Affordability struggles continue for many nationwide, with mortgage rates reported still in the 7% range and the average U.S. home value at $360,681, up 4.3% year-over-year according to Zillow, the Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey found that the total number of loans now in forbearance declined slightly to 0.21% as of May 31, 2024.

The MBA estimates that approximately 105,000 homeowners are currently in forbearance plans, and that mortgage servicers have provided forbearance options to approximately 8.2 million borrowers since March 2020.

In May 2024, the share of Fannie Mae and Freddie Mac (GSE) loans in forbearance declined one basis point from 0.11% to 0.10%. Ginnie Mae loans in forbearance remained the same relative to the previous month at 0.39%, and the forbearance share for portfolio loans and private-label securities (PLS) also stayed flat at 0.31%.

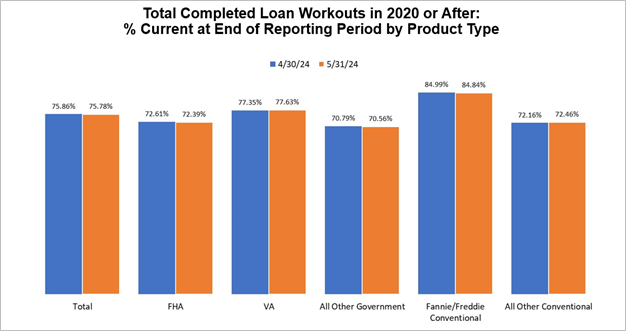

“The performance of servicing portfolios in May was solid, with about 96% of borrowers making their mortgage payments on time,” said Marina B. Walsh, CMB, MBA’s VP of Industry Analysis. “There was a slight decline in the performance of post-forbearance loan workouts, but the results were relatively strong with 75% of homeowners making their payments in accordance with the workout terms.”

By reason, 78% of borrowers were in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability. Another 12.6% were in forbearance because of a natural disaster, and 9.4% of borrowers were still in forbearance due to COVID-19-related reasons.

By stage, 57.2% of total loans in forbearance were in the initial forbearance plan stage, while 22.5% were reported in a forbearance extension. The remaining 20.3% were classified as forbearance re-entries, including re-entries with extensions.

Total loans serviced that were current (not delinquent or in foreclosure) as a percentage of servicing portfolio volume (#) increased to 96.14% (on a non-seasonally adjusted basis) in May 2024, up five basis points from 96.09% in April 2024.

The state of unemployment

According to the U.S. Bureau of Labor Statistics (BLS), total nonfarm payroll employment increased by 272,000 in May 2024, and the unemployment rate changed little at 4%, as employment continued to trend upward in several industries, including healthcare; government; leisure and hospitality; and professional, scientific, and technical services. Unemployment trends relate to trends in loss mitigation as the impact on the job market is tied to a rise or fall in forbearance and foreclosure totals.

ATTOM’s May 2024 Foreclosure Market Report found a total of 32,621 U.S. properties with foreclosure filings during the month—default notices, scheduled auctions, or bank repossessions—up 3% from April 2024, but down 7% from a year ago.

“May’s foreclosure activity highlights nuanced shifts in the housing market,” said Rob Barber, CEO at ATTOM. “While we observed a slight increase in foreclosure starts, the decline in completed foreclosures indicates resilience in certain areas. Monitoring these evolving patterns remains crucial to understanding the full impact on the real estate sector.”

Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts decreased to 75.78% in May 2024, down eight basis points from 75.86% reported in April 2024.

The regional impact of forbearance

The five states reporting the highest share of loans that were current as a percent of servicing portfolio include:

- Washington

- Colorado

- Idaho

- Oregon

- California

The five states reporting the lowest share of loans that were current as a percent of servicing portfolio include:

- Louisiana

- Mississippi

- Indiana

- Alabama

- New York