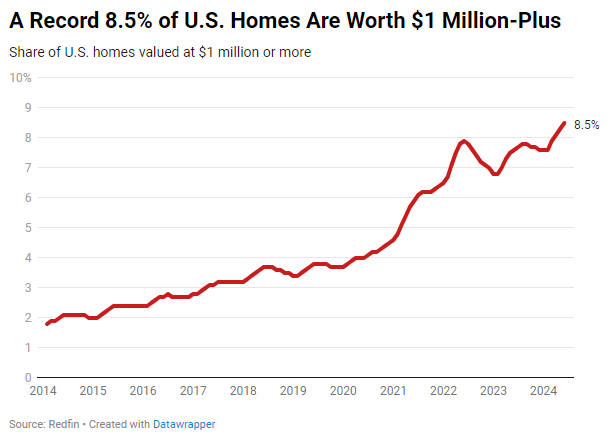

According to a new Redfin study, nearly one in ten (8.5%) American houses are valued at $1 million or more, the largest percentage ever. This is more than twice the 4% proportion that existed prior to the epidemic and up from 7.6% a year earlier.

The record high in home prices—the median sale price nationally increased by 4% in June—has led to a record high in the percentage of American homes valued at $1 million or more. Despite a minor slowdown in price increase since the beginning of 2024, prices have been climbing year-over-year for the past year, pushing several properties beyond the $1 million barrier.

Even more expensive properties are seeing price increases: In Q2, the median sale price of luxury homes in the U.S. reached a record $1.18 million, up 9% year-over-year. Rising luxury property prices have a disproportionate effect on the proportion of properties valued at $1 million or more since many of them were long on the verge of becoming million-dollar residences and recently did so.

Home Values, Home Prices Up Despite Softening Demand

Since the beginning of 2022, mortgage rates have been more than twice as low as they were during the pandemic, which has caused monthly housing prices to soar and decreased sales of homes.

Although low demand would normally lead to lower property prices, the current market’s robust prices are being driven by competition from a lack of supply. Even though the inventory has lately increased, many homeowners are locked in by low rates, thus it is still roughly 30% below pre-pandemic levels.

A greater likelihood of a home being valued over $1 million for homeowners and sellers translates into more money in their budget or real estate portfolio. However, the increasing percentage of properties listed for seven figures makes it harder for potential buyers, particularly first-time ones, to afford a home.

Recent declines in mortgage rates have given buyers a small respite, increasing their purchasing power by tens of thousands of dollars. According to Zubiate, some buyers are returning to the Bay Area market as a result of the recent decline in mortgage rates.

“Home prices, insurance and mortgage rates have shot up so much that many people are either priced out of the market or weary of committing to such a high monthly payment,” said Julie Zubiate, a Redfin Premier agent in the Bay Area, where the majority of homes go for at least $1 million. “The people who are buying without hesitating are in tech and work at Google, Apple, Facebook or a similar company. Many Bay Area buyers–especially those without tech money–are getting more selective, jumping ship if a small problem comes up in, say, the inspection. They’re spending too much money to rationalize not getting everything on their must-have list.”

More Million-Dollar Homes Exist Than A Year Ago in Nearly All the U.S.

In all but three of the 50 most populated U.S. metro areas, the percentage of residences valued at least $1 million increased annually. In Austin, Texas, it decreased slightly from 10.1% to 10% of properties valued at $1 million or more this past year. In Houston (3.6%) and Indianapolis, IN (2%) it remained unchanged.

Due in part to Texas’s prodigious new building, which has increased supply and restrained price increases, the percentage of homes valued at seven figures isn’t rising in Austin or Houston.

California Gaining Million-Dollar Homes Faster Than Anywhere Else

More million-dollar homes are being built in pricey California metro areas than in any other state in the U.S. A year ago, some 51% of homes in Anaheim, CA, were worth at least $1 million; today, the percentage is 58.8%. Los Angeles (39.3%, up from 35%) and San Diego (42.6%, up from 36.5%) saw the next-biggest gains. Because the typical home price in each of those metro areas is approximately $1 million, meaning there are many properties ready to surpass the million-dollar milestone, those areas are rapidly accumulating seven-figure residences.

The majority of the metro areas with million-dollar residences are located in California. About 80% of homes in San Francisco and San Jose, CA, are valued at seven figures, with Anaheim, CA, coming in second with 58.8%.

Due to its high median sale price of approximately $1.5 million, the Bay Area also has a far higher share of properties valued at $1 million or more than any other area in the nation.

Virtually no home in a few still reasonably priced major metro areas is worth a million dollars. Less than 1% of properties in Detroit, Cleveland, Pittsburgh, and Kansas City, MO, are valued at seven figures.

To read the full report, including more data, charts, and methodology, click here.