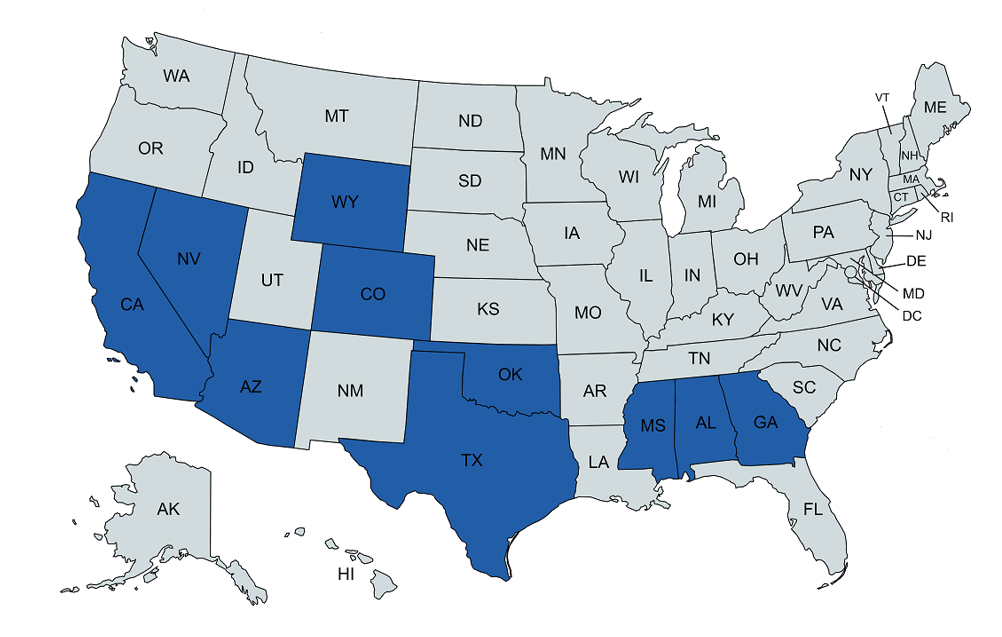

BDF Law Group, a provider of legal services to the financial services industry, has announced its expansion into four new states: Alabama, Mississippi, Oklahoma, and Wyoming. The firm is now offering foreclosure, litigation, bankruptcy, evictions, and collections services across these states, along with Texas, Colorado, Georgia, California, Arizona, and Nevada.

“This expansion is not merely for growth’s sake, but rather to address a pressing need to deliver quality legal services expressed by several key clients. We are obviously excited and will continue to strategically grow to accommodate our clients’ needs in the future,” said Robert D. Forster II, Managing Partner of BDF. “The addition of these states reflects BDF’s ongoing mission to deliver exceptional legal services across a larger service area while making a positive impact in these new locations.”

As the firm begins its 35th year in service, it continues to rely on its four founding principles of C.A.R.E.: Communication, a service-oriented Attitude, earning and giving Respect, and operational Effectiveness. The BDF Law Group is comprised of the following firms: Barrett Daffin Frappier Turner & Engel LLP; Barrett Daffin Frappier Treder & Weiss LLP; and Barrett Frappier & Weisserman LLP.

Managing Partner Forster joined the firm in 2006, and his practice has consisted of real estate, mortgage banking, and probate matters throughout the state of Texas. He is a frequent speaker at continuing legal and title education programs on mortgage banking, title, probate, and creditor’s rights related topics and has authored numerous articles and publications, including serving as a co-author of the Texas State Bar’s Foreclosure Manual (3rd Edition and 2017 Supplement), as well as the 26th Annual Advanced Real Estate Drafting Course for the State Bar of Texas, the 49th, 50th, 51st, 52nd, and 54th Annual William W. Gibson, Jr. Mortgage Lending Institute by the University of Texas School of Law, 25th Annual Robert C. Sneed Texas Land Title Institute, as well as participating on panels hosted by the Five Star Institute and Legal League, among others. In 2017, Robert was awarded the Suzanne Kelly New Member of the Year Award by the United Trustee Association, has been named as a “Super Lawyer-Rising Star” several times, and actively serves on the Mortgage Bankers Association State Legislative and Regulatory Committee. He recently authored the article, “CFPB Unveils Highly Anticipated Updates to Regulation X,” available on MortgagePoint.com and in the September 2024 print edition of MortgagePoint magazine.