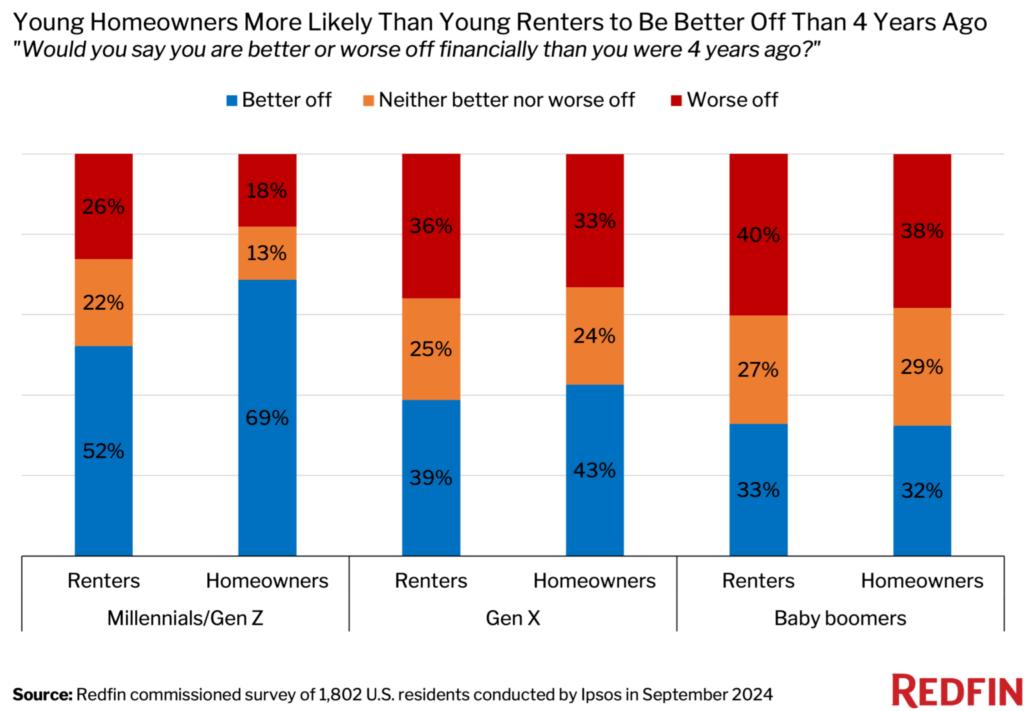

According to a recent Redfin study, just over two-thirds (68.7%) of millennial/Gen Z homeowners feel their financial situation has improved over the past four years, compared to just over half (52.2%) of millennial/Gen Z renters. The primary question asked was:

“Would you say you are better or worse off financially than you were 4 years ago?”

Respondents were asked to select one of five answer choices:

- Much better off financially

- Slightly better off financially

- Much worse off financially

- Slightly worse off financially

- Neither better nor worse off financially

The gap between the sentiments of younger homeowners and renters is far greater than that between older homeowners and renters. For instance, compared to Gen X renters, Gen X homeowners were more likely to say they were doing better four years earlier, though not by much (42.6% vs. 38.8%).

Millennials were viewed as the “unluckiest generation” just four years ago due to their comparatively poor economic situation, but that began to change during the pandemic. Many young Americans purchased their first homes during the pandemic or in the years preceding it, and they later profited from a historic increase in home values brought on by the homebuying boom of 2021–2022. Many young people were able to amass significant home equity as a result, and today’s home values continue to climb.

Younger Generations Weigh In on Renting & Homeownership

“Economic inequality is on the rise between young people who have been able to break into homeownership and young people who haven’t,” said Redfin Economics Research Lead Chen Zhao. “There was a short window during the pandemic when mortgage rates were extremely low, allowing a lot of millennials and Gen Zers to buy homes—but not everyone could afford to take advantage of the window. Housing affordability has worsened dramatically since then, with mortgage rates now more than double their pandemic low and home prices near their record high. As a result, many young folks are priced out of homeownership and the wealth gains that come with it, and many of the people who did buy homes during the pandemic couldn’t afford to buy their same home today.”

Even while rent growth has slowed down in the past year, asking prices are still around 20% more than they were before the pandemic, and many tenants are finding it difficult to make ends meet because of the high price of groceries and other necessities. However, compared to older generations, young renters are significantly more likely to claim that they are doing better than they were four years ago. This could be because they are more likely than older tenants to see significant income increases as their careers progress.

Most Baby Boomers Report Being Worse Off Than 4 Years Ago

For the only generation surveyed, the majority of respondents (38.2% of baby boomer homeowners and 40.2% of baby boomer renters) stated that their financial situation has been worse over the past four years. According to Zhao, this might be the case because a large portion of baby boomers are on fixed incomes.

Conversely, some 33.1% of Gen X homeowners and roughly 35.9% of Gen X renters reported being in poorer financial standing, while 18% of millennial/Gen Z homeowners and 26.2% of millennial/Gen Z renters claimed the same—according to a Redfin-commissioned survey conducted by Ipsos in September.

To read the full report, including more data, charts, and methodology, click here.