Fannie Mae has released a new report showing that while it can be a hassle, borrowers must pay closing expenses, which are fees and charges associated with finalizing a property purchase or mortgage refinance. Title insurance charges, appraisal fees, settlement fees, borrower credit report fees, mortgage origination fees, and real estate agent commissions are a few examples. These expenses have increased significantly in recent years, which makes buying a home extremely difficult for many first-time and low-income homebuyers.

Fannie Mae’s Mortgage Lender Sentiment Survey—conducted in late July—polled more than 200 senior mortgage executives to learn more about lenders’ thoughts on how to streamline and standardize closing cost line-item descriptions and which cost areas would benefit from more precise definitions to improve borrower transparency. The GSE also requested input from lenders regarding potential areas for cost reduction.

Key Findings from the Mortgage Lender Sentiment Survey:

- Although 60% of lenders think it’s simple to calculate closing costs, they have diverse experiences when it comes to communicating these expenses to borrowers: Explaining closing costs to borrowers is simple, according to just 50% of lenders.

- The majority of lenders (81%) concurred that the mortgage industry would benefit from standardizing and streamlining closing cost line-item descriptions. The most significant advantage of such an endeavor, according to respondents, would be greater transparency, especially for borrowers, followed by lower compliance costs and facilitating comparative shopping for customers.

- “Getting key players to align on standardization” is the main implementation problem, according to lenders. This is followed by updating the requisite technology (e.g., integrating with industry data portals or loan origination systems).

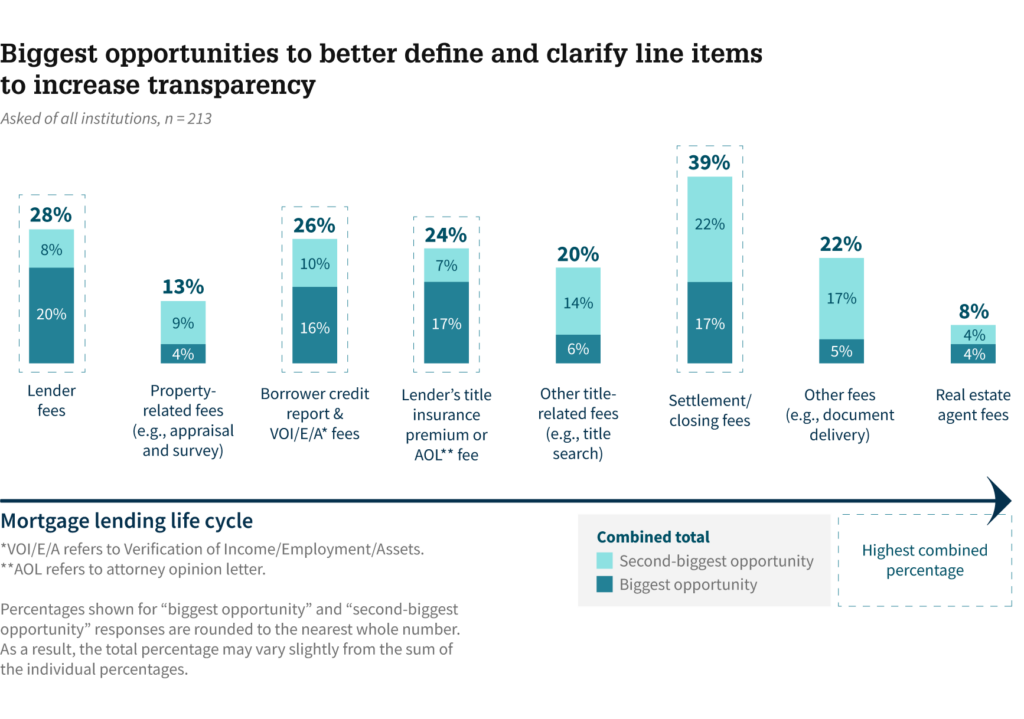

- Lender fees, settlement/closing fees, lender’s title insurance premium or attorney opinion letter (AOL) fees, borrower credit report and verification of income/employment/assets (VOI/E/A) fees, and other closing cost types were identified by lenders as being particularly likely to benefit from additional clarity in order to help improve transparency for borrowers.

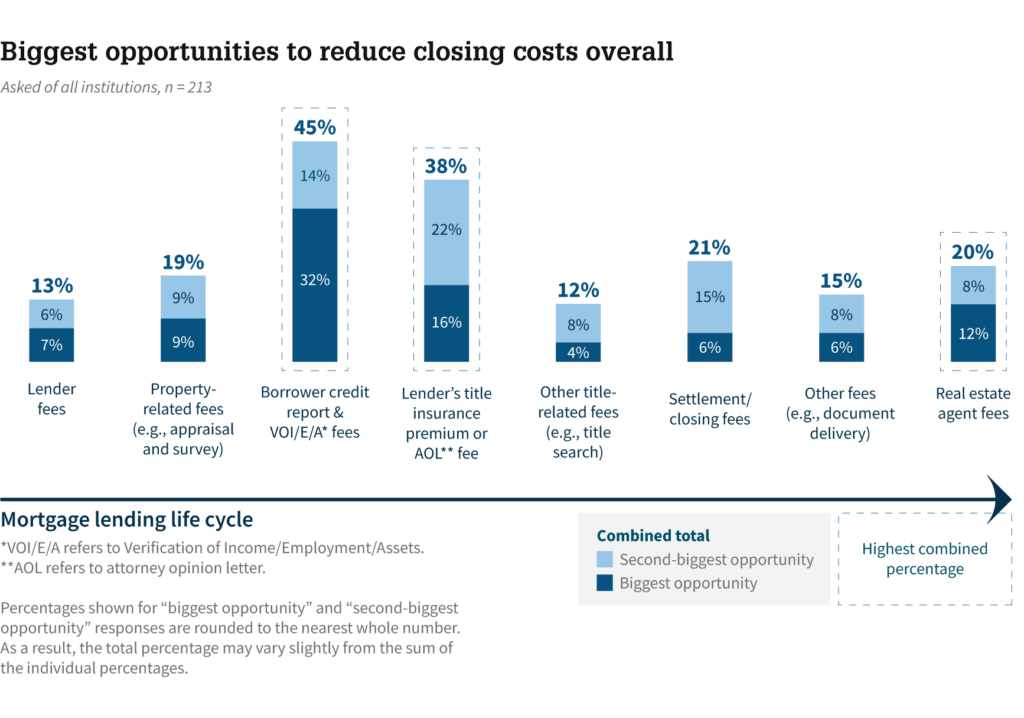

- The most frequently cited answers to Fannie Mae’s question about where they think closing expenses can be cut were the lender’s title insurance premium or AOL fees, the borrower credit report and VOI/E/A fees, and real estate agent commissions, in that order.

Lenders Weigh in on Closing Cost Challenges

Additionally, the GSE asked lenders to write in their thoughts about the closing-cost issues that are most important to them as part of the poll. Despite technology developments meant to make the process more efficient and cost-effective, some lenders pointed out that some third-party costs, like credit reports and employment verification fees, had increased dramatically. While some noted that closing fees can vary significantly, even for essentially the same service, others felt that some closing costs were excessive given the risk involved.

Some lenders pointed out that although while the fees assessed by the parties involved in a transaction are frequently rather little, the total cost of closing usually adds up to a substantial sum. In the end, a lot of lenders came to the conclusion that standardizing and simplifying closing cost line-item descriptions would be a significant value-add for the whole mortgage industry. They claimed that it would help boost transparency, lower compliance costs, and give customers the ability to better understand the costs and compare prices.

Fannie Mae concludes that there are significant chances for the mortgage sector to improve closing cost transparency and possibly save consumers money in light of these results. The mortgage industry has made some progress in this area in recent years, such as allowing lenders to use an Attorney Opinion Letter (AOL) in place of a lender’s title insurance policy, implementing property valuation modernization efforts to streamline the home-valuation process and lower appraisal costs for borrowers, and introducing tools to help borrowers better understand (and calculate for themselves) the various mortgage costs and fees.

To read the full report, including more data, charts, methodology, click here.

To see more commentary from Mark Palim, Senior VP and Chief Economist at Fannie Mae, and John Thibaudeau, VP of Single-Family Real Estate Asset Management at Fannie Mae, click here.