According to the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI) for May 2024, homebuyer affordability improved in May, as the national median payment applied for by purchase applicants decreased around $40 to $2,219 from $2,256 reported in April 2024. MBA’s PAPI measured how new monthly mortgage payments vary across time–relative to income–using data from MBA’s Weekly Applications Survey (WAS).

“Homebuyer affordability conditions improved in May, as slightly lower mortgage rates and an uptick in housing inventory slightly eased the recent rise in application payment amounts,” said Edward Seiler, Ph.D., MBA’s Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America (RIHA). “MBA is forecasting for mortgage rates to fall closer to 6.5% by the end of the year, which along with rising inventory levels, and a subsequent slowdown in home-price growth, should help affordability.”

Riding the market waves

An increase in MBA’s PAPI is indicative of declining borrower affordability conditions, meaning that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI is indicative of improving borrower affordability conditions, and occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

According to Forbes Advisor, after hitting a 2024 high of 7.22% to start May, the average 30-year fixed-rate mortgage (FRM) has fallen 36 basis points. For the week ending June 27, the 30-year FRM was 6.86%, according to Freddie Mac.

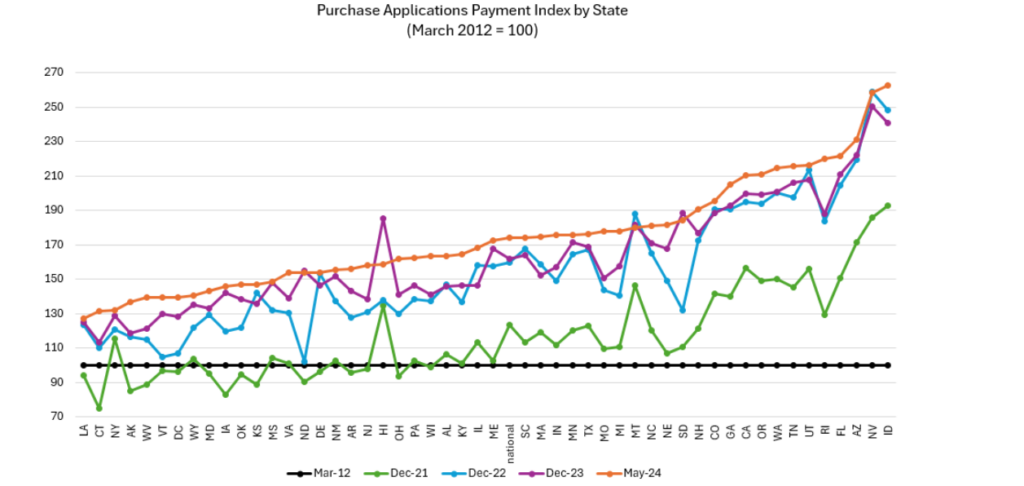

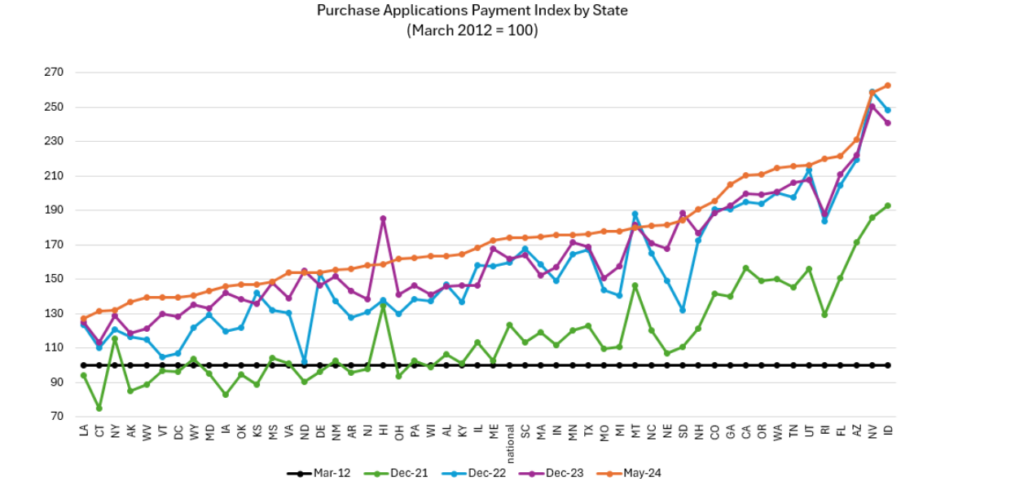

The national PAPI fell 1.6% to 173.9 in May 2024 from 176.8 in April. Median earnings were up 4.6% year-over-year, and while payments increased 2.5%, the strong earnings growth means that the PAPI is down 2% on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment decreased to $1,508 in May from $1,537 in April.

And while mortgage payments may have dipped, restrictive mortgage rates continued to put a damper on new home sales in May. Sales of newly built, single-family homes in May fell 11.3% to a 619,000 seasonally adjusted annual rate from a sharp upwardly revised reading in April, according to data from the U.S. Department of Housing & Urban Development (HUD) and the U.S. Census Bureau. The pace of new home sales in May is down 16.5% from a year earlier and the lowest pace since November 2023.

“Persistently high mortgage rates in May kept many prospective buyers on the sidelines,” said Carl Harris, Chairman of the National Association of Home Builders (NAHB) and a custom home builder from Wichita, Kansas. “However, significant unmet demand exists, and we expect mortgage rates to moderate in the coming months, which will bring more buyers into the market.”

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey decreased to $2,522 in May from $2,604 in April.

Additional findings for May 2024

- The national median mortgage payment was $2,219 in May—down $37 from April, but up by $55 from one year ago, a 2.5% increase.

- The national median mortgage payment for FHA loan applicants was $1,924 in May 2024, down from $1,955 in April, and up from $1,802 in May 2023.

- The national median mortgage payment for conventional loan applicants was $2,226, down from $2,271 in April, and up from $2,202 in May 2023.

- The top five states with the highest PAPI were: Idaho (262.9), Nevada (258.3), Arizona (231.4), Florida (221.8), and Rhode Island (220.2).

- The top five states with the lowest PAPI were: Louisiana (127.4), Connecticut (131.4), New York (132.2), Alaska (136.8), and West Virginia (139.3).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 183.1 in April to 180.1 in May 2024.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 168.9 in April to 166.1 in May.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 179.4 in April to 176.5 in May.

Click here for more information on MBA’s PAPI.