Despite a September interest rate cut by the Federal Reserve, the average 30-year mortgage rate has been on the rise during Q4—continued high rates, combined with steadily rising housing prices, have put a strain on mortgage customers, according to the latest J.D. Power 2024 U.S. Mortgage Origination Satisfaction Study.

Some lenders have managed to turn those challenges into an opportunity to play a more direct advisory role with customers, earning praise from customers along the mortgage process, while others may have struggled.

“The variability in rates and higher costs for buyers increases the importance of understanding consumers’ individual situations,” said Bruce Gehrke, Senior Director of Wealth and Lending Intelligence at J.D. Power. “Consistently, we’re seeing that lenders that play an active advisory role in helping their clients navigate the current market are earning significantly higher customer satisfaction, loyalty and advocacy scores than those that are treating mortgage lending as a transactional process.”

The U.S. Mortgage Origination Satisfaction Study measures overall customer satisfaction based on performance in six factors (in alphabetical order): communication; digital channels; level of trust; loan offering meets my needs; made it easy to do business with; and people. The 2024 study was fielded from August 2023 through September 2024 and is based on responses from 7,534 customers who originated a new mortgage or refinanced within the past 12 months.

Key Study Findings

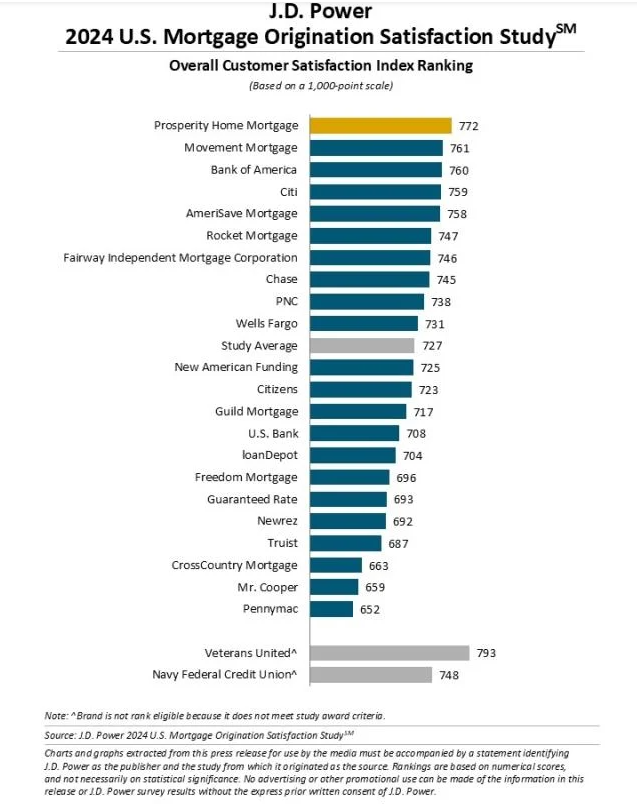

- Overall satisfaction has declined following a sharp increase in 2023: Overall customer satisfaction with mortgage lenders is 727 (on a 1,000-point scale), down a total of three points from a year ago when mortgage customer satisfaction surged 14 points year-over-year. In the past year, mortgage lenders have noticeably trimmed their staff, thus making it more challenging to deliver high quality, personalized customer service that drove the gains in customer satisfaction just a year ago.

- Interpersonal relationships with local brand reps is critical to customer satisfaction: The only factor showing gains in this year’s study is people, which has risen by a single point. The factors showing the biggest year-over-year declines in customer satisfaction are digital (-8 points); communication (-5); and loan offering met my needs (-5). J.D. Power found that when local brand representatives are directly involved in the mortgage origination process, overall satisfaction rises 40 points.

- Having a lender as an advisor becomes key to navigating a tough market: Lenders that actively advise clients throughout the lending process have driven significantly higher customer satisfaction scores. The satisfaction score for trust among borrowers who strongly rely on the lender’s expertise to get through the borrowing process is 133 points higher than among those borrowers who do not strongly rely on the lender’s expertise.

- Timing is everything and earlier is better: Overall satisfaction is 41 points higher when lenders engage early with customers, connecting with them when they are first thinking about purchasing a home, compared with overall satisfaction when lenders get involved once customers are actively shopping. Satisfaction is 107 points lower when lenders get involved at the time customers are getting ready to apply for a mortgage.

Ranking Highest in Customer Satisfaction

According to J.D. Power, Fairfax, Virginia-based full-service mortgage banker Prosperity Home Mortgage ranked highest in mortgage origination satisfaction, with an overall score of 772. A subsidiary of HomeServices of America, a Berkshire Hathaway Affiliate, Prosperity Home Mortgage, featuring a team of more than 500 mortgage consultants, operates in 49 jurisdictions, and in 2023, funded nearly $7 billion in production.

Landing in the number two spot on J.D. Power’s list of U.S. Mortgage Origination Satisfaction Study was Indian Land, South Carolina-based Movement Mortgage. Founded in 2008, Movement Mortgage currently features more than 775 licensed offices in 49 states, staffed by more than 4,500 employees nationwide. Movement Mortgage, totaled a customer satisfaction score of 761 on the list.

Bank of America, with a customer satisfaction score of 760, ranked third on the list. Bank of American serves approximately 69 million consumer and small business clients with approximately 3,700 retail financial centers, approximately 15,000 ATMs (automated teller machines), and offers digital banking solutions for approximately 58 million verified digital users.

Citi ranked fourth on the list, with a customer satisfaction score of 759. Citi does business in more than 180 countries and jurisdictions, providing corporations, governments, investors, institutions, and individuals with a broad range of financial products and services.

Scoring fifth on J.D. Power’s list was AmeriSave Mortgage, with a score of 758. With total loan volume of $130 billion, AmeriSave has been in existence for more than two decades, having helped more than 773,600 borrowers realize the dream of homeownership through the refinance and purchase processes in 49 states.

With a customer satisfaction score of 747, Rocket Mortgage ranked sixth on J.D. Power’s satisfaction list. Founded in 1985, Rocket Companies is a Detroit-based fintech platform company consisting of personal finance and consumer technology brands including Rocket Mortgage, Rocket Homes, Amrock Title and Settlement Services, Rocket Money, and Rocket Loans.

Coming in at seventh, Madison, Wisconsin- and Carrollton, Texas-based Fairway Independent Mortgage Corporation scored 746 on the survey. A full-service mortgage lender licensed in all 50 states, Fairway is the number two overall retail lender in the U.S., and was ranked the number one mortgage origination company for borrower satisfaction in 2023 by J.D. Power.

Chase ranked eighth on the customer satisfaction list. With a score of 745, Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Company, a financial services firm based in the U.S. with assets of $4.2 trillion and operations worldwide. Chase serves 84 million consumers and 6.9 million small businesses, with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans, and payment processing.

Coming in at ninth, Pittsburgh-based PNC scored 738 on the survey. PNC Bank is a member of The PNC Financial Services Group, including a full range of lending products; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management.

Rounding out the top 10, Wells Fargo landed a score of 731 according to J.D. Power. Wells Fargo has approximately $1.9 trillion in assets, and provides a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through its four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management.

Click here to view more on the J.D. Power 2024 U.S. Mortgage Origination Satisfaction Study.