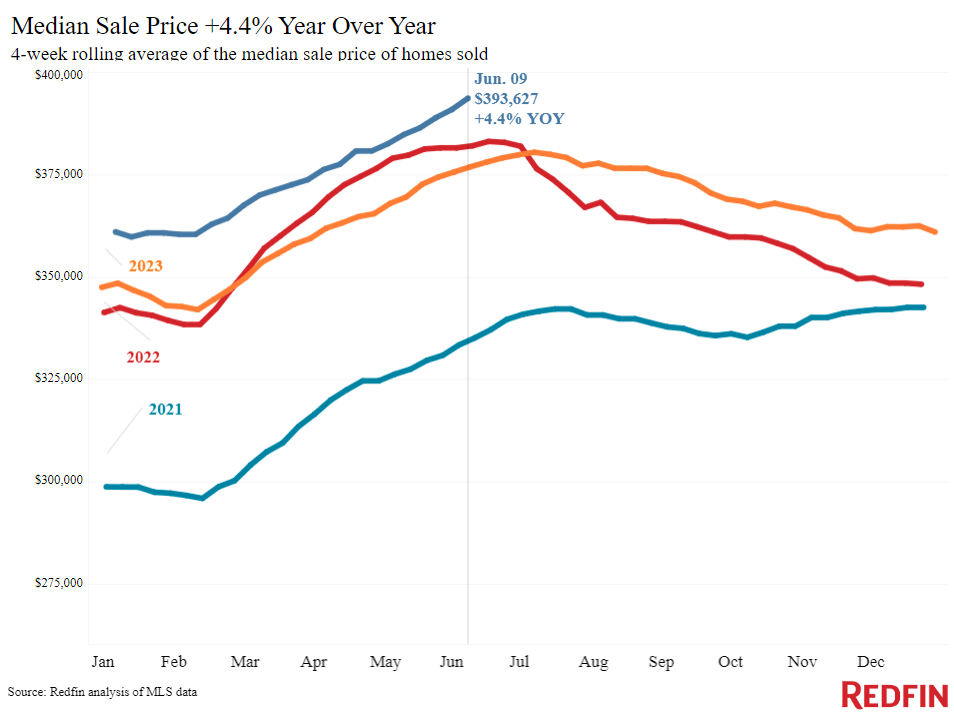

A new report from Redfin revealed the median U.S. home-sale price reached an all-time high of $394,000 in the four weeks ending June 9, up 4.4% year-over-year—the largest gain in roughly three months.

There are indications that home-price increases may slow soon. Asking prices have leveled down, with 6.5% of house sellers lowering asking price on average, the largest percentage since November 2022. Prices are already falling in four major U.S. cities: Austin, Texas, Fort Worth, Texas, San Antonio, and Portland, OR.

Meanwhile, the average homebuyer’s monthly housing payment fell to $2,829, roughly $30 less than April’s record high. Despite record sale prices, median housing payments have decreased somewhat since April, with weekly average mortgage rates falling to 6.99%.

Key Housing Market Data: The Four Weeks Ending June 9

- The median sale price was $393,627, reflecting a 4.4% year-over-year (YoY) change, representing an all-time high and the biggest increase in nearly three months (tied with increase for the four weeks ending April 21).

- The median asking price was $417,475, representing a 6% YoY change.

- The median monthly mortgage payment was $2,829 at a 6.99% mortgage rate, representing an 8.6% YoY change—roughly $30 below all-time high set during the four weeks ending April 28.

- Pending sales were 86,604, representing a -3.5% YoY change, experiencing the biggest decline in three months.

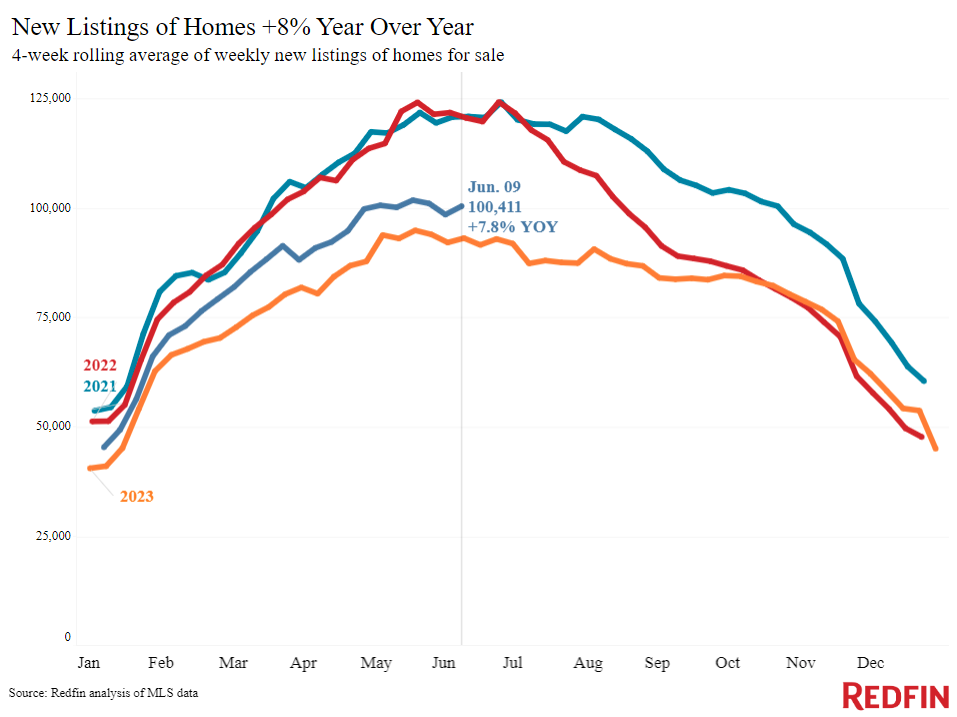

- New listings were at 100,411, representing a 7.8% YoY change.

- Active listings were at 939,839, representing a 16.7% YoY change.

- The months of supply of homes was 3.2, representing a +0.6 pt YoY change.

- The share of homes off market in two weeks was 42.4%, down from 48% YoY.

- Median days on market was 31, representing a +3-day YoY change.

- The share of homes sold above list price was 32.1%, down from 35% YoY.

- The share of homes with a price drop was 6.5%, representing a +2 pt YoY change and the highest level since November 2022.

- The average sale-to-list price ratio was 99.6%, representing a -0.3 pt YoY change.

Metros with Biggest YoY Increases in Median Sale Price

- Anaheim, CA (16.8%)

- Newark, NJ (16.4%)

- New Brunswick, NJ (15.5%)

- Nassau County, NY (14.6%)

- San Jose, CA (13%)

The median U.S. sale price declined in four metros—three of which are located in The Lone Star State: Austin, Texas (-3.5%), Fort Worth, Texas (-2.5%), and San Antonio (-1.1%). Home sale prices also declined in Portland, OR (-0.9%).

Pending sales increased in 13 U.S. metros, with the top five being spread out across the nation. Pending sales increased year-over-year in San Jose, CA (12.2%), Columbus, OH (5.8%), Pittsburgh (5.4%), Milwaukee (4%), and Seattle (3.6%). Overall pending sales declined year-over-year in Houston (-16.2%), West Palm Beach, FL (-13.4%), Fort Lauderdale, FL (-11.5%), Atlanta (-10%), and Tampa, FL (-9.9%).

New listings declined in seven U.S. metros, but rose in some of the most popular. New listing ticked up in San Jose, CA (39.9%), Phoenix (26.1%), San Diego (23.2%), Miami (20.9%), and Denver (17.7%). New listings declined in Atlanta (-7.9%), Chicago (-5.1%), Newark, NJ (-3.2%), Indianapolis (-2.8%), and Minneapolis (-2.1%).

2024 Mortgage Rate Forecast

Mortgage rates are expected to fall further throughout the summer, preventing monthly housing prices from skyrocketing upward again. On June 12, daily average mortgage rates fell to their lowest level in three months, following the latest CPI report, which showed that inflation is further cooling. And, while the Fed anticipated only one interest-rate drop this year at its June 12 meeting, it’s likely that the Fed was unable to properly evaluate the new inflation statistics in time for the meeting; they may change their projection at the next meeting. It’s worth remembering that daily rates have been erratic in recent days, soaring following last Friday’s strong jobs report before falling back down.

“The latest inflation report is good for homebuyers because it has already sent mortgage rates down, though this week’s Fed meeting will temper mortgage-rate declines,” said Chen Zhao, Redfin’s Economic Research Lead. “But on the other side of the coin, if lower mortgage rates bring back more demand than supply, that could erase the possibility that home-price growth softens, and push prices up even further. Lower rates and higher prices may ultimately cancel each other out when it comes to homebuyers’ monthly payments.”

For the time being, high prices are deterring some potential buyers. Pending house sales are down 3.5% year-over-year, the largest drop in three months, and Redfin’s Homebuyer Demand Index—a measure of requests for tours and other buying services from Redfin agents—is down 18%, reaching its lowest level since February. However, there is one positive indicator for demand: mortgage-purchase applications are up 9% week-over-week. On the selling side, new listings are up 7.8% year-over-year, but they are lower than typical springtime levels, which explains why property prices continue to rise despite lackluster demand.

To read the full report, including more data, charts, and methodology, click here.