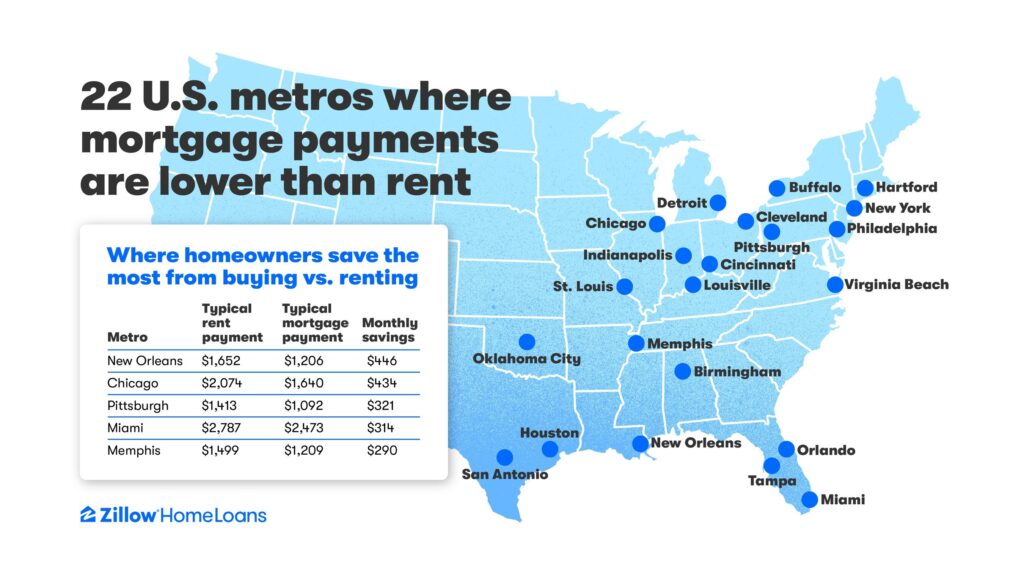

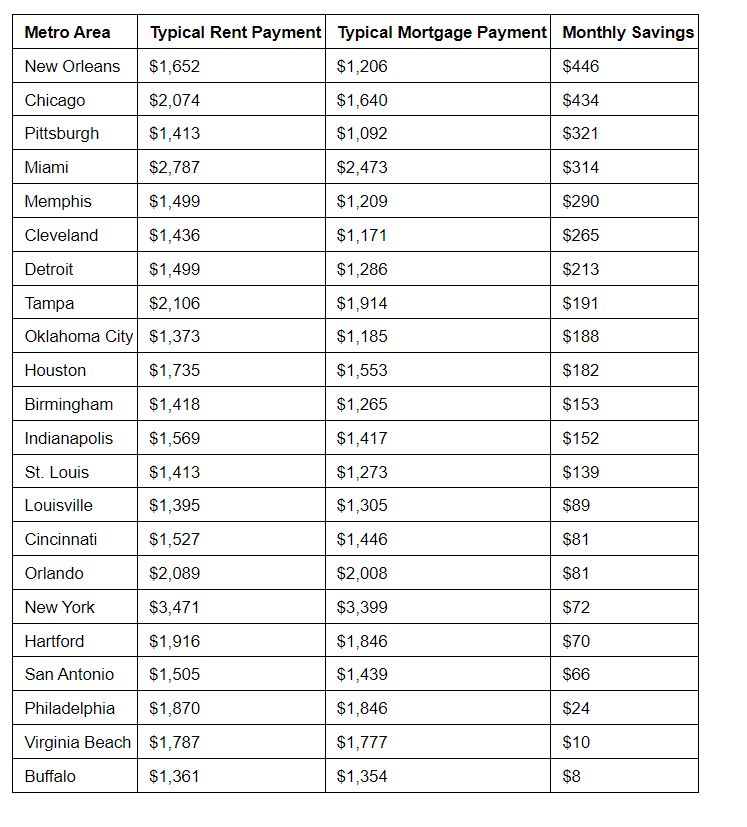

According to a new Zillow Home Loans analysis, monthly mortgage payments have grown less expensive than rent prices in 22 of the 50 largest U.S. metros. Recent dips in mortgage rates, which have fallen to the lowest level since early 2023, have significantly reduced monthly payments.

According to the latest Primary Mortgage Market Survey (PMMS) from Freddie Mac, the 30-year fixed-rate mortgage (FRM) dropped last week to its lowest level since February 2023, coming in at 6.20%.

According to Zillow, the average U.S. home value currently stands at $361,282, up 2.9% year-over-year.

“This analysis shows homeownership may be more within reach than most renters think,” said Zillow Home Loans Senior Economist Orphe Divounguy. “Coming up with the down payment is still a huge barrier, but for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity—something you lose out on as a renter. With mortgage rates dropping, it’s a great time to see how your affordability has changed and if it makes more sense to buy than rent.”

Targeting Affordable Regions

Zillow found that New Orleans, Chicago, and Pittsburgh offered the greatest savings when comparing the cost of rent to a mortgage payment, before taxes and insurance, and assuming a buyer can put 20% down. For those who can put together a down payment, buying a home in these cities may be the right move.

In Chicago, the typical rent payment was reported as $2,074 per month, but the average monthly mortgage payment was $1,640—a savings of $434 a month by owning rather than renting.

In New Orleans, homeowners can also save nearly $450 a month paying a mortgage rather than renting, and in Pittsburgh, the savings are about $320 a month.

This savings trend also holds true across the nation as the typical rent payment nationally is $2,063 a month, but the typical mortgage payment is $1,827—a savings of approximately $236 monthly by owning rather than renting.

Rent growth has come down from pandemic-era highs and returned to long-run norms, but prices are still climbing. The typical rent is 3.4% more expensive than a year ago and nearly 34% more expensive than before the pandemic. The for-sale market, on the other hand, is offering opportunities for buyers heading into the fall, with more than one in four sellers cutting prices. With inventory up 22% compared to a year ago, buyers are gaining bargaining power.

U.S. Metros Where Mortgage Payments are Lower Than Rent

Click here for more information on Zillow analysis of renters versus home buyers.