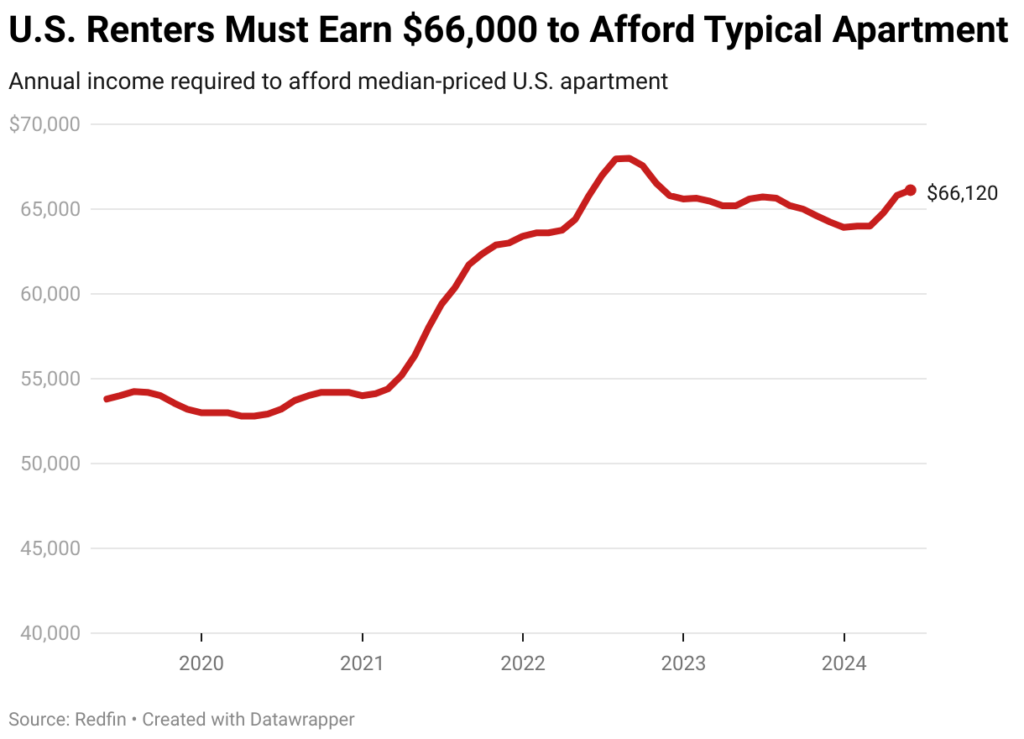

The typical U.S. renter household earns an estimated $54,712 per year, which is 17.3% less—roughly $11,408 in dollar terms—than the $66,120 required to pay monthly rent for the median-priced U.S. apartment ($1,653). This is according to new research from Redfin, which found that just 39% of American renters earn enough to purchase a median-priced apartment.

The amount renters must earn to afford the median-priced flat has reached its highest level since October 2022. It’s up 0.8% year-over-year and 22.9% since before the epidemic (May 2019), which is how much asking rentals have grown. In May, the median asking rent for an apartment in the United States was $1,653, only $47 less than the previous record high. Still, it’s worth noting that rent increase has been practically flat.

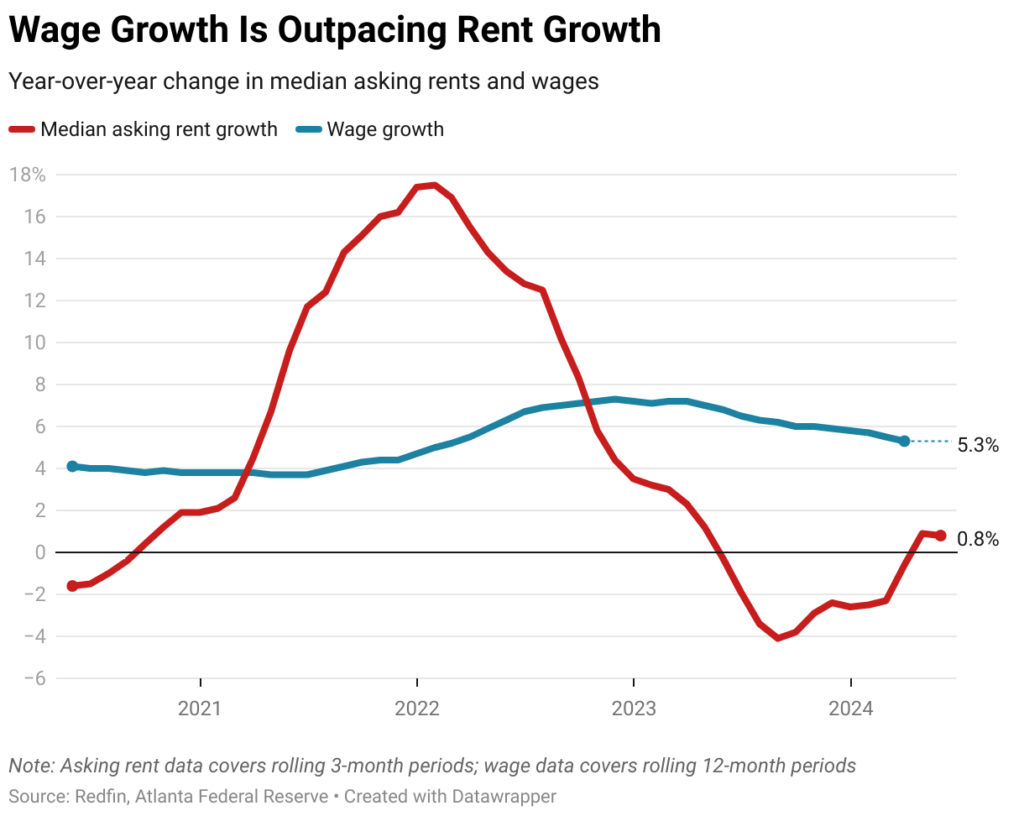

“Rents are growing at a snail’s pace compared to the rapid increases we saw during the pandemic, and are unlikely to soar again anytime soon. As a result, wage growth should continue to outpace rent growth in the coming months, as it has been doing since 2022,” said Sheharyar Bokhari, Senior Economist at Redfin. “That will help narrow the affordability gap for renters, but for a lot of folks, the math still won’t check out. Many U.S. renters are and will remain burdened by the cost of having a roof over their head, and unlike homeowners, they’re not building wealth through rising property values.”

While the income required to rent a typical apartment did decline in the previous year, rentals are currently starting to rise once more. Rents briefly dropped below $1,600 in December 2023, when they reached as low as $63,920, but many tenants could not afford it even then.

Rents fell during the pandemic because of an increase in multifamily building, but persistent demand is again driving rents higher; many young renters are choosing to stay put rather than deal with an increasingly expensive homebuying market. However, there is still a backlog of new units coming onto the market each month, which limits the rate of price increases.

Average Renters in New York, Miami Earn Roughly 40% Less Than Needed to Afford the Typical Apartment

The average annual income of a renter in New York is expected to be $67,358. That represents the largest difference among the 33 major metro areas Redfin examined, coming in at 43.5% less than the $119,120 a renter needs to afford the median-priced apartment. Miami is next with 42.2% less, then Boston with 38.7% less, Los Angeles with 36.1% less, and Riverside, California with 30.8% less.

1. New York

- Income required to afford median-priced apartment: $119,120

- Estimated median renter household income: $67,358

- Median asking rent: $2,978

2. Miami

- $99,440

- $57,471

- $2,486

3. Boston

- $113,400

- $69,493

- $2,835

4. Los Angeles

- $112,440

- $71,853

- $2,811

5. Riverside, CA

- $92,480

- $64,016

- $2,312

Although “the Big Apple”—New York—is always one of the most expensive rental markets, issues with affordability have gotten worse; in May, rentals increased by 9.2% from the previous year, which was one of the worst increases in the country. Although Miami rents decreased 4.2% annually, affordability is still a problem because to the sharp rise in costs during the pandemic moving frenzy.

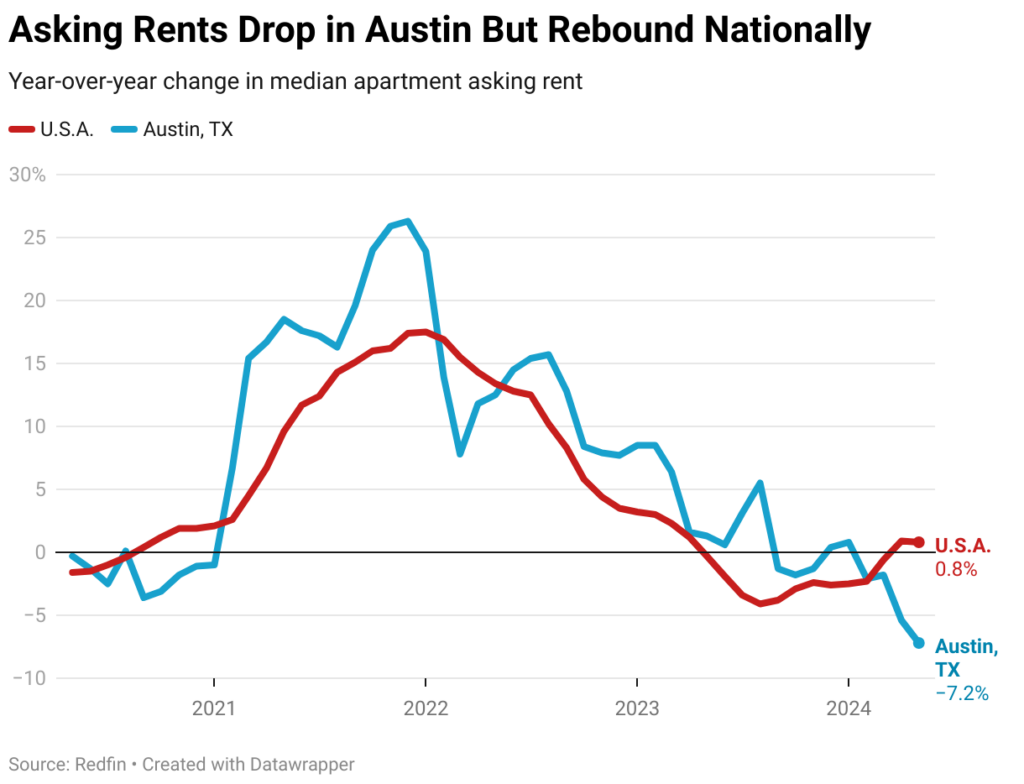

The Typical Renter Earns Enough to Afford the Median-Priced Apartment in Only Five Metros

The average annual income of a renter in Austin, Texas, is estimated to be $72,808.00. That represents a significant increase from 2023, when the average renter earned just 2.7% more, and 16.8% more than the $62,360 a renter needs to afford the median-priced apartment. Four other significant metropolises that Redfin examined have renters making enough money to afford the average apartment: Dallas (0.9% more), Phoenix (9.2% more), Houston (10.2% more), and Washington, D.C. (3.2% more).

1. Austin, Texas

- Income required to afford median-priced apartment: $62,360

- Estimated median renter household income: $72,808

- Median asking rent: $1,559

2. Houston

- $51,000

- $56,177

- $1,275

3. Phoenix

- $61,640

- $67,302

- $1,541

4. Washington, D.C.

- $82,680

- $85,336

- $2,067

5. Dallas

- $61,160

- $61,740

- $1,529

With one of the steepest rent declines in the country, Austin has contributed to the affordability of apartments. The third-largest decrease among the metro areas Redfin examined was the median apartment asking rent in the Texas capital, which dropped 7.2% year-over-year in May. Phoenix and Dallas saw a 5.5% and 1.3% decrease in rent, respectively.

The Sun Belt has been developing more apartments than other regions of the nation (including the Midwest and Northeast) to meet demand brought on by the influx of individuals who came there during the pandemic, which is one reason why rents are declining there. However, the pandemic housing bubble is now in the past, and landlords are dealing with vacant properties, which is driving down rental prices.

Conversely, the most apparent outlier is Washington, D.C., which is home to a large number of high-earning temporary workers. Although the average renter in D.C. makes slightly more than the median apartment cost, this difference is closing as rents rise. In 2023, the average renter in D.C. will only make $2,656 more than the median apartment cost, compared to $6,487 more in 2023. The largest increase among the metro areas Redfin examined was seen in May, when asking rents in Washington, D.C. increased 11.1% from a year earlier.

To read the full report, including more data, charts, and methodology, click here.