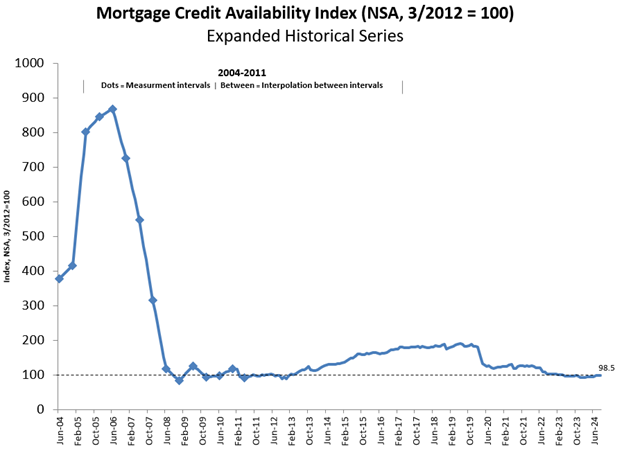

The Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) based on data analysis from ICE Mortgage Technology, indicates a drop in mortgage credit availability in September.

Key Findings from the Mortgage Credit Availability Index:

- In September, the MCAI dropped by 0.5% to 98.5. While increases in the index point to looser credit, a decrease in the MCAI suggests tighter lending requirements.

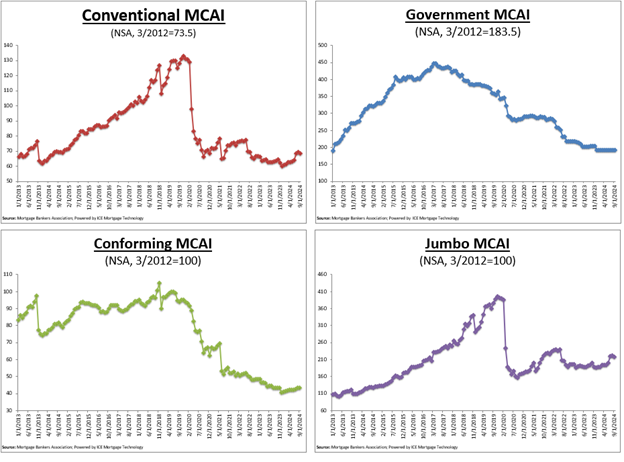

- In March 2012, the index was benchmarked at 100. The Government MCAI grew by 0.8%, while the Conventional MCAI fell by 1.7%.

- The Conforming MCAI did not change, whereas the Jumbo MCAI had a 2.6% decline among the Conventional MCAI’s component indices.

“Mortgage credit availability tightened slightly in September as lenders remained cautious in this uncertain economic environment,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “There was a decline in loan programs for cash-out refinances, jumbo and non-QM loans, including loans that require less than full documentation. Most component indexes decreased over the month, but the government index increased, driven by more offerings of VA streamline refinances.”

Conventional, Government, Conforming & Jumbo MCAI Component Indices

Using the same process as the Total MCAI, the Conventional, Government, Conforming, and Jumbo MCAIs are created to display the relative credit risk and availability for each index. The population of credit programs that the Component Indices and the Total MCAI both analyze is the main distinction between them. While the Conventional MCAI looks at non-government loan programs, the Government MCAI looks into FHA, VA, and USDA loan programs.

FHA, VA, and USDA loan offerings are not included in the Jumbo and Conforming MCAIs, which are subsets of the normal MCAI. Conventional lending programs that are not subject to conforming loan restrictions are examined by the Jumbo MCAI, whereas those that are are examined by the Conforming MCAI.

Expanded Historical Series

A longer historical series for the Total MCAI provides perspective on credit availability dating back around ten years; the expanded historical data excludes Conventional, Government, Conforming, and Jumbo MCAI. The expanded historical series, which spans 2004 to 2010, was developed to give the current series historical context by illuminating changes in loan availability during the previous ten years, including the housing crisis and recession that followed.

Less complete and less frequent data were used to construct the data previous to March 31, 2011, which were measured at 6-month intervals and interpolated for charting purposes in the months in between.

Note: The expanded historical series from 2004 to 2010 does not include updated methodology.

To read the full report, including more data, charts, and methodology, click here.