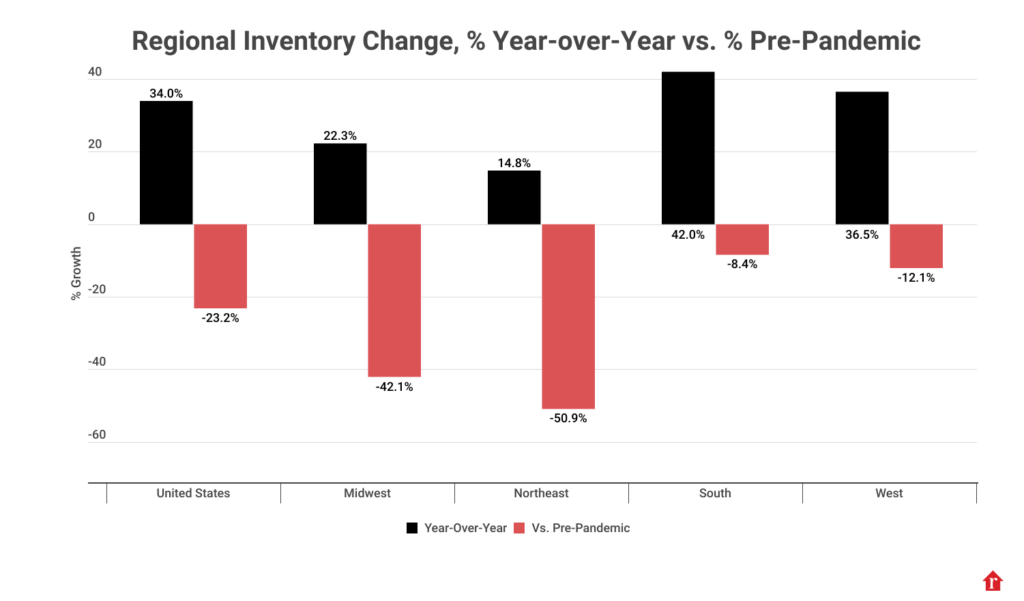

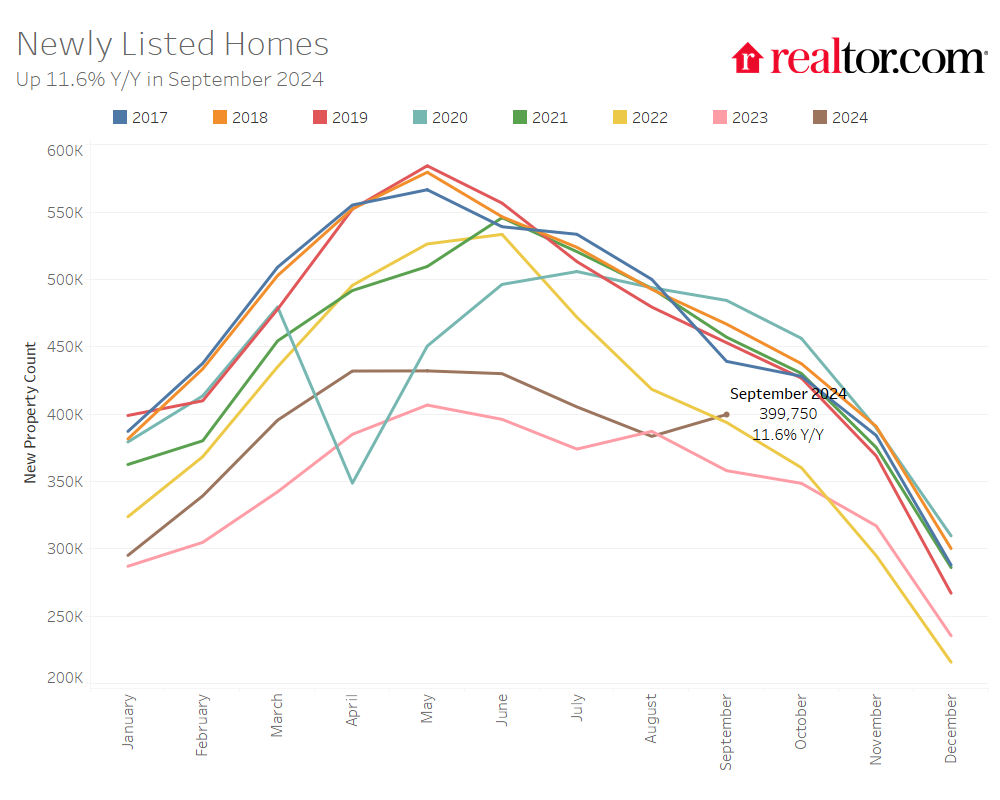

Following the Federal Reserve‘s 50 basis point reduction in the jumbo rate in September, mortgage rates significant fell to a 24-month low, prompting sellers to move. The Realtor.com 2024 September Housing Report states that actively listed properties increased by 34.0%, while newly listed homes increased by 11.6% over the previous September. This represents a major reversal from the 0.9% fall in August 2024.

“Sellers, especially those who are locked into a low rate, have been waiting for market conditions to change,” said Danielle Hale, Chief Economist, Realtor.com. “Now that we’re seeing mortgage rates down to their lowest levels in two years, there are signs of movement, with more sellers putting homes on the market even in what’s typically a real estate shoulder season.”

September 2024: National Housing Metrics

Median listing price:

- (Change over September 2023: -1.0% to $425,000)

- (Change over Sept. 2019: +36.0 %)

Active listings:

- (+34.0 %)

- (-23.2 %)

New listings:

- (+11.6 %)

- (-11.8 %)

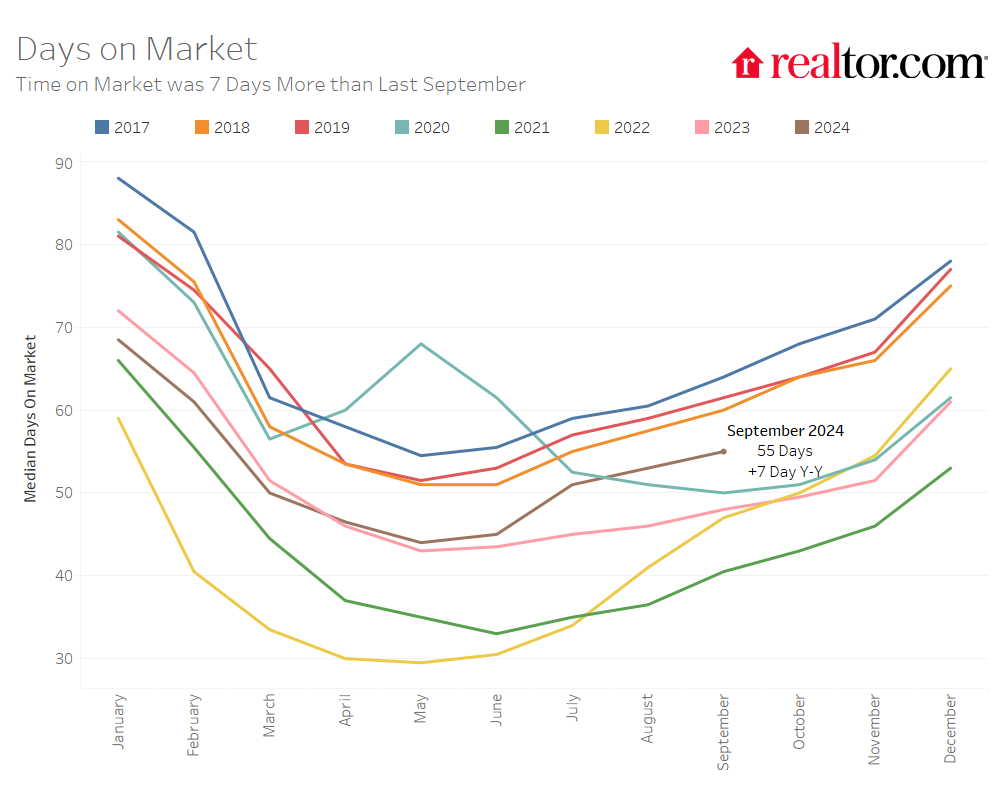

Median days on market:

- (+7 days to 55 days)

- ( -7 days)

Share of active listings with price reductions:

- (+0.5 percentage points to 18.4%)

- (-1.0 percentage points)

Median List Price Per Sq.Ft.:

- (+2.3 %)

- (+50.8 %)

“Lock-in” Effect Causing Buyers to Stay Put

The real estate market has been hampered by the “lock-in” effect for many years now, whereby homeowners, who are tied into a relatively cheap mortgage rate, have been remaining there, having a negative influence on available inventory. In actuality, 84% of active mortgages had a mortgage rate under 6% as of mid-2024, while 56% had a rate under 4%. On the other hand, September housing data from Realtor.com indicates that the quantity of new listings increased year over year to the highest level recorded in September since 2021.

The increase can be a sign that more homeowners are ready to jump into the market again and sell, or that the sentiment among homeowners is changing. In fact, the number of new listings increased most in more costly property markets, possibly as a result of the greater impact that declining mortgage rates had on purchasers in these locations.

“We expect mortgage rates to hold around 6% through the end of the year, which is a significant difference from their 7.8% high in October 2023,” Hale said. “This has increased the buying power of many home shoppers and is a bonus over and above the seasonal factors that make this time of year the ‘Best Time to Buy’.”

Homes Staying On Market Longer

In general, when homes remain on the market longer, buyers may anticipate both an increase in inventory and a slight reduction in time constraints. September saw an average of 55 days spent on the market for homes, which is two days more than August 2024 and seven days longer than the previous year. September 2024 marked the slowest pace since 2019.

Although the average home listed in September took 55 days to sell, in other metro areas that amount is significantly higher. An examination of the top 50 metro areas reveals that a typical New Orleans property was listed for some 78 days, which is 13 more days than it was in September of last year. The remaining four major metros, Miami (73 days), Austin, TX (72 days), San Antonio (67 days), and Tampa (66 days), round out the top five. Conversely, Milwaukee (31 days), San Jose (31 days), Boston (31 days), Hartford, CT (33 days), and San Francisco (33 days) are the metro areas that had the quickest movement.

“Generally speaking, relief is brewing. On the one hand, buyers are seeing not only an increase in home listings but they’re also seeing homes spend more time on the market, which means more options and less frenzy to buy,” said Ralph McLaughlin, Senior Economist for Realtor.com. “For sellers, there’s been positive movement in home value as indications show an increase in price growth since before the pandemic. And, all around, the decline in mortgage rates are lowering the barrier to entry and encouraging people to get into the market once again.”

Metros with Highest Increase in New Listings in September 2024

1. Seattle-Tacoma-Bellevue, WA

- (% change in New Listings count YoY: 41.8 %)

- (Median listing price: $772,425)

2. San Jose-Sunnyvale-Santa Clara, CA

- (27.1 %)

- ($1,432,170)

3. Washington-Arlington-Alexandria, DC-VA-MD-WV

- (26.2 %)

- ($599,948)

4. Denver-Aurora-Lakewood, CO

- (25.5 %)

- ($610,250)

5. Boston-Cambridge-Newton, MA-NH

- (24.4 %)

- ($839,900)

6. Raleigh-Cary, NC

- (24.2 %)

- ($453,165)

7. Los Angeles-Long Beach-Anaheim, CA

- (22.6 %)

- ($1,154,440)

8. San Diego-Chula Vista-Carlsbad, CA

- (21.5 %)

- ($997,000)

9. Providence-Warwick, RI-MA

- (21.5 %)

- ($567,500)

10. Richmond, VA

- (20.1 %)

- ($442,346)

A rise in price per square foot is a sign of rising property values, and data from September 2024 shows that prices of residences have increased significantly when compared to those advertised before the pandemic. While the price per square foot has climbed by 50.9% from September 2019 to the current year, the median listing price per square foot has increased by 2.3% from the previous year.

In actuality, the price per square foot increase rate varied from 22.7% to 71.9% among the top 50 metro areas. Not surprisingly, the New York metro area is leading the way with a 71.9% increase in price per square foot from September 2019. Tampa, FL (+63.6%), and Hartford, CT (+62.3%), came next. The markets with the lowest returns were Birmingham, AL (+26.7%), New Orleans (+25.0%), and San Francisco (+22.7%).

To read the full report, including more data, charts, and methodology, click here.