According to the recently released Quarterly Mortgage Bankers Performance Report by the Mortgage Bankers Association (MBA), independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net profit of $693 on each loan they originated in Q2 of 2024. This is an increase from the reported loss of $645 per loan in Q1 of 2024.

“Net production income was positive in the second quarter of 2024—a welcome sign after eight consecutive quarters of net production losses,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “With a pickup in quarterly volume, productivity, and closings-to-applications pull-through, production costs dropped by about $1,800 per loan. These developments contributed to better net results, even as production revenues decreased from the previous quarter.”

Key Findings of MBA’s Q2 2024 Quarterly Mortgage Bankers Performance Report:

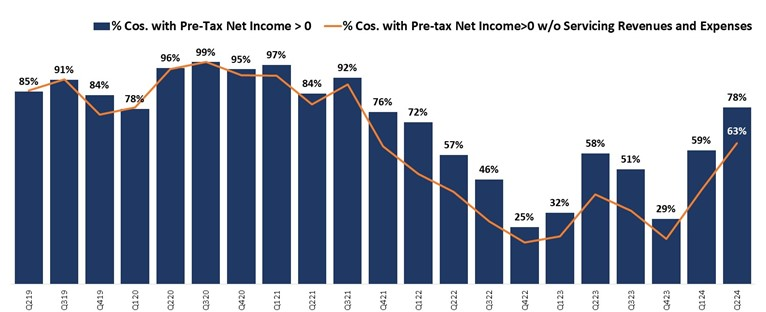

- Including all business lines (both production and servicing), 78% of the firms in the report posted pre-tax net financial profits in Q2 of 2024, up from 59% in Q1 of 2024.

- The average pre-tax production profit was 17 basis points (bps) in Q2 of 2024, compared to an average net production loss of 25 bps in Q1 of 2024, and a loss of 18 basis points one year ago. The average quarterly pre-tax production profit, from Q3 of 2008 to the most recent quarter, is 42 basis points.

- The average production volume was $492 million per company in Q2, up from $384 million per company in the first quarter. The volume by count per company averaged 1,503 loans in the second quarter, up from 1,193 loans in Q1.

- Total production revenue (fee income, net secondary marketing income and warehouse spread) decreased to 347 bps in Q2, down from 371 bps in Q1. Average quarterly production revenue, from Q3 of 2008 to the most recent quarter, is 347 basis points. On a per-loan basis, production revenues decreased to $11,499 per loan in Q2, down from $11,947 per loan in Q1.

- The purchase share of total originations, by dollar volume, was 86%. For the mortgage industry as a whole, MBA estimates the purchase share was at 78% in Q2 of 2024.

- The average loan balance for first mortgages increased to $356,993 in Q2, up from $345,761 in Q1.

Examining Loan Costs, U.S. Loan Volume

Total loan production expenses —commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations—decreased to 330 basis points in Q2 of 2024 from 395 basis points in Q1 of 2024. Per-loan costs decreased to $10,806 per loan in Q2, down from $12,593 per loan in Q1 of 2024. From Q2 of 2008 to last quarter, loan production expenses have averaged $7,524 per loan.

Servicing net financial income for Q2 (without annualizing) was $69 per loan, down from $82 per loan in Q1. Servicing operating income, which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses, and gains/losses on the bulk sale of MSRs, was $88 per loan in Q2, down from $93 per loan in Q1.

“Almost 80% of mortgage companies in the sample posted overall profits, including both production and servicing business lines,” Walsh said. “After two of the most challenging years in the mortgage business, many companies are seeing light at the end of the tunnel.”

To read the full report, including more data, charts, and methodology click here.