Over the past few years, the most popular housing markets in the U.S. have experienced significant changes, showing a pattern of ongoing development and evolution, according to CoreLogic’s May Home Price Insights report.

Per CoreLogic’s research, South Dakota—home to the historical Mount Rushmore—is the state with the second-fastest rate of appreciation, and Camden, New Jersey is among the top metro areas for appreciation in March 2024.

However, just a year ago, things were very different. The leading groups in March 2023 were Miami and Florida. On the other hand, Idaho was the state that was appreciating the slowest at the time, while Austin, Texas, was the bottom metro. The latter two sites seem quite chilly presently, but three years ago they were heralded as the country’s new real estate hot spots, leading the nation in gains during the pandemic. Pandemic boomtown real estate markets, however, continue to seem robust going forward, even despite the abrupt reverse.

“Home prices increased again this March beyond the typical seasonal uptick, despite mortgage rates reaching this year’s high and the affordability crunch continuing to keep many prospective buyers on the sidelines,” said Dr. Selma Hepp, Chief Economist for CoreLogic. “Even with the long-anticipated break in for-sale inventory, the surging cost of homeownership, further fueled by rising insurance and tax expenses, is holding potential home sales back, as is evident in the slow rise in sales compared with last year. These price pressures reflect the overall supply-and-demand mismatch, as well as continued interest from households with larger budgets.”

Phoenix and Salt Lake City Show Major Price Gains During the Pandemic

Four strong markets in 2020, 2021, and 2022 were Austin, Texas; Boise, Idaho; Phoenix; and Salt Lake City, according to the CoreLogic Home Price Index. Boise saw the biggest increase over that time, rising to 230% of its starting value in May 2022 before beginning to decline. Nevertheless, as of February 2024, the capital of Idaho’s prices had more than doubled over the previous five years.

Like Boise, the other three metro areas peaked in the middle of 2022 before beginning to decline. There is some variance in 2023 activity, though. For the first eleven months of the year, Phoenix actually reported aggressive price rises of more than 5%, Salt Lake City was essentially unchanged, and Austin saw the biggest price decrease of any major metro in the nation for the year, at 6%.

Despite being perceived as unexpected travel destinations during the epidemic, evidence indicates that Salt Lake City and Boise were among the county’s fastest-appreciating cities in the years preceding the 2020–2022 price bubble. Phoenix was another such metropolis.

In CoreLogic’s analysis, Austin, Texas, is the only metro that might be considered an anomaly. The capital of Texas saw a sharp increase in value between 2020 and 2022, going from being in the bottom third of the top 100 in 2018. Since then, all four metro areas have quickly fallen into the bottom 10, where they now are, except Phoenix, which is starting to rise.

Rapid market slowdowns, however, need to be seen in a larger perspective. Since prices reflect what an individual or household is willing to pay to live in a particular location, overall price rankings serve as a rough indicator of the relative demand for a given market. In other words, if one location starts to cost more than another, it is usually acceptable to assume that an underlying factor has changed, making that location a more desired neighborhood, or vice versa.

Despite the volatile price growth, Austin, Texas, and Salt Lake City continue to rank among the 30th to 40th most expensive cities in the U.S. to live in. However, Phoenix and Boise, Idaho, saw increases in their rankings that moved them up to the same tier as Austin and Salt Lake City from among the 40th to 50th most expensive cities in the nation. This is an alternate viewpoint, according to which metro areas that saw booms and/or crashes valued until they attained a level that matched their current level of buyer appeal.

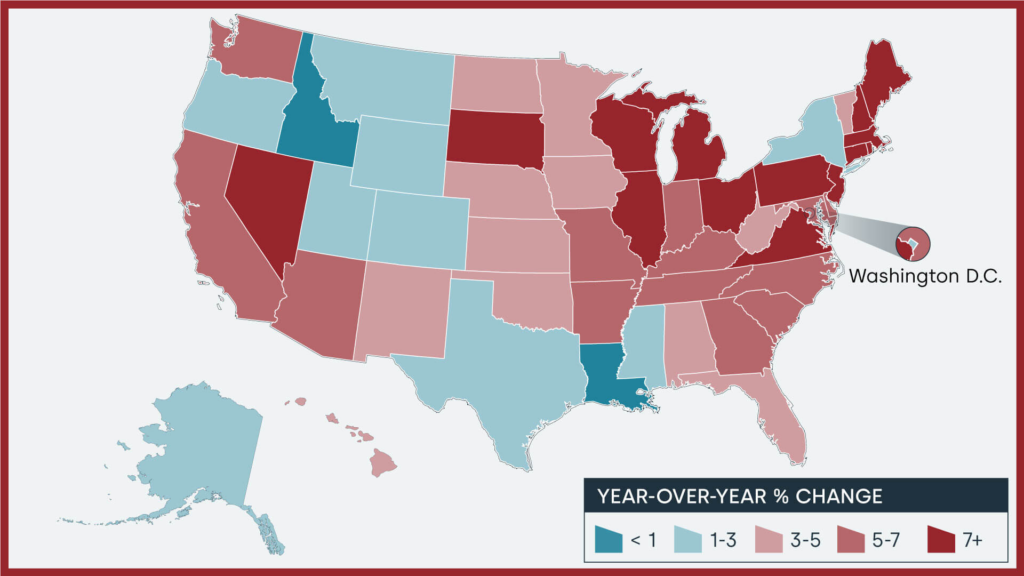

Northeastern States Lead for Annual Home Price Growth in March

Home price growth was above 5% in March. These gains are expected to persist in that broad range for most of the upcoming 12 months. As more people move to the suburbs of large cities and employment centers, as well as to places where household incomes are comparatively higher and can support the higher cost of homeownership, the Northeastern states continue to record the greatest gains in the country.

Further, the Northeast continues to lag the states in terms of inventory gains, such as Florida and Texas. This pattern exacerbates supply-and-demand fundamentals and increases pressure on housing prices in the Northeast. Consequently, home price increase is currently slowing in locations where there has been a greater influx of new listings.

Examining appreciation at the metro level reflects regional patterns. In 2024, the top 10 fastest-appreciating U.S. housing markets to date include:

- Camden, NJ

- Hartford, CT

- Syracuse, NY

- Worcester, MA

- Newark, NJ

- Allentown, PA

- Rochester, NY

- Miami

- Anaheim, CA

- San Jose, CA

States like Idaho, Washington, and Utah, where some Americans moved to avoid the worst of the pandemic, are currently the ones that are farthest from their price peaks.

Top Markets at Risk of Home Price Decline

According to the CoreLogic Market Risk Indicator (MRI), which provides a monthly assessment of the state of the nation’s housing markets overall, Palm Bay-Melbourne-Titusville, Florida is at a very high risk of experiencing a decrease in home values over the course of the next year (70%-plus chance).

Price reductions are also extremely likely to occur in:

- Atlanta-Sandy Spring-Roswell, GA

- Spokane-Spokane Valley, WA

- Deltona-Daytona Beach-Ormond Beach, FL

- Greenville-Anderson-Mauldin, SC

Homeowners in the Top Four Metros Still Have Plentiful Equity

The majority of the gains made during the epidemic have been retained, with only minor equity adjustments as a consequence of recent slowdowns. According to CoreLogic’s Q4 2023 Homeowner Equity Insights data, homeowners in all four locations increased their equity by more than $150,000 between 2019 and 2022, and they all still have more than $100,000 in equity.

In the end, it would be an exaggeration to suggest that epidemic boomtowns have witnessed anything like a price crash, even though they have had abrupt and severe slowdowns in appreciation over the previous 18 months. Furthermore, because of their rapid population increase, these marketplaces were popular before the epidemic, indicating that they had solid fundamentals for long-term price rise.

The most recent information on national, state, and metro home prices is available in CoreLogic’s Home Price Insights and U.S. CoreLogic S&P Case-Shiller Index reports, which are typically released on the first and last Tuesdays of each month, respectively, along with analysis from staff of housing economists.

To read the full report, including more data, charts, and methodology, click here.