According to the National Association of Realtors (NAR), pending home sales in August 2024 rose 0.6%, with the Midwest, South, and West posting monthly gains in transactions, and the Northeast recording a loss. Year-over-year, the West registered growth, but the Northeast, Midwest, and South declined.

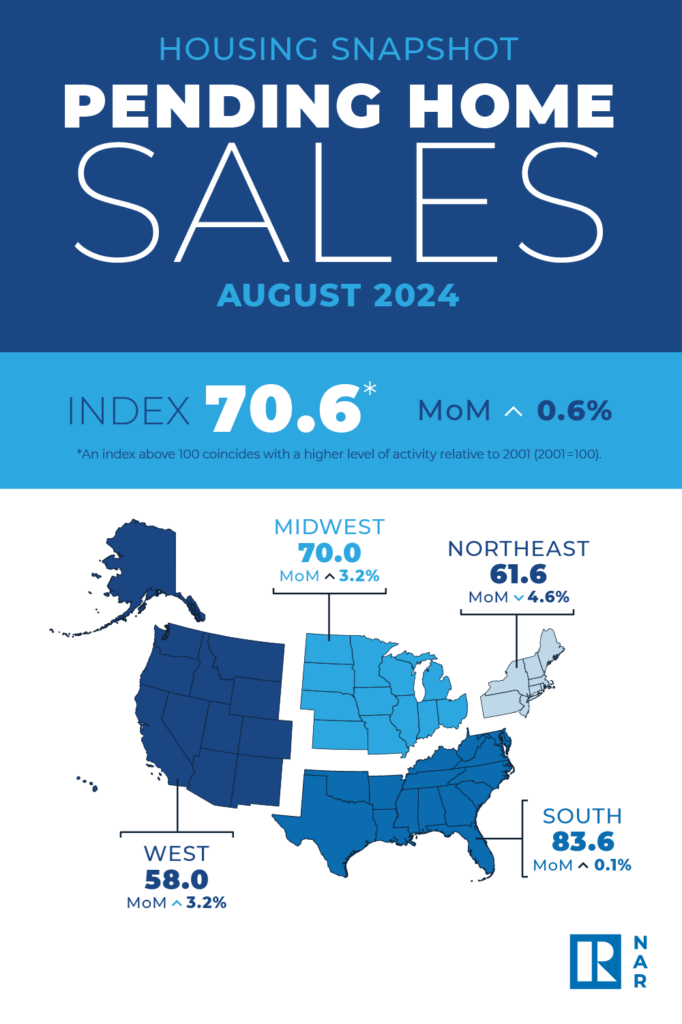

NAR’s Pending Home Sales Index (PHSI) is a forward-looking indicator of home sales based on contract signings, ad increased to 70.6 in August. Year-over-year, pending transactions were down 3.0%. A PHSI reading of 100 is equal to the level of contract activity in 2001.

“A slight upward turn reflects a modest improvement in housing affordability, primarily because mortgage rates descended to 6.5% in August,” said NAR Chief Economist Lawrence Yun. “However, contract signings remain near cyclical lows even as home prices keep marching to new record highs.”

“Pending home sales once again rebounded after a record low, but it wasn’t much of a bounce,” said Kate Wood, Home and Mortgage Expert at NerdWallet. “Potential August buyers were dealing with the same old story—high prices, low inventory—but had other reasons to hold off, too. Even though mortgage interest rates had been going down since spring, buyers may have been waiting on a rate cut from the Federal Reserve. It’s also possible that the uncertain atmosphere of the Presidential election is adding to buyers’ hesitation.”

A Regional Look

The Northeast PHSI diminished 4.6% from last month to 61.6, a drop of 2.2% from August 2023. The Midwest index intensified 3.2% to 70.0 in August, down 3.6% from one year ago.

“In terms of home sales and prices, the New England region has performed relatively better than other regions in recent months,” Yun said. “Contract signings rose in both the most affordable and most expensive regions–the Midwest and West, respectively–because mortgage rates have fallen nationally. Housing affordability will continue to see notable improvements.”

The South PHSI grew 0.1% to 83.6 in August, receding 5.3% from the prior year. The West index increased 3.2% in August to 58.0, up 2.7% from August 2023.

What Lies Ahead?

While the pending home sales reported in August were living in a different rate environment than today, the Mortgage Bankers Association (MBA) reported this week that mortgage applications increased 11% from one week earlier, just days after the Federal Reserve cut the benchmark interest rate. The rate cut of a full half-point to a new range of 4.75% to 5.0% was announced by Federal Reserve Chair Jerome H. Powell at the conclusion of the Federal Open Market Committee (FOMC) meeting. The move by Powell is in response to the fight against inflation, after the Fed kept rates at a an all-time 23-year high for more than a year.

“Mortgage applications increased to their highest level since July 2022, boosted by a 20% increase in refinance applications after a large increase the prior week. The 30-year fixed rate decreased for the eighth straight week to 6.13%, while the FHA rate decreased to 5.99%, breaking the psychologically important 6% level,” said Joel Kan, MBA’s VP and Deputy Chief Economist.

Realtor.com Senior Economic Research Analyst Hannah Jones added, “Pending home sales, or contract signings, measure the first formal step in the home sale transaction, namely, the point when a buyer and seller have agreed on the price and terms. Pending home sales tend to lead existing home sales by roughly one-to-two months and are a good indicator of market conditions.”

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows the 30-year fixed-rate mortgage (FRM) averaging 6.08% as of September 26, 2024, down from last week when it averaged 6.09%. A year ago at this time, the 30-year FRM averaged 7.31%.

“The Federal Reserve does not directly control mortgage rates, but the anticipation of more short-term interest rate cuts has pushed long-term mortgage rates down to near 6% in late September,” added Yun. “On a typical $300,000 mortgage, that translates to approximately $300 per month in mortgage payment savings compared to a few months ago.”