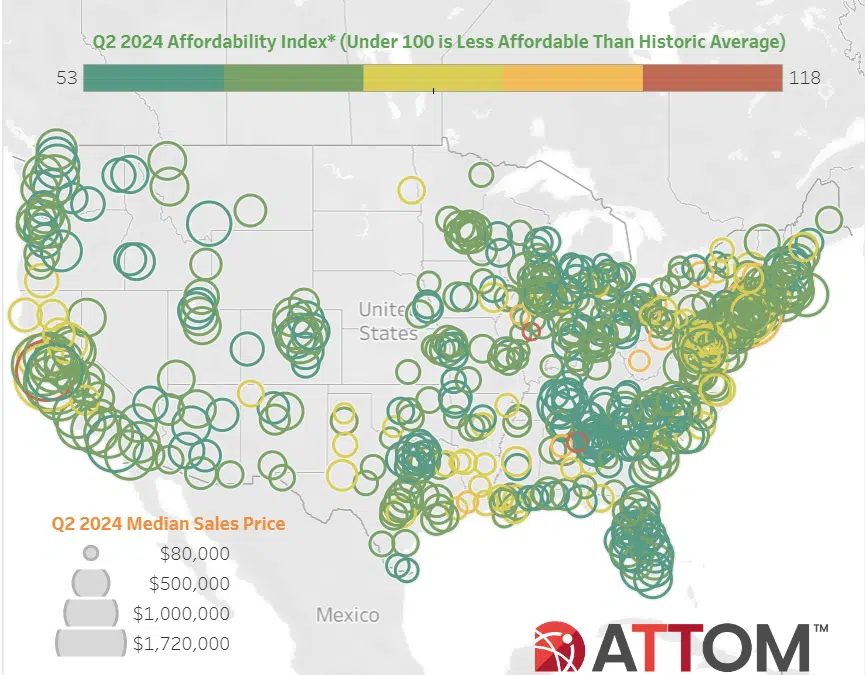

In 99% of the counties in the country with sufficient data for analysis, median-priced single-family homes and condominiums remained less affordable in the second quarter of 2024 compared to historical norms, according to ATTOM‘s second-quarter 2024 U.S. Home Affordability Report.

The most recent trend followed a pattern that began in early 2022 and has continued to this day where owning a home nationwide has historically required a sizable amount of salaries due to high residential mortgage rates and persistently high property prices.

The survey also reveals that in the second quarter, significant costs associated with median-priced residences accounted for 35.1% of the average national wage, which is higher than the standard lending guideline of 28 percent and represents the highest level since 2007.

The historical and present measurements both showed quarterly and annual declines after a small uptick from late 2023 to early 2024. The changes occurred during the spring purchasing season, when the national median home price surged to a record high of $360,000 while mortgage rates stayed at roughly 7%. As a result, the rising cost of homeownership exceeded recent improvements in salaries.

Therefore, compared to the first quarter of this year and the second quarter of last year, the proportion of average wages required nationwide for normal mortgage payments, property taxes, and insurance increased by around three percentage points.

“The latest affordability data presents a clear challenge for home buyers,” said said Rob Barber, CEO for ATTOM. “While home prices are increasing and mortgage rates remain relatively high, these factors are making homes less affordable. It’s common for these trends to intensify during the Spring buying season when buyer demand increases. However, the trends this year are particularly challenging for house hunters, more so than at any point since the housing market boom began in 2012. As the 2024 buying season progresses into the Summer, we will continue to monitor the data closely.”

Throughout the months of April through June, the national median home price increased by 4.7% annually and 7.3% quarterly. The average 30-year house mortgage rate, which ended the quarter at roughly 6.9%, or more than twice where they stood in 2021, further hurt buyers during the second quarter.

Following a modest decline in the previous two quarters, these variables contributed to an approximately 10% increase in house ownership expenses in the second quarter of 2024.

In order to determine affordability for average wage earners, the report calculated the monthly income required to cover the major costs of home ownership, such as property taxes, insurance, and mortgage payments, on a median-priced single-family home. This calculation was based on the assumption of a 20% down payment and a maximum “front-end” debt-to-income ratio of 28%. The annualized average weekly wage data from the U.S. Bureau of Labor Statistics was then compared to that required income.

In 582 of the 589 counties examined in the second quarter of 2024, the median cost of home ownership was lower than it had ever been. Compared to 579 of the same counties in the first quarter of this year and 577 in the second quarter of last year, that figure was just marginally higher. However, it was over fifteen times higher than the early 2021 figure.

Meanwhile, the portion of average local wages consumed by major home-ownership expenses on typical homes was considered unaffordable during the second quarter of 2024 in about 80 percent of the 589 counties in the report, based on the 28% guideline. Counties with the largest populations that were unaffordable in the second quarter were Los Angeles County, CA; Cook County (Chicago), IL; Maricopa County (Phoenix), AZ; San Diego County, CA, and Orange County, CA (outside Los Angeles).

The most populous of the 115 counties with affordable levels of major expenses on median-priced homes during the second quarter of 2024 were Harris County (Houston), TX; Wayne County (Detroit), MI; Philadelphia County, PA; Cuyahoga County (Cleveland), OH, and Allegheny County (Pittsburgh), PA.

National Median Home Price Jumps Quarterly, Annually in Most Markets

In the second quarter of 2024, the national median price for single-family homes and condos skyrocketed to $360,000, a whole $15,000 higher than the previous peak of $345,000 set in the spring of 2022. The most recent amount was higher than $335,500 in 2024’s first quarter and $344,000 in the previous year’s second quarter.

In 514, or 87.3 percent, of the 589 counties in the study, median house prices increased from the first to the second quarter of this year. They showed a similar trend annually, rising in 441, or 74.9 percent of those markets.

Among the 47 counties in the report with a population of at least 1 million, the biggest year-over-year increases in median prices during the second quarter of 2024 were in Orange County, CA (outside Los Angeles) (up 16.2 percent); Alameda County (Oakland), CA (up 12 percent); King County (Seattle), WA (up 11.3 percent); Santa Clara County (San Jose), CA (up 9.8 percent) and Nassau County, NY (outside New York City) (up 8.9 percent).

Counties with a population of at least 1 million where median prices remained down the most from the second quarter of 2023 to the same period this year were Honolulu County, HI (down 3.8 percent); Tarrant County (Forth Worth), TX (down 1.5 percent); Oakland County, MI (outside Detroit) (down 1.4 percent); Hennepin County (Minneapolis), MN (down 1.1 percent) and Fulton County (Atlanta), GA (down 1 percent).

Home Prices Growing Faster Than Wages in Half the U.S.

In 293 (49.7%) of the 589 counties examined in the analysis, year-over-year price changes during the second quarter of 2024 exceeded changes in weekly annualized salaries. This is because home values are generally rising annually throughout the United States. This pattern, coupled with rising property taxes and mortgage rates, made affordability worse.

The latest group of counties where prices increased more than wages annually included Los Angeles County, CA; Cook County, (Chicago), IL; Maricopa County (Phoenix), AZ; San Diego County, CA, and Orange County, CA (outside Los Angeles).

Conversely, in 296 of the counties studied (50.3 percent), year-over-year changes in average annualized wages outpaced price variations during the second quarter of 2024. Harris County (Houston), Texas; Dallas County, Texas; Queens County, New York; Tarrant County (Fort Worth), Texas; and Bexar County (San Antonio), Texas, were the most recent counties where wages grew faster than prices.

Portion of Wages Needed for Homeownership Climbs Quarterly and Annually in Most of Nation

The share of average local salaries consumed by significant expenses on median-priced single-family homes and condos increased from the first quarter of 2024 to the second quarter of 2024 in 547, or 92.9 percent, of the 589 counties evaluated, as housing values skyrocketed and interest rates remained relatively high. In 92.4 percent of those markets, it was higher than the level from the previous year.

The average cost of homeowner insurance, mortgage insurance, property taxes, and mortgage payments ($2,114) in the country set a new record last quarter, accounting for 35.1% of the average annual national earnings of $72,358. This was significantly higher than the most recent low point of 21.3 percent reached in the first quarter of 2021, having increased from 31.9 percent in the first quarter of 2024 and from 32.1 percent in the second quarter of last year.

Assuming a 20% down payment, the most recent statistic exceeded the 28% lending standard in 474, or 80.5 percent, of the counties examined. This represents an increase from 73.5 percent and 73.2 percent of the same group of counties in the first quarters of 2024 and 2021, respectively. About twice as much as the early 2021 record was reached.

Major expenses devoured at least 43% of typical local wages in over 33% of the markets evaluated, a criterion that was deemed extremely expensive. Higher, more expensive markets with second-quarter median prices of at least $450,000 that are concentrated in the West and Northeast typically experience the largest decreases in affordability. Even before, those counties were among the most expensive in the nation.

To read the full report, including more data, charts, and methodology, click here.