As weekly average mortgage rates decline to their lowest point in more than a year, the median housing payment for American homebuyers has reached its lowest point since February. During the four weeks ending August 11, the average home payment for a buyer was $2,588. This is an increase of just 1% year-over-year and is roughly $250 below the all-time high of April, the lowest gain in five years, according to a new Redfin study.

Additionally, there are a few more positive indicators for today’s purchasers: There are almost 20% more houses available overall than there were a year ago, and a growing percentage of the inventory is becoming stale, giving some buyers the opportunity to haggle. Furthermore, the percentage of residences selling above list price has decreased to less than 30% from 35% a year ago.

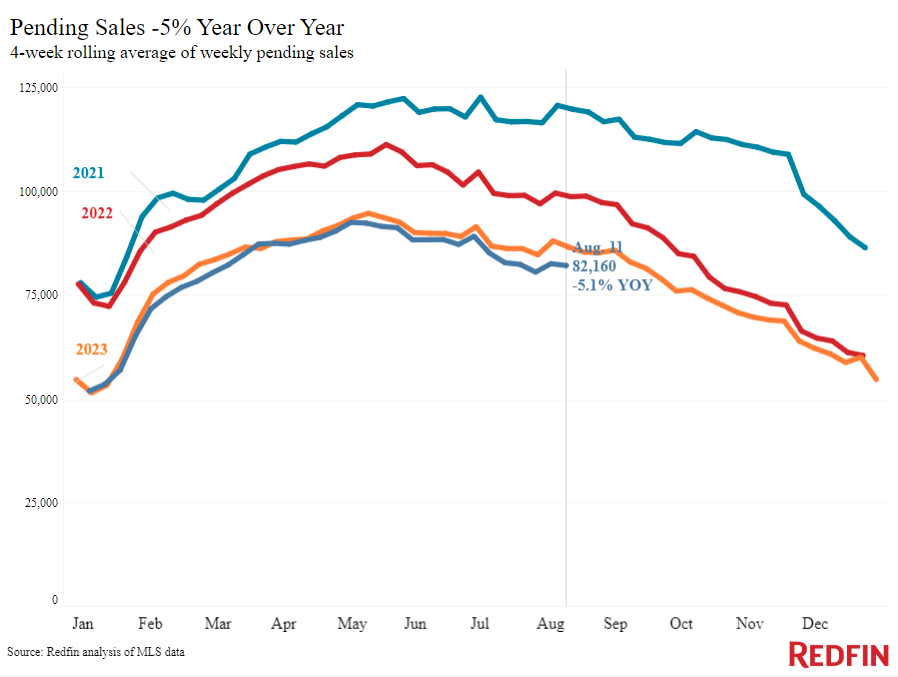

Pending home sales have not improved even with decreasing costs and increasing inventory: With the exception of the previous four weeks, when there was a 6.2% fall, pending sales are down 5.1% year over year, the largest decline since November. There are a few reasons why purchasers aren’t seizing the opportunity to benefit from the decline in mortgage rates.

Metros with Biggest YoY Increases in Pending Sales:

- San Francisco (20.4%)

- Cincinnati (10.4%)

- Sacramento, CA (10.2%)

- Los Angeles (7.5%)

- San Jose, CA (6.8%)

Metros with Smallest YoY Increases in Pending Sales:

- Houston (-20.6%)

- Atlanta (-17.1%)

- Tampa, FL (-15.7%)

- Minneapolis (-12.9%)

- West Palm Beach, FL (-12.5%)

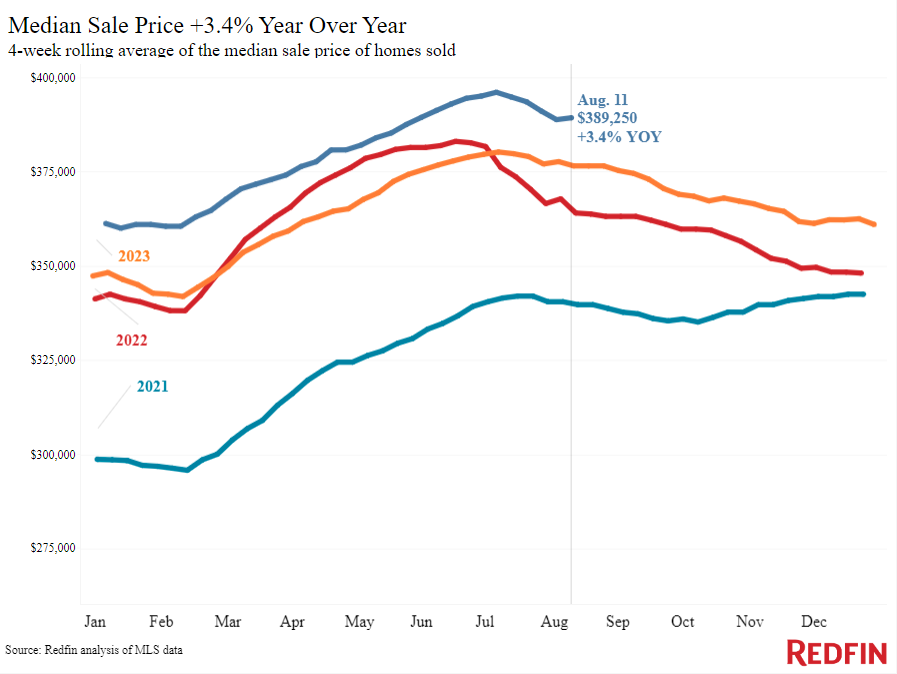

Despite having declined from their July peak, home prices are still very close to all-time highs. In addition, a number of potential purchasers are keeping their options open due to political and economic uncertainties surrounding the upcoming presidential election, the potential decline in mortgage rates, and the possibility of an official recession in the U.S.

There are some indications that more people are beginning the process of buying a home. Seasonally adjusted, the number of applications for mortgage purchases has increased by 3% per week. Additionally, although it is down 10% from the previous year, Redfin’s Homebuyer Demand Index—a gauge of requests for tours and other purchasing services from Redfin agents—is at its lowest point since April.

Metros with Smallest YoY Increases in Median Sale Price:

- Philadelphia (12.5%)

- Detroit (12.4%)

- Anaheim, CA (11.2%)

- Newark, NJ (10.3%)

- New Brunswick, NJ (10.1%)

Metros with biggest year-over-year decreases were Austin, TX (-3%), Tampa, FL (-1.3%), and San Antonio, TX (-1.3%).

“I was hoping more buyers would emerge when mortgage rates started declining. And while house hunting has picked up a bit, the increase isn’t all that significant,” said Brynn Rea, a Redfin Premier agent in Spokane, WA. “Budgets are typically the most important factor for buyers, and homes are still really expensive for a lot of people. A lot of buyers are waiting to see if mortgage rates fall more if and when the Fed cuts interest rates, and to see what happens with the economy and the election later in the year.”

The CPI report indicates that inflation is still down, which supports the anticipation that the Fed will begin reducing interest rates in September—how much less is yet unknown. Expectations of significant rate reduction have been priced in by the markets. Mortgage rates have additional room to fall if the Fed cuts as quickly as markets anticipate, if not quicker. Rates may climb slightly if the Fed doesn’t meet those expectations. Furthermore, if declining rates increase demand, house prices may rise as a result.

To read the full report, including more data, charts, and methodology, click here.