A new report called the “Cost of Bills Index (COBI),” published by doxo, a web and mobile bill-pay service, is based on doxo’s nationwide bill payment statistics for the most common household bill categories which provides a standard comparison index for the most fundamental expenses that comprise the cost of living.

By leveraging doxo’s unique aggregate findings along with anonymized bill pay data, the COBI is a new feature of doxoINSIGHTS which provides a comprehensive look into the bill pay economy at the state, county, and city levels.

Alongside the launch of the COBI feature, doxoINSIGHTS released its 2024 Cost of Bills Index Report which reveals how much it costs to live in one area as compared to another as it relates to the most common household bills. This includes Utilities, Cable & Phone, Mobile Phone, Auto Loans, Auto Insurance, Life Insurance, Health Insurance, Alarm & Security, Rent, and Mortgage.

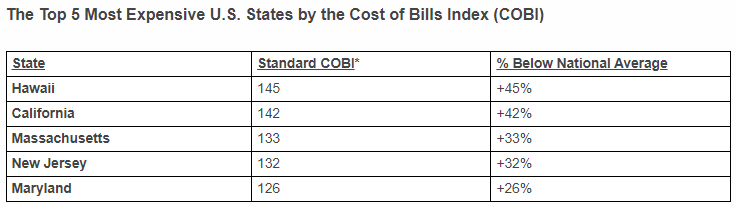

Providing a standard benchmark, the report includes state- and city-specific breakdowns with comparisons to the national average, and uncovers the five most and least expensive U.S. states to live in, based on the COBI:

The top five most expensive states by the COBI

- Hawaii (+45% above national average)

- California (+45)

- Massachusetts (+33%)

- New Jersey (+32%)

- Maryland (+26%)

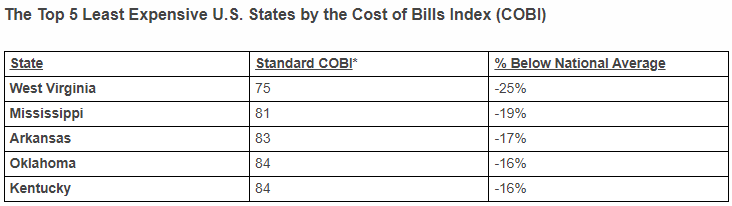

The top five least expensive states by the COBI

- West Virginia (-25% below national average)

- Mississippi (-19%)

- Arkansas (-17%)

- Oklahoma (-16%)

- Kentucky (-16%)

“As consumers continue to feel the heat from inflation, it’s never been more critical to arm them with data transparency that uncovers not only how their household bills compare to the national average, but also where are the most affordable places to live,” says Liz Powell, Senior Director, Insights at doxo. “With COBI, doxo provides a snapshot into the amount houses are spending on the ten most essential bills, down to the state, county and city level. Adding COBI to the doxoINSIGHTS platform gives consumers a deeper level of understanding so they can make more-informed decisions and enhance their cost savings during a time where every dollar counts.”

According to doxo, through the easy-to-navigate tool, the COBI offers three key ways to examine the household cost of bills for each state, county and city:

- Standard COBI: household bills expense per month, including housing. This version of the COBI is representative of the total amount spent on the ten most common household bills in a given area, inclusive of mortgage and rent, as it relates to the average national income.

- Standard COBI Without Housing: household bills expense per month, excluding housing. This version of the COBI is representative of the total amount spent on the ten most common household bills in a given area, excluding mortgage and rent, as it relates to the average national income.

- Income-Adjusted COBI: household bills as a percent of income, including housing. This version of the COBI is representative of the total amount spent on the ten most common household bills in a given area, including mortgage and rent, as it relates to the average income in the local (state, county, city) area.

For more on the COBI’s methodology please visit: https://www.doxo.com/w/cost-of-bills-index/