It was announced that the Homeowner Equity Report (HER) for Q3 of 2024 was recently published by CoreLogic. According to the research, home equity for U.S. homeowners with mortgages—who own about 62% of all properties—rose by $425 billion since Q3 of 2023, representing a 2.5% annual gain. As a result, the total net homeowner equity reached over $17.5 trillion in Q3 of 2024.

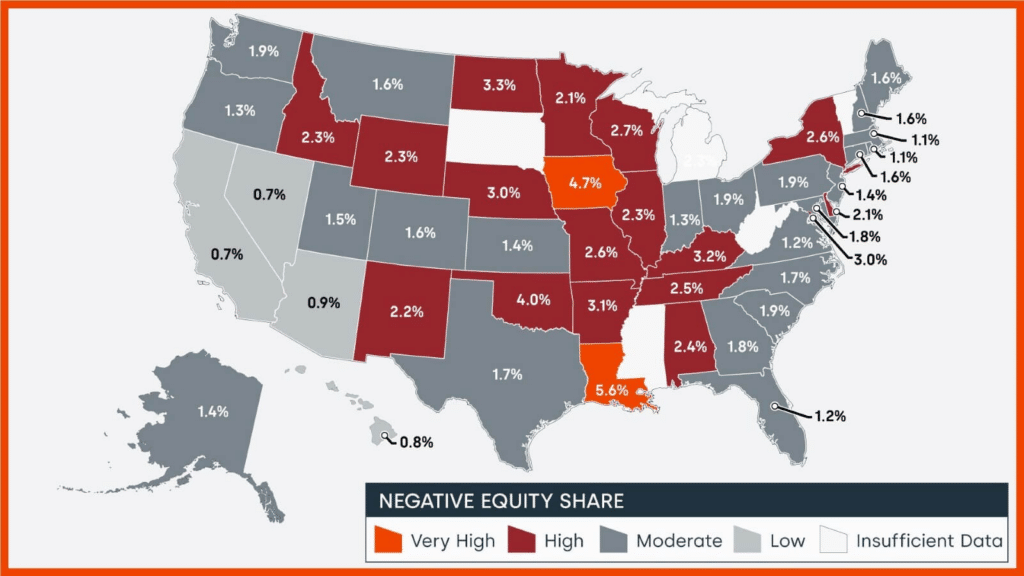

In the U.S., the percentage of negative equity increased on a quarterly basis for the first time since the fourth quarter of 2022. The number of residential properties with negative equity rose by 30,000, or 1.8%, over the previous quarter.

“As home prices flattened in the third quarter, home equity gains also slowed, even declined in some regions of the country,” said Dr. Selma Hepp, Chief Economist at CoreLogic. “While home equity closely depends on home price changes, equity losses are also tied to natural disaster events since households can lose a lot of their equity following a catastrophe, particularly if not property insured. As a result, following Maui’s 2023 devastating wildfire, Hawaii now tops the list with largest decline in home equity.”

Many other homeowners are profiting from the ongoing increase in property values and the ensuing increase in equity, even though over 1 million residential homeowners are currently struggling with negative equity on their properties.

The “surge” seen last quarter, when yearly equity gains reached $25,400, was far greater than the $5,700 average equity gains between Q3 2023 and Q3 2024.

Nationwide U.S. Equity Share Sees Various Gains, Decreases

The largest increases in home prices occurred in the Northeastern states, which also had the biggest equity gains. New Jersey and Rhode Island saw the most year-over-year price increases in October, climbing 8.1% and 7.5%, respectively, and setting new highs.

Home equity fell this quarter in Hawaii, Colorado, and Idaho, which were once popular places for people to work from home because of their beautiful scenery. With an average loss of $34,000, Hawaii experienced the biggest decline in home equity.

The largest increases in home prices occurred in the Northeastern states, which also had the biggest equity gains. October saw new highs for prices in New Jersey and Rhode Island, which took the top two positions for year-over-year price increases, gaining 8.1% and 7.5%, respectively.By the conclusion of the third quarter of 2024, negative equity had a total national worth of almost $324 billion. This is an increase of about $4.3 billion, or 1%, from the second quarter of 2024’s $319 billion, and an increase of about $9.1 billion, or 3%, from the third quarter of 2023’s $315 billion, year-over-year.

According to the CoreLogic equity data analysis—which started in Q3 of 2009—negative equity reached its highest point in Q4 of 2009, accounting for 26% of mortgaged residential properties.

The average homeowner in the U.S. increased their equity by about $5,700 over the course of the previous year in Q3 of 2024.

New Jersey ($43K), New York ($37K), and Rhode Island ($43K) saw the biggest average national equity improvements. Annual equity losses were reported by three states: Idaho (-$13K), Colorado (-$17K), and Hawaii (-$34K).

According to CoreLogic metropolitan-level homeowner equity statistics, Las Vegas and Los Angeles are the least affected, with negative equity shares of all mortgages at 0.6% and 0.8%, respectively, despite the fact that negative equity has recently increased nationally.

To read the full report, click here.