According to the recently released Quarterly Mortgage Bankers Performance Report by the Mortgage Bankers Association (MBA), independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net profit of $701 on each loan they originated in Q3 of 2024. This is an increase from the reported net profit of $693 per loan in Q2 of 2024.

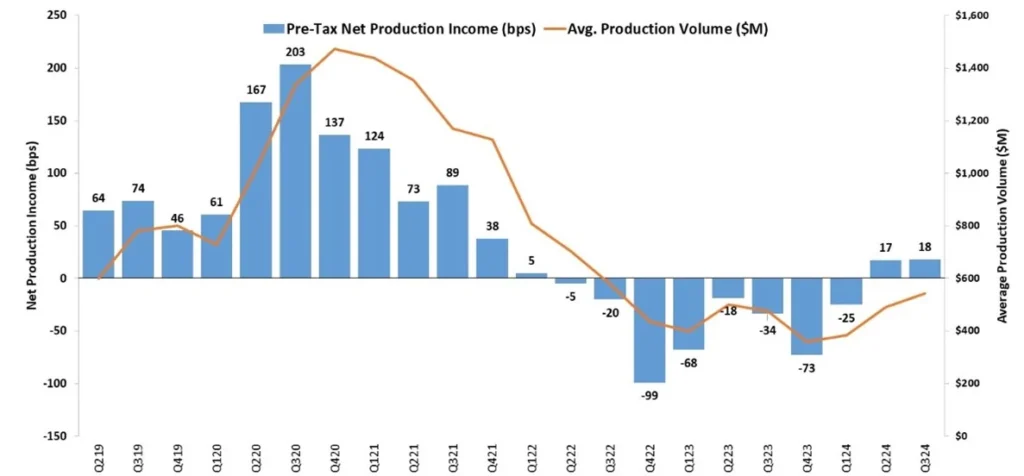

“Mortgage companies reported net production profits for the second consecutive quarter after an unprecedented period of net production losses that spanned two years,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Net production profits increased to 18 basis points last quarter—far improved from the average loss of 43 basis points the past two years—with a drop in secondary marketing income offset by a decrease in production expenses.”

Walsh claims that the possibility of increased third-quarter prepayments led to mortgage servicing right (MSR) impairments and decreased profitability on the servicing side of the company. In the third quarter, net servicing financial income decreased from a gain of $69 per loan in the second quarter to a loss of $25 per loan serviced.

“Overall, it was a decent showing for independent mortgage banks with 71% reporting profitability across production and servicing operations, compared to 78% in the second quarter,” Walsh said.

Key Findings of MBA’s Q3 2024 Quarterly Mortgage Bankers Performance Report:

- The third quarter of 2024 saw an average pre-tax production profit of 18 basis points (bps), up from the reported 17 bps in the second quarter and a 34 basis point loss in the previous year.

- From the third quarter of 2008 to the most current quarter, the average quarterly pre-tax production profit was 42 basis points.

- In Q3, the average production volume per company increased from $492 million in the second quarter to $542 million.

- Compared to 1,503 loans in the second quarter, the average volume by count per company increased to 1,642 loans in the third quarter.

- In Q3, total production revenue (which includes fee income, net secondary marketing income, and warehouse spread) dropped from 347 basis points in the second quarter to 341 basis points.

- Production revenues on a per-loan basis dropped from $11,499 per loan in the second quarter to $11,417 per loan in Q3.

Q3 2024 Highlights: Loans, Mortgage Originations and Profits

In Q3 of 2024, the total cost of loan production—which includes commissions, compensation, occupancy, equipment, and other production costs and corporate allocations—dropped from 330 basis points in the second quarter to 323 basis points. In 2024, per-loan costs dropped from $10,806 per loan in the second quarter to $10,716 per loan in the third quarter. Loan production costs have averaged $7,573 per loan since the third quarter of 2008.

By monetary volume, some 84% of all originations were purchases. According to MBA, the buy share for the entire mortgage business was 75% in Q3 of 2024. Also in Q3, the average loan balance for first mortgages climbed from $356,993 in the second quarter to $361,518.

In Q3 (without annualizing), servicing net financial income decreased from $69 per loan in the second quarter to a loss of $25 per loan. In the third quarter, servicing operational income—which does not include MSR amortization, profits or losses in the valuation of servicing rights net of hedging gains or losses, or gains or losses on the bulk sale of MSRs—rose from $88 per loan to $93 per loan.

Compared to 78% in Q2 of 2024, some 71% of the companies in the report reported pre-tax net financial profits in the third quarter of 2024, including all business lines (production and servicing).

Other performance metrics for the mortgage banking sector are provided by MBA’s Mortgage Bankers Performance Report series, which includes pull-through rates, productivity, product mixtures for originations and servicing volume, and revenue and cost breakouts.

To read the full report, including more data, charts, and methodology, click here.