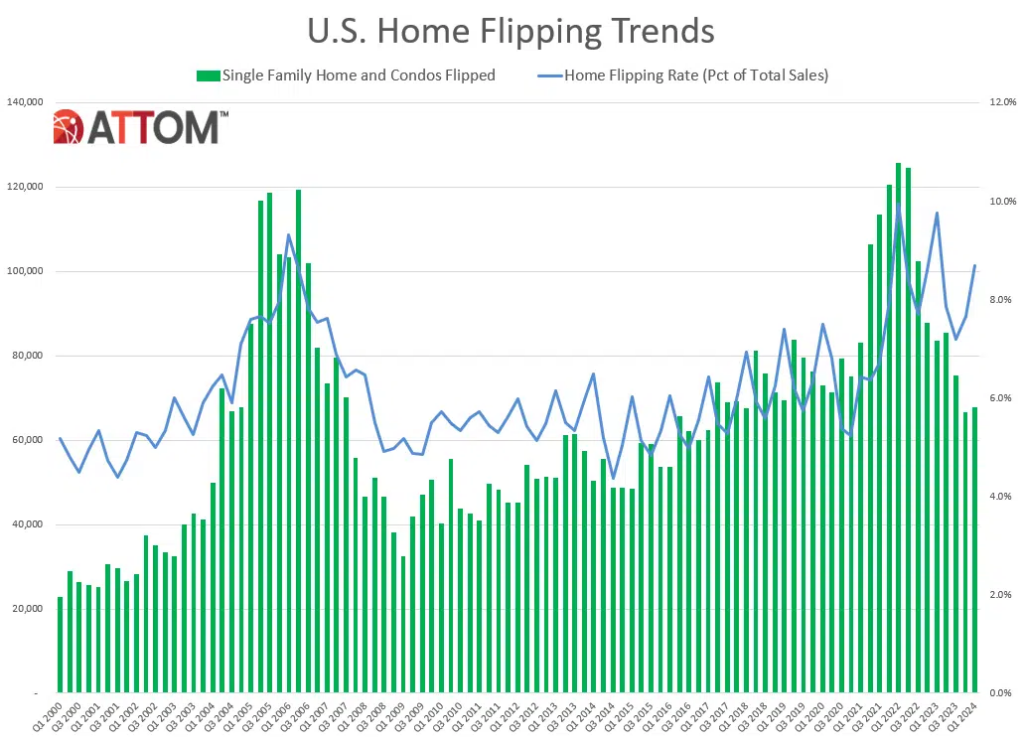

ATTOM has released its Q1 2024 U.S. Home Flipping Report, which shows that 67,817 single-family homes and condominiums in the United States were flipped in Q1. Those transactions accounted for 8.7%—or one out of every 12 home sales overall—from January to March 2024.

The latest figure was up from 7.7% of all home sales in the U.S. in Q4 of 2023, representing the second consecutive quarterly increase. While the percentage was still lower than 9.8% in Q1 of last year.

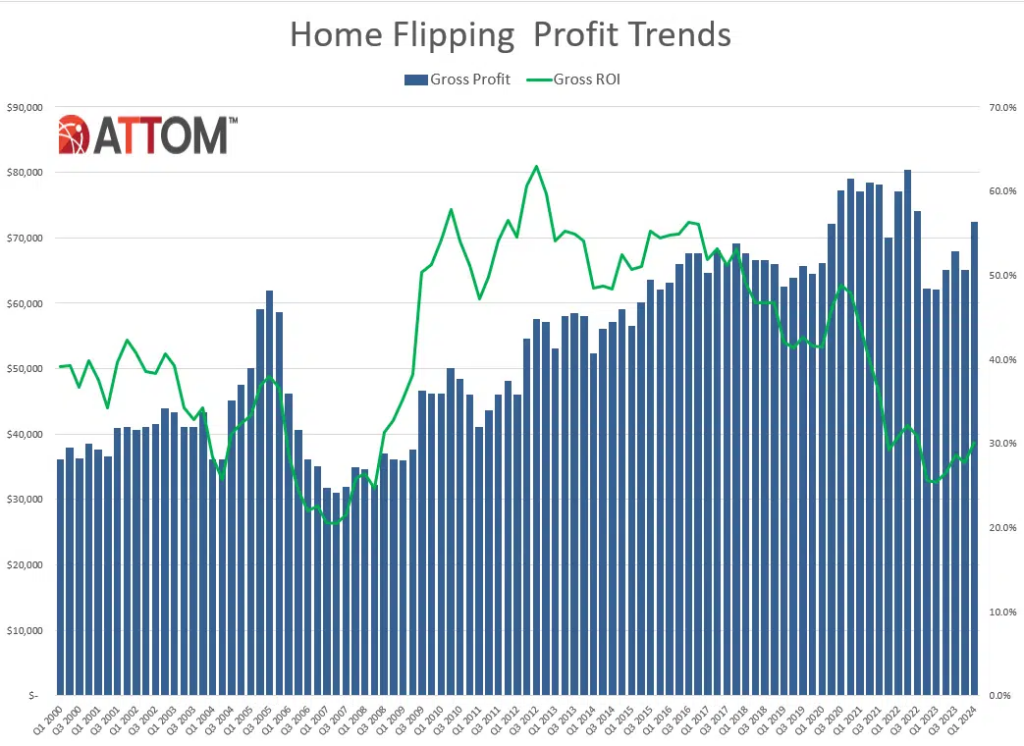

As flipping rates rose, good luck seemed to improve for investors who bought and swiftly sold residences. According to the most recent data, home flippers earned an average of 30.2% gross profit nationwide before expenses on homes sold in Q1 of this year, the third time in four quarters that margins climbed after a six-year stretch of mostly constant reductions.

The normal first-quarter profit margin for home flips, calculated as the difference between the median buy and median resale price, was roughly 25 percentage points lower than the peak reached in 2016. It also remained within a range that might be easily depleted by carrying costs such as renovation fees, mortgage payments, and property taxes.

However, it was up from both Q4 of 2023 and a decade-low of almost 25% in Q1 of last year.

Meanwhile, gross revenues from typical flips across the country rose to $72,375. That was down from a high of almost $80,000 attained in 2022. However, it was up from $65,000 in Q4 of 2023 and was around $10,000 more than last year’s low point.

“The latest numbers show that investors still face an uphill climb to clear significant profits after expenses,” said Rob Barber, CEO for ATTOM. They, like others, also face tenuous times amid a housing market boom that’s cooled down over the past year. But we now have a year’s worth of a trend showing that things have started to turn around for the flipping industry, with clear signs of increasing interest flowing into the market.”

Profits and profit margins have continued to grow over the last year, indicating a revitalized pattern of investors benefiting from price swings that favor them between buy and resale.

The average countrywide sales price for flipped homes rose to $312,375 in Q1 of 2024, up 4.1% from Q4 of 2023. The gain surpassed the 2.1% rise in median prices that recent home flippers experienced when purchasing their properties. Similar gaps emerged annually, resulting in quarterly and yearly increases in investment returns.

Home Flipping Rates Tick Up in Nearly 80% of U.S.

Home flips grew as a percentage of total home sales from the fourth quarter of 2023 to the first quarter of 2024 in 134 of the 173 metropolitan statistical areas with sufficient data to examine (77.5%). Most of the reductions were smaller than two percentage points. (Metro regions were included if they had a population of 200,000 or more, at least 50 home flips in Q1 of 2024, and adequate data.)

The metros with the highest flipping rates in Q1 of 2024 were: Warner Robins, GA (18.7% of all house sales), Macon, GA (17.1%), Fayetteville, NC (15.8%), Atlanta (14.7%), and Memphis, TN (14.6%).

Aside from Atlanta and Memphis, TN, metro areas with a population of more than one million had the greatest switching rates: Columbus, OH (12.8%); Birmingham, AL (12.7%); and Kansas City, MO (12.1%).

The smallest home-flipping rates among metro areas evaluated in the first quarter were in Honolulu (3.7%); Oxnard, CA (5.3%); Naples, FL (5.4%); Des Moines, Iowa (5.5%); and Seattle (5.5%).

Average Home Flipping Returns Rose Slightly in More Than Half of U.S.

The median $312,375 resale price of properties flipped worldwide in Q1 of 2024 resulted in a $72,375 gross profit, which was higher than the median investor buying price of $240,000. This resulted in a usual 30.2% profit margin in Q1 of 2024, up from 27.7% in Q4 of 2023 and 25.3% in Q1 of the previous year. However, the most recent countrywide statistic was still significantly lower than the 56.3% level in mid-2016 and the more recent top of 48.8% in 2020.

Profit margins increased from Q4 of last year to Q1 of this year in 89 of the 173 metro areas examined (51.4%) and were up annually in 111 of those markets (64.2%).

The most significant year-over-year increases in typical profit margins occurred in Reading, PA (ROI increased from 56.7% in Q1 of 2023 to 124.9% in Q1 of 2024); Trenton, NJ (up from 22.7% to 64.2%); Harrisburg, PA (up from 73.6% to 113.6%); Lynchburg, VA (up from 49% to 87.5%); and Columbus, GA (up from 41.8% to 80.1%).

The markets with the highest returns on investment for typical home flips completed in Q1 of 2024 were concentrated in lower-priced areas of the Northeast, led by Buffalo, NY (127.8% return); Reading, PA (124.9%); Pittsburgh (120.6%); Scranton, PA (115.7%); and Harrisburg, PA (113.6%).

Austin, Texas (0.3%), Honolulu (1.7%), San Antonio (2%), Dallas (5.3%), and Houston (8.4%) were the metro regions with a population of at least one million and the lowest returns on typical home flips in Q1 of 2024.

Purchase Investors Earn Highest Raw Profits in Expensive West, South, and Northeast Areas

The highest raw gains on median-priced home flips in Q1 of 2024, measured in dollars, were centered in areas of the West, South, and Northeast, where resale prices typically exceeded $400,000. Some 15 of the top 20 fell into that category, led by San Jose, CA (typical gross profit of $297,500 on a median resale value of $1.6 million), San Francisco ($280,000 profit on a median resale value of $1.1 million), San Diego ($190,750 profit on a median resale value of $926,500), Bridgeport, CT ($175,000 profit on a median resale value of $500,000 million), and Oxnard, CA ($162,000 profit on a median resale value of $929,500).

Investors paid cash for 63.8% of the properties flipped nationwide in Q1 of 2024. That was nearly the same as the 63.7% level in Q4 of 2023, but still lower than the 65.4% portion in Q1 of 2023. Meanwhile, some 36.2% of the properties flipped in Q1 of 2024 were purchased with financing. That was down slightly from 36.3% in the previous quarter, but still higher than 34.6% a year ago.

Among metropolitan areas with a population of one million or more and enough data to analyze, Buffalo, NY (82.2%), Detroit (77.3%), Cleveland (74.8%), Birmingham, AL (73.1%), and Pittsburgh (73%) had the highest percentage of homes flipped in Q1 of 2024 that were purchased with cash.

Typical Time to Flip Rises Nationwide, But Remains Down From a Year Ago

The average time it took from purchase to resale on home flips increased to 164 days in Q1 of 2024. That was up from 156 in Q4 of 2023, but still down from 178 days in Q1 of 2023.

Home flips accounted for at least 10% of all home sales in 284 (31.5%) of the 902 counties around the U.S. with at least 10 flips in Q1 of 2024. That was well above the 22.7% of all counties with enough data to measure in Q4 of 2023. The leaders in Q1 of this year were Cobb County (Marietta), GA (23.5%); Hickman County, TN (outside Nashville) (20.3%); Houston County (Warner Robins), GA (20.1%); Clayton County, GA (outside Atlanta) (19.6%) and Douglas County, GA (outside Atlanta) (19.5%).

In Q1 of 2024, roughly 11.2% of the 67,817 properties flipped in the U.S. were sold to buyers with Federal Housing Administration (FHA) loans, the second consecutive quarterly rise. The current portion increased from 10.4% in Q4 of 2023 and 10.7% in Q1 of 2023.

To read the full report, including more data, charts, and methodology, click here.