Consumers expressed strong levels of optimism in the survey regarding a drop in mortgage rates over the next year, which helped the Fannie Mae Home Purchase Sentiment Index (HPSI) to rise 1.8 points in September to 73.9, the highest level in over two years. A record 42% of consumers stated in September that they anticipate a decrease in mortgage rates, up from 24% in June and 39% in the month before. In contrast, 27% anticipate an increase in mortgage rates and 31% anticipate a stay the same.

A majority of consumers did, however, also say that they anticipate rising housing costs over the course of the upcoming year, which would somewhat counteract the anticipated rate-driven gain in affordability. While respondents’ perceptions of the state of the homebuying market improved slightly this month, they are still relatively close to their all-time low, with only 19% saying it’s a good time to buy a house. Conversely, 65% of consumers believe that now is a favorable moment to sell a house. Year-over-year, the entire index is up 9.4 points.

“Although most consumers continue to think it’s a ‘bad time’ to buy a home, the recent shift in attitude toward mortgage rates is pushing overall housing sentiment higher, and a growing share are now pointing to high home prices rather than high mortgage rates as the primary sticking point for affordability,” said Mark Palim, Senior VP and Chief Economist at Fannie Mae. “Increased positivity that mortgage rates will continue to fall has driven the HPSI to a 30-month high, but we’ve yet to see consumers’ newfound rate optimism translate into a meaningful increase in home sales activity. Instead, as we noted in our latest housing forecast, existing home sales are on pace to record their lowest annual total since 1995. This signals to us that consumers are paying attention to the easing interest rate environment but still feel stymied by the considerable run-up in home prices over the last four years.”

Fannie Mae HPSI Component Highlights

The Home Purchase Sentiment Index (HPSI) for Fannie Mae increased by 1.8 points to 73.9 in September. When compared to the same period last year, the HPSI is up 9.4 points.

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home increased 2 percentage points this month (19%) while the percentage who say it is a bad time to buy decreased from 83% to 81%. As a result, the net share of those who say it is a good time to buy increased 3 percentage points month-over-month (MoM) to -62%.

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home (65%) remained unchanged from last month, while the percentage who say it’s a bad time to sell (35%) increased 1 percentage point. As a result, the net share of those who say it is a good time to sell fell 1 percentage point MoM to 30%.

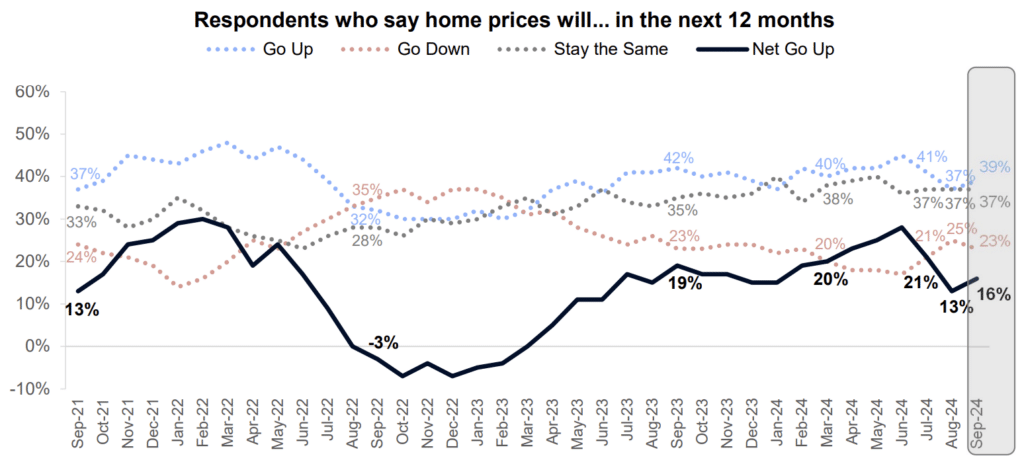

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months increased from 37% to 39% and the percentage who say home prices will go down decreased from 25% to 23%. The share who think home prices will stay the same remained at 37%. As a result, the net share of those who say home prices will go up in the next 12 months increased 3 percentage points MoM to 16%.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 39% to 42%, a new survey high. The percentage who expect mortgage rates to go up increased from 26% to 27%. The share who think mortgage rates will stay the same decreased from 35% to 31%. As a result, the net share of those who say mortgage rates will go down over the next 12 months increased 2 percentage points month over month to 15%, a second consecutive survey high and the highest in NHS history.

- Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 78% to 77%, while the percentage who say they are concerned increased 1 percentage point (22%). As a result, the net share of those who say they are not concerned about losing their job decreased 1 percentage point MoM to 56%.

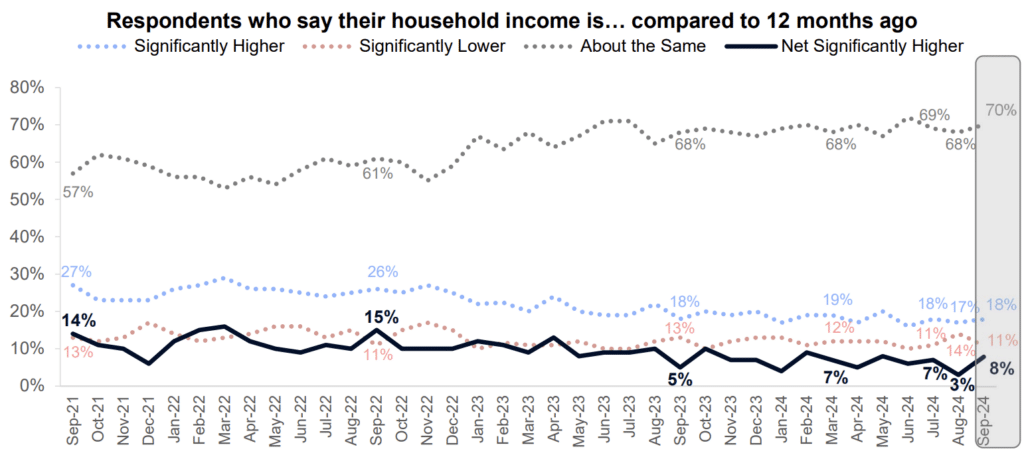

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago increased from 17% to 18%, while the percentage who say their household income is significantly lower decreased from 14% to 11%. The percentage who say their household income is about the same increased from 68% to 70%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago increased 5 percentage points MoM to 8%.

“Notably, housing sentiment among renters, a common source of first-time homebuyers, has improved at approximately the same pace as homeowners,” Palim said. “Over the last three months, the share of renters believing it’s a good time to buy a home has risen from 13% to 20%, while the share expecting mortgage rates to fall has risen from 16% to 30%. While these numbers are still relatively low, we think the improvement may signal that some potential homebuyers who have been waiting for mortgage rates to come down may be closer to coming off the sidelines, despite their ongoing concerns about home prices.”

To read the full report, including more data, charts, and methodology, click here.