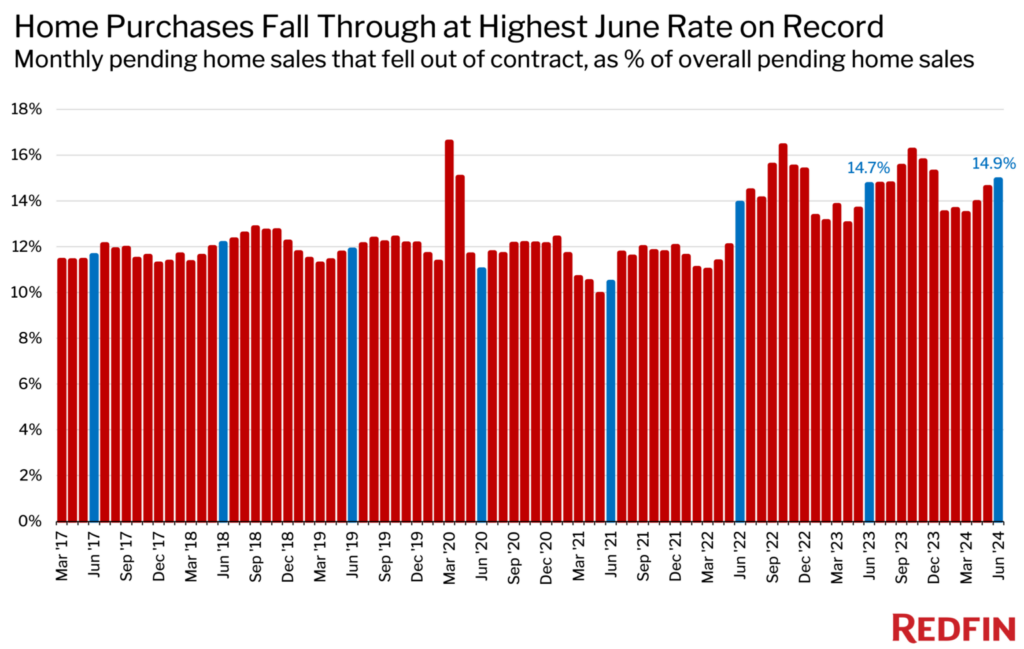

According to a recent Redfin survey, home purchase deals are collapsing at an unprecedented rate as purchasers become hesitant due to exorbitant housing expenses. June had the greatest percentage of canceled home purchase agreements ever, with nearly 56,000 agreements, or 14.9% of all homes under contract, being canceled in that month alone.

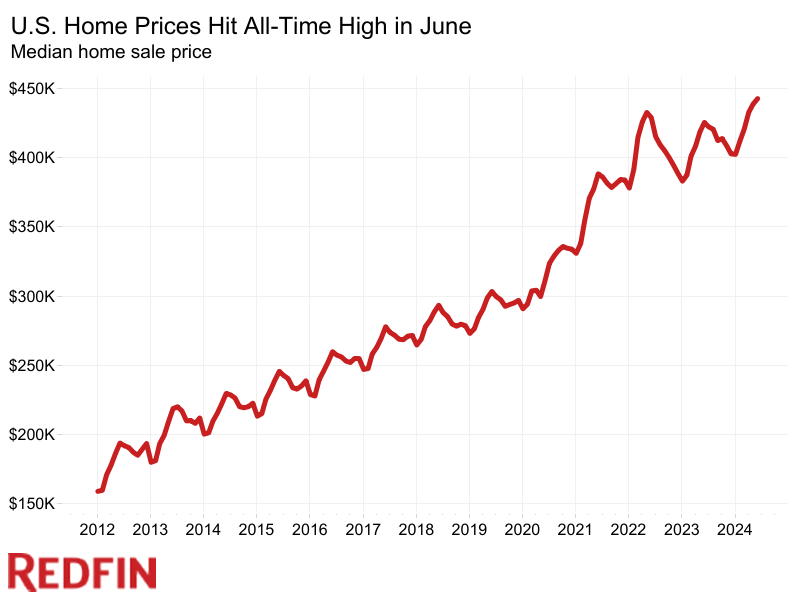

The rising cost of purchasing a home is causing house searchers to hesitate before making a decision. In June, the average interest rate on a 30-year mortgage was 6.92%, while the median house sale price increased by 4% year-over-year to a record $442,525. That is still more than twice the all-time low reached during the epidemic, even though it is somewhat lower than the 7.06% recorded the previous month.

“Buyers are getting more and more selective,” said Julie Zubiate, a Redfin Premier real estate agent in the San Francisco Bay Area. “They’re backing out due to minor issues because the monthly costs associated with buying a home today are just too high to rationalize not getting everything on their must-have list.”

Metro-Level Highlights: June 2024

- Prices: Median sale prices rose most from a year earlier in Anaheim, CA (13.2%) Newark, NJ (12.6%) and Nassau County, NY (12%). They fell in four metros, all of which are in Texas: Austin (-5.5%), Dallas (-1.6%), San Antonio (-1.3%) and Fort Worth (-0.2%).

- Price cuts: In Indianapolis, 49.2% of listings had a price drop—a higher share than any other metro Redfin analyzed. Next came Denver (46.6%) and Tampa (43%). The lowest shares were in Newark (15.2%), Chicago (16.3%) and Milwaukee (17%).

- Active listings: Active listings rose most in Tampa (47%), Fort Lauderdale, FL (45.3%) and Orlando (41.4%). They fell most in Chicago (-7.4%), New Brunswick, NJ (-7%), Chicago (-7.3%) and New York (-5.8%).

- Closed home sales: Home sales rose in just one metro: San Jose, CA (1.8%). They fell least in Portland, OR (-3.2%), Oakland, CA (-3.7%) and San Diego (-5%), and fell most in West Palm Beach, FL (-23.5%), Fort Lauderdale (-23%) and Virginia Beach, VA (-17.7%).

- Sold above list price: In San Jose, 72.1% of homes sold above their final list price, the highest share among the metros Redfin analyzed. Next came Newark (71.7%) and Oakland (63.1%). The shares were lowest in West Palm Beach (7.3%), Miami (11.4%) and Fort Lauderdale (12.3%).

Three Florida Metros Lead the U.S. in Home Purchase Cancellations

Approximately 900 home purchase agreements were canceled in June in Orlando, which is the highest rate among the 50 most populous U.S. metropolitan areas. That number represents 20.8% of the residences that were under contract in that month. San Antonio (19.9%), Jacksonville (20.5%), Tampa (20.5%), and Las Vegas (20.2%) followed.

“We’re seeing nightmare scenarios where deals are getting canceled at the last minute for the most minute reasons,” said Rafael Corrales, a Redfin Premier agent in Miami, where roughly 2,500 home purchases were canceled in June—equal to 17.6% of homes that went under contract. “Buyers often back out during the inspection period because they find something they don’t like, but affordability is really the underlying issue. I don’t want my buyers to be surprised by all of the expenses that come with owning a home in Florida, so I advise them to proactively research the hefty costs of insurance, property taxes and HOA fees, in addition to the cost of their mortgage payment.”

Nearly 1 in 5 Sellers Dropped Asking Prices as Homes Sat on the Market—the Highest June Rate on Record

The biggest percentage of price reductions ever recorded for a June was found in nearly one in five (19.8%) of the residences listed for sale. That is somewhat less than the record high of 21.7% recorded in October 2022, having increased from 14.4% a year earlier.

A persistent affordability dilemma that is affecting purchasers is causing some sellers to lower their prices since their properties are sitting on the market and growing stale. The average June house that sold took the longest to come off the market (32 days) since 2020. That represents the largest annual increase since last summer, up three days from a year ago. As a result, there are an increasing number of postings; the total number of properties for sale, or active listings, has not increased significantly from a month ago but jumped 12.8% from a year earlier—representing the largest annual gain on record.

U.S. Home Sales Post Steep Monthly Declines Since October

Seasonally adjusted home sales in June decreased by 0.5% month-over-month. Even while it might not seem like much, that reduction is the largest since October 2023. Property sales were 21.5% lower in June 2019 than they were before to the pandemic, down 1.1% from the previous year.

Due to the fact that many Americans cannot afford to purchase homes, sales remain slow. Although mortgage rates decreased slightly in June and have continued to decline this month, some purchasers are holding off in the hopes that they would decrease even more. However, Redfin Economics Research Lead Chen Zhao warned that such buyers would be waiting in vain because markets have already factored in a rate cut in September and rates are not expected to drop further over the next few months.

June 2024 U.S. Housing Market Highlights

- The median sale price was $442,525 in June, representing a 0.9% month-over-month (MoM) change and a 4.0% year-over-year (YoY) change.

- The share of homes sold was 417,179, representing a -0.5% MoM change and a -1.1% YoY change.

- The share of total homes for sale (active listings) was 1,636,110, representing a -0.1% MoM change and a 12.8% YoY change.

- The months’ supply of was 2.6, representing a 0.2 MoM change and a 0.7 YoY change.

- Median days on market was 32, representing a 1 day MoM change and a 3 day YoY change.

- The share of for-sale homes with a price drop was 19.8%, representing a 1.7 ppts MoM change and a 5.4 ppts YoY change.

- The share of homes sold above final list price was 35.1%, representing a 0.0 ppts MoM change and a -4.5 ppts YoY change.

- The average sale-to-final-list-price ratio was 99.9%, representing a 0.1 ppts MoM change and a -0.4 ppts YoY change.

- The share of pending sales that fell out of contract, as % of overall pending sales was 14.9%, representing a 0.3 ppts MoM change and a 0.2 ppts YoY change.

- The average 30-year fixed mortgage rate was 6.92%, representing a -0.14 ppts MoM change and a 0.21 ppts YoY change.

To read the full report, including more data, charts, and methodology, click here.