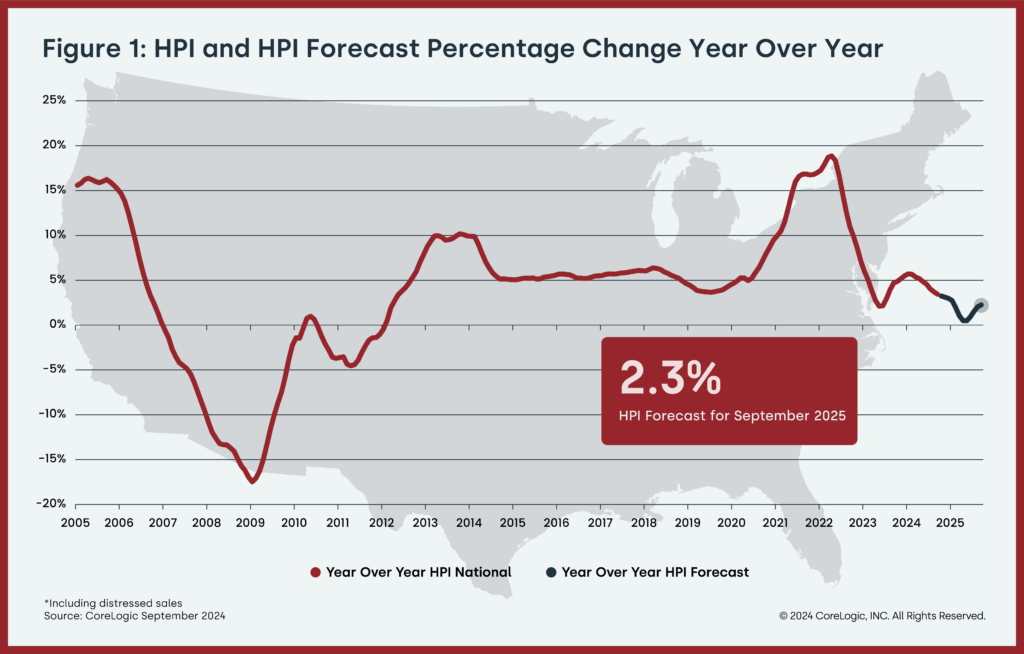

The CoreLogic has released the Home Price Index (HPI) and HPI Forecast for September 2024. In September, the annual growth rate of U.S. home prices slowed to 3.4%.

After months of moderate monthly losses, property prices recovered to register a very minor rise (0.02%) when compared to the previous month. All things considered, since late summer, home prices have remained largely unchanged.

Key Findings:

- U.S. single-family home prices (including distressed sales) increased by 3.4% year-over-year in September 2024 compared with September 2023. On a month-over-month basis, home prices increased by 0.02% compared with August 2024.

- In September, the annual appreciation of detached properties (3.6%) was 1.5 percentage points higher than that of attached properties (2.1%).

- CoreLogic’s forecast shows annual U.S. home price gains relaxing to 2.3% in September 2025.

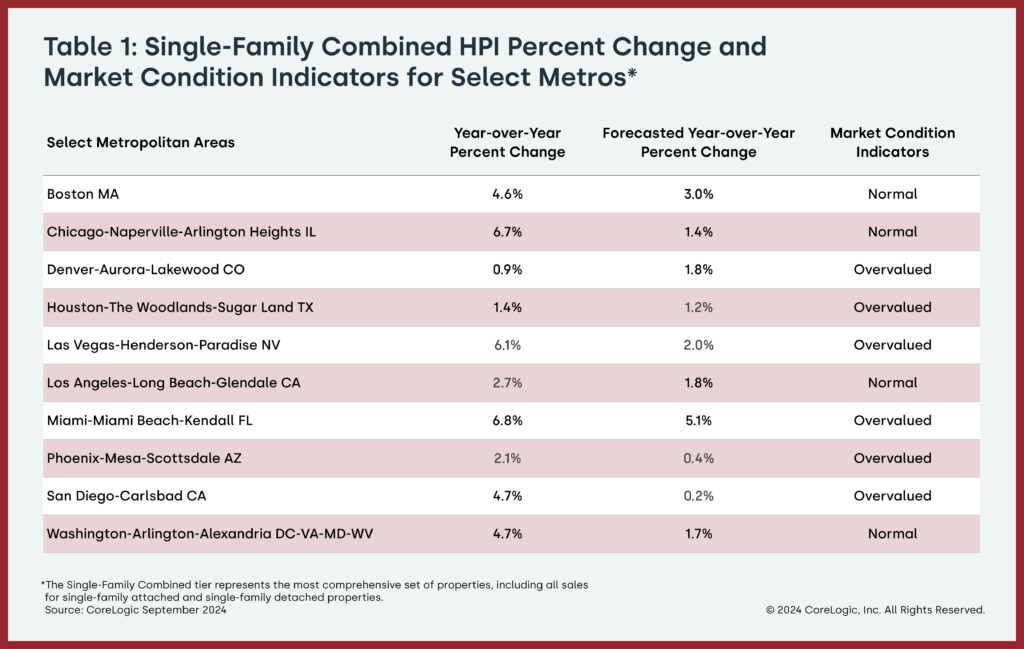

- Miami posted the highest year-over-year home price increase of the country’s 10 highlighted metro areas in September, at 6.8%. Chicago saw the next-highest gain at 6.7%.

- Among states, Rhode Island ranked first for annual appreciation in September (up by 9%), followed by New Jersey (up by 8.6%). Hawaii was the only state to record a year-over-year home price loss (-0.4%).

Annual Home Price Slowdown Continues in September

Demand and price growth may be slowed by the conflicting signals surrounding the current status of the US economy, in addition to the uncertainty surrounding the US election and the volatility of mortgage rates.

The U.S. Bureau of Labor Statistics recently released data showing that the economy created just 12,000 new jobs in October 2024—the fewest in nearly four years. The latest consumer expenditure figures, however, indicated strong ongoing spending and a positive consumer outlook.

“Like much of the housing market at the moment, home prices remained relatively flat coming into the fall,” said Dr. Selma Hepp, Chief Economist for CoreLogic. “Despite some improved affordability from lower mortgage rates during August, homebuyers mostly kept on the sidelines and decided to wait out the mortgage rate drop for a potentially better opportunity next year, when the current volatility, uncertainty surrounding the election’s outcome, and the impact on longer-term rates may be slightly clearer. And while the mortgage rate and economic outlook is full of questions, home prices are likely to maintain their leveled path until early next year when buyers return to the housing market.”

To read the full report, click here.