In a new study, Realtor.com has identified the top 10 U.S. metros best suited for military households, as the nation celebrates the 80th anniversary of the GI Bill on June 22, and its many benefits for military households. Coming in at the top of the list was Des Moines-West Des Moines, Iowa.

With affordability still a major factor in home buying decisions, knowing which markets offer lower home prices, high military homeownership rates, and a lower forecasted unemployment rate can help military households across the U.S. find the best town for their family. Moreover, these markets also have a high rate of home sales financed by VA loans, which provide significant financial relief and make it easier for military members to achieve homeownership in their desired location, despite soaring prices, and competition for U.S. homes.

On June 22, 1944, President Franklin Roosevelt signed the Servicemen’s Readjustment Act, known as the GI Bill, to provide financial aid to veterans returning from World War II. The Act provided a range of benefits for those returning from WW II, including federal aid to help veterans buy homes, find employment, and pursue an education.

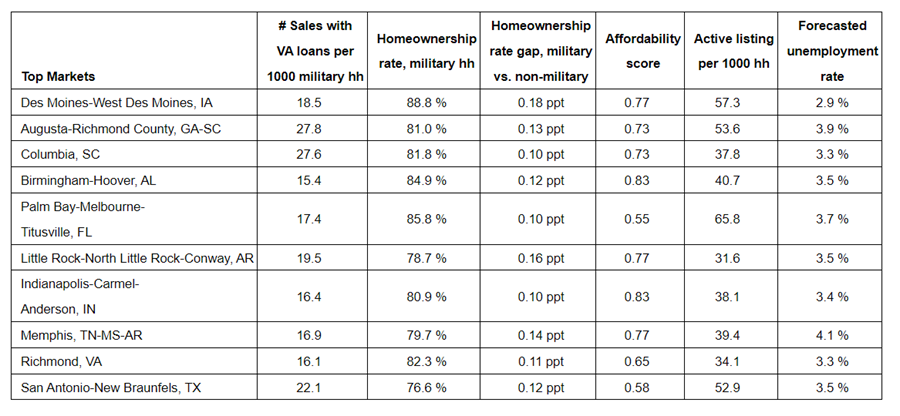

The top 10 metros ranked order include:

VA loan education is key

“Veterans have many benefits when it comes to real estate, thanks to the GI Bill and other important legislation. Unfortunately, seven in 10 veterans are unaware they qualify for a zero-down home loan,” said Mickey Neuberger, Chief Marketing Officer for Realtor.com. “Understanding what you qualify for and navigating the process can be really overwhelming in the biggest financial transaction of your life. The best way for military homebuyers to be certain they are taking advantage of all their benefits is to work with a buyer’s agent who specializes in working with the military community and can provide insights into the best local markets, the right home, and loan options.”

Veterans United Home Loans recently conducted a survey and found that the VA loan program has contributed $3.9 trillion to the U.S. economy, and VA loans rank as the top benefit veterans and military members receive for serving their country, over the 80-year history of the GI Bill. The economic impact analysis considers what the economy would have looked like if the VA loan hadn’t existed. It found the loan program has withstood various market changes, accounting for as much as 11% of new home mortgages in the postwar building boom. Total VA loan volume in 1947 was more than $3 billion, compared to its $447 billion peak in 2021, according to the study.

Despite the popularity of VA loans, Veterans United found that myths and misconceptions surrounding the benefit still exist among veterans, servicemembers, and the real estate community overall. The Veterans United survey found that 75% of veterans and servicemembers believe at least one myth about VA loans:

- 35% think they take longer to close than other loan types

- 32% think the government sets interest rates

- 18% think the VA loan can only be used once

- 18% think VA loans cost more than other loan products

The survey also uncovered other challenges and improvement areas that highlight the outsized role that real estate agents and home sellers can play when it comes to whether veterans can compete with their earned benefit. Nearly 20% of those veterans polled cited seller hesitation about VA offers and negative attitudes about VA loans among sellers’ real estate agents as major challenges with using their benefit.

“Having a buyer’s agent in your corner who understands the unique needs and circumstances of veterans is essential in the homebuying process,” said Barby Wulff, Executive Director for Veterans United Realty. “A buyer’s agent will help veterans navigate the challenges of today’s real estate market to best take advantage of their hard-earned home buying benefit. The VA home loan is a time-proven resource that has helped over 28 million veterans and military families realize and succeed at the American dream of homeownership.”

Factors in ranking markets

In seeking out the 10 U.S. metros for military households, Realtor.com took into consideration:

- A measure of VA loan use, estimated by the number of sales financed by VA loans per 1000 military households

- A measure of homeownership accessibility, estimated by the homeownership rate among military households

- A measure of the effectiveness of military benefits in promoting financial stability and access to homeownership, estimated by the homeownership rate gap between military and non-military households, adjusted for age-differences

- A measure of affordability, measured by the Realtor.com affordability score reflecting the share of home listings in a market that are affordable to those at various local income levels

- The availability of homes for sale, measured by active listings per 1000 existing households, to ensure that homebuyers have a good amount of choice in their search

- A measure of job stability, estimated by the forecasted unemployment rate

For the purpose of the research, a household is considered a military household if any member in the household is on active-duty or has a veteran status. In addition, Realtor.com only focused on households where the head of household is 18 or older. To estimate the homeownership rate among military households, Realtor.com first calculated the rates for three age groups (18-34, 35-54, and 55+) and then took a weighted average across these groups. To get the homeownership rate gap between military and non-military households, study authors calculated the homeownership rates gap for each age group (18-34, 35-54, and 55+), and then took a weighted average across these groups, based on their proportion among all households.

Click here for more on Realtor.com’s study of the nation’s top military households.