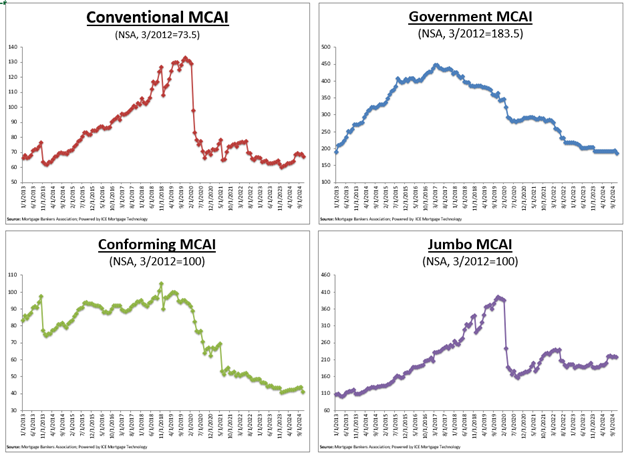

The Mortgage Credit Availability Index (MCAI), a survey from the Mortgage Bankers Association (MBA) that examines data from ICE Mortgage Technology, shows a decline in mortgage credit availability in November.

While an increase in the index signifies loosening credit, a decrease in the MCAI suggests tightening lending rules.

Overview of the November Mortgage Credit Availability Index:

- In November, the MCAI dropped 3.3% to 95.9.

- In March 2012, the index was benchmarked at 100.

- While the Government MCAI fell by 3.9%, the Conventional MCAI fell by 2.7%.

- The Conforming MCAI dropped by 6.6%.

- The Jumbo MCAI dropped by 0.9% among the Conventional MCAI’s component indices.

“Credit availability tightened considerably in November, pushing the index to the lowest level in five months,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Part of the decline was attributable to investors pulling back on high LTV and low credit score programs for both fixed and ARM loans, as well as further exits from the broker channel in an originations market that is still challenging for many lenders. The most notable impact was on the government index, which decreased to its lowest since December 2012.”

Measuring the Jumbo MCAI Component Indices, Conventional, Government, and Conforming Loans

In November, the MCAI dropped 3.3% to 95.9. While the Government MCAI fell by 3.9%, the Conventional MCAI fell by 2.7%. The Conforming MCAI dropped by 6.6%, while the Jumbo MCAI dropped by 0.9% among the Conventional MCAI’s component indices.

Using the same technique as the Total MCAI, the Conventional, Government, Conforming, and Jumbo MCAIs are created to demonstrate the relative credit risk and availability for their respective indices. The population of loan programs that are examined is the main distinction between the Component Indices and the entire MCAI.

While the Conventional MCAI looks at non-government loan programs, the Government MCAI looks at FHA, VA, and USDA loan programs. FHA, VA, and USDA loan offerings are not included in the Jumbo and Conforming MCAIs, which are a subset of the standard MCAI. Conventional lending programs that come inside conforming loan limitations are examined by the Conforming MCAI, whereas conventional programs outside of conforming loan limits are examined by the Jumbo MCAI.

To read the full report, including more data, charts, and methodology, click here.