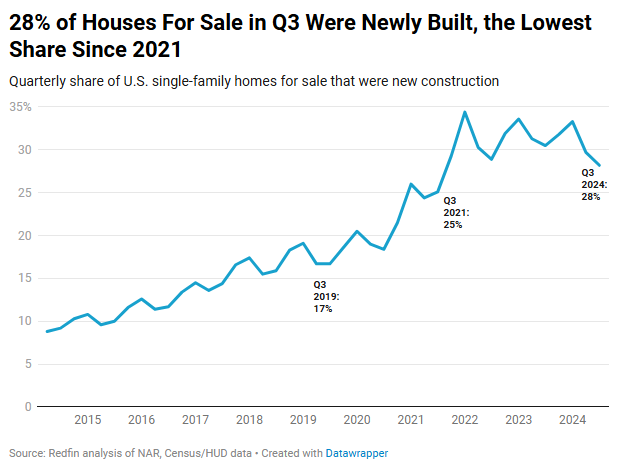

According to a new Redfin research, in Q3 of this year, an estimated 28% of single-family homes for sale nationwide were newly constructed, the lowest percentage in three years. That is lower than the record-high 34.4% at the beginning of 2022 and 30.5% a year ago.

For a number of factors, the proportion of newly constructed homes for sale has decreased from its peak, including:

- The market has seen an increase in existing inventory. The total supply of inventory of single-family homes is up 22% over the previous year. The lock-in effect has begun to lessen, in part because people are sick of waiting for mortgage rates to drop before selling their house and looking for a new one.

- A large portion of the new development on the market has been purchased by homebuyers. The U.S. Census reports that in September 2024, sales of newly constructed single-family houses increased 6.3% year-over-year, in part because to builders’ efforts to attract buyers with incentives including cash toward closing costs and mortgage-rate buydowns. According to Redfin agents, many purchasers have turned to new construction in order to receive a better offer, proving that those incentives have been effective.

- Overall construction has slowed. Due to rising mortgage rates that have slowed demand, homebuilders have retreated since the pandemic-driven building boom; they are now more concerned with selling the new homes they already have on the books than with building new ones. Single-family home building permits fell 23% from their 15-year peak in early 2021 and 2% year-over-year in September.

Overall U.S. Housing Inventory Shrinks in Q3

However, compared to before the pandemic, a much larger percentage of the inventory for sale consists of newly constructed dwellings. This is due to the fact that the share increased significantly throughout the pandemic, rising from about 17% in 2019 to about 30% by the end of 2021.

Since the supply of new-construction homes increased in 2022 and 2023 while the supply of existing homes decreased, a significant percentage of homes for sale during the past four years have been newly constructed.

During that time, the lock-in effect and rising mortgage rates caused a decline in the inventory of existing homes. On the other hand, builders responded to strong demand for homes due to remote work and ultra-low mortgage rates, which resulted in a spike in newly constructed homes. Even though construction has subsequently halted, contractors are still finishing up projects they began a few years ago.

Where Today’s Homeowners Fall on the Mortgage-Rate Spectrum:

- Below 6%: Some 88.5% of mortgaged U.S. homeowners have a rate below 6%, down from a record 92.8% in Q2 of 2022.

- Below 5%: Roughly 78.7% have a rate below 5%, down from a record 85.6% in Q1 of 2022.

- Below 4%: Approximately 59.4% have a rate below 4%, down from a record 65.3% in Q1 of 2022.

- Below 3%: An estimated 22.6% have a rate below 3%, down from a record 24.6% in Q1 of 2022.

“A lot of sellers are worried about finding their next house because even though listings are rising, there’s still a housing shortage,” said David Palmer, a Redfin Premier real estate agent in Seattle.

As fewer permits are issued, the proportion of newly constructed homes in the inventory may decline even further in the future. However, because mortgage rates are expected to stay high and prevent the supply of existing homes from increasing, the share should continue to be higher than it was before the pandemic.

To read the full report, including more data, charts, and methodology, click here.