Key Highlights

- Single-family existing-home sales prices rose in 89% of measured metro areas—199 of 223—in the second quarter, down from 93% in the previous quarter. The national median single-family existing-home price rose 4.9% from a year ago to $422,100.

- Twenty-nine markets (or 13% of the 229 tracked markets) experienced double-digit annual price appreciation (down from 30% in the prior quarter).

- The monthly mortgage payment on a typical, existing single-family home with a 20% down payment was $2,262—up 10.3% from one year ago.

Nearly 90% of U.S. metropolitan areas saw home prices rise in the second quarter of 2024, with one area reaching a historic milestone, according to the latest report from the National Association of Realtors (NAR). San Jose, California, became the first metro area to record a median single-family home price above $2 million since NAR began tracking such data in 1979.

Out of 223 metro areas tracked, 199 (89%) experienced home price gains as the average 30-year fixed mortgage rate fluctuated between 6.82% and 7.22% according to the latest data from Freddie Mac. Thirteen percent of these areas reported double-digit price increases, a significant drop from the 30% recorded in the first quarter of this year.

“The record-high home prices in most metro markets bring good and bad news,” said NAR Chief Economist Lawrence Yun. “It’s terrific news for homeowners who are moving ahead in wealth gains. However, it’s difficult for those wanting to buy a home as the required income to qualify has roughly doubled from just a few years ago.”

The national median single-family existing-home price rose 4.9% from a year earlier, reaching $422,100, marking a slight deceleration from the 5% year-over-year growth reported in the previous quarter.

Regionally, the South led the nation in single-family existing-home sales, accounting for 45.5% of all sales in Q2 2024, with a 2.3% year-over-year price increase. The Northeast saw the largest price jump at 9.8%, followed by the Midwest at 5.5%, and the West at 5.4%.

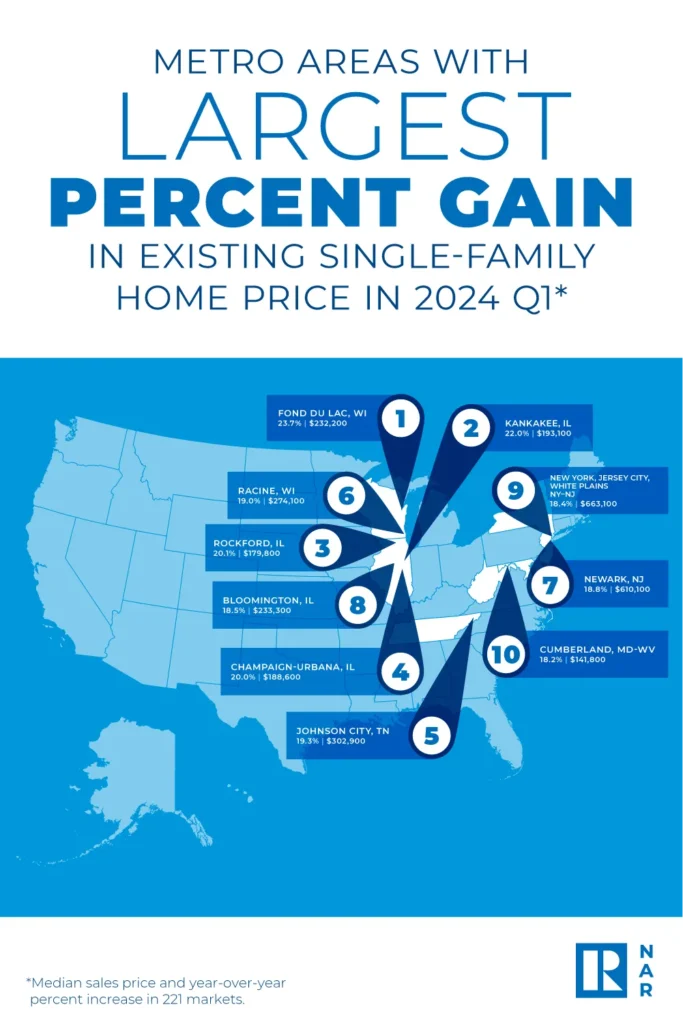

The top 10 metro areas with the highest year-over-year median price increases all saw gains of at least 14.1%, with five of these markets located in the Northeast. The areas with the most significant increases were Racine, Wisconsin (19.8%), Glens Falls, New York (19.8%), and El Paso, Texas (19.2%).

California dominated the list of the most expensive markets, with seven of the top 10 priciest metro areas located in the state. San Jose-Sunnyvale-Santa Clara, California, led with a median home price of $2,008,000, an 11.6% increase from the previous year. Other costly markets included San Francisco-Oakland-Hayward, California ($1,449,000), and Anaheim-Santa Ana-Irvine, California ($1,437,500).

While most markets saw price gains, nearly 10% (22 out of 223) experienced declines in the second quarter, up from 7% in the first quarter. Markets that had previously seen rapid price increases, such as Nashville, Durham, and Austin, took a “breather,” according to Yun. Meanwhile, some areas that saw price drops last year, including San Francisco, Anaheim, and New York, experienced a rebound.

Housing affordability continued to deteriorate in the second quarter as mortgage rates edged higher. The average monthly mortgage payment for a typical existing single-family home with a 20% down payment rose to $2,262, an 11.1% increase from the first quarter. This pushed families to spend 26.5% of their income on mortgage payments, up from 24.2% in the previous quarter.

First-time buyers faced even steeper challenges, with affordability worsening due to rising home prices and limited inventory. The monthly mortgage payment for a typical starter home valued at $358,800 with a 10% down payment surged to $2,218, a 10.3% increase from a year ago. As a result, first-time buyers spent 40% of their income on mortgage payments, up from 36.5% in the previous quarter.

A family needed an income of at least $100,000 to afford a 10% down payment mortgage in nearly half of the metro areas tracked by NAR, up from 40.7% in the first quarter. Conversely, only 2.7% of markets required an income of less than $50,000 to afford a home, down from 4.5% in the prior quarter.

Looking ahead, Yun expressed optimism about improving affordability in the coming months. “Mortgage rates have fallen measurably, and more supply is reaching the market,” he said. “Therefore, the income required to buy a home will decrease.”

As the housing market continues to adjust, potential buyers may find some relief, though the challenges of affordability are likely to persist in the near term.