In order to give more Americans significant opportunity to become homeowners, Ginnie Mae has released its Fiscal Year 2024 (FY24) Annual Financial Report, which highlights its financial outcomes and demonstrates exceptional success in bolstering the U.S. housing financing sector.

Some 1.2 million households countrywide, including servicemembers, veterans, and first-time homebuyers, were assisted by Ginnie Mae’s mortgage-backed securities (MBS) program during FY24.

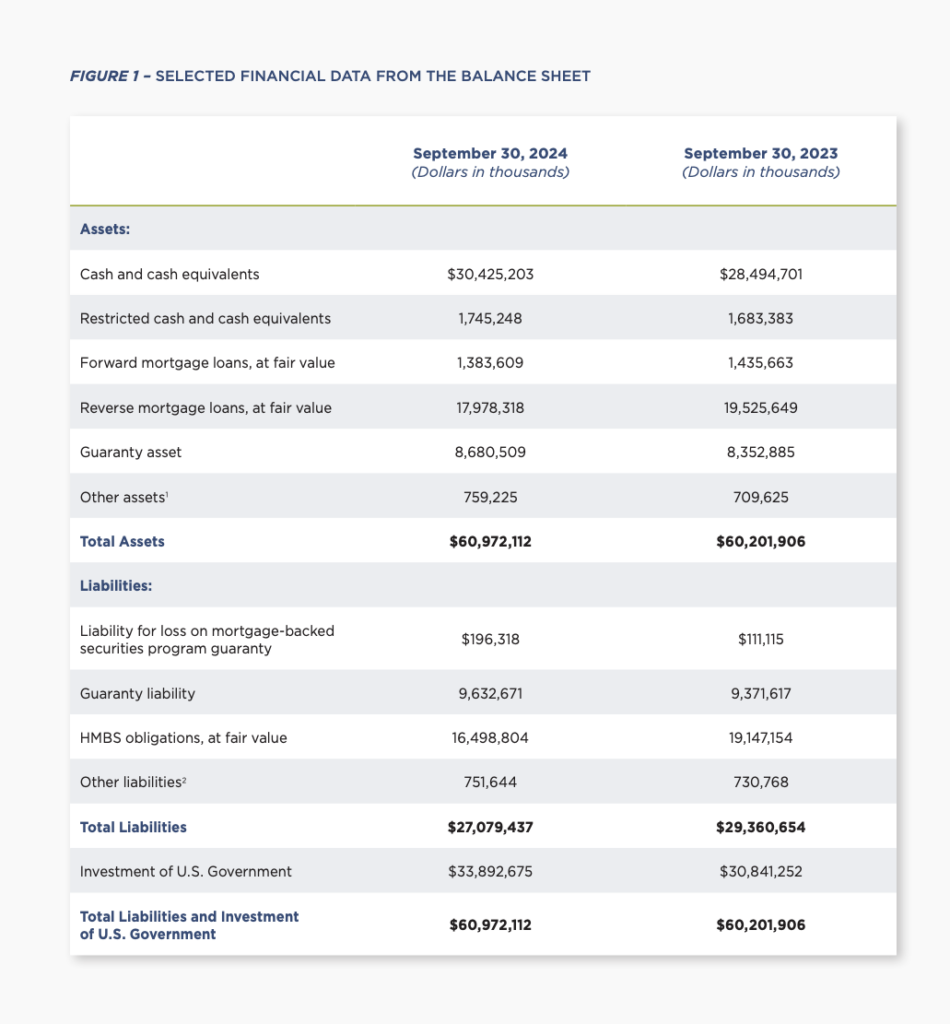

These households were spread across urban, rural, and Tribal communities. With the $423.4 billion gross yearly issuance of MBS, Ginnie Mae’s outstanding portfolio reached a record $2.64 trillion. Operational outcomes from this performance were $3.1 billion, which included a $1.3 billion donation to the U.S. government.

“Once again, our fiscal year results demonstrate Ginnie Mae’s ability to provide consistent access to affordable credit throughout all market cycles while delivering value to taxpayers,” said Gregory Keith, Senior VP and Chief Risk Officer at Ginnie Mae. “In generating $3.1 billion net financial impact, including supporting 1.2 million households, Ginnie Mae proved how impactful our business can be in strengthening the housing finance market while generating superior financial results. Perhaps more amazing is that Ginnie Mae accomplishes this mission with fewer than 300 employees.”

Effective financial management, operational effectiveness, and strategic expansion are Ginnie Mae’s top priorities. These are essential to the company’s long-term performance and favorable influence on the US home finance industry. These initiatives promote investor confidence both domestically and internationally while ensuring that more Americans have significant opportunity to obtain a home.

“Despite economic challenges, Ginnie Mae maintained strong financial health and operational excellence,” said Adetokunbo “Toky” Lofinmakin, Chief Financial Officer at Ginnie Mae. “With a business model that generates a negative subsidy, we directly contribute to U.S. Government earnings. This year’s $1.3 billion contribution underscores our value and unwavering commitment to advancing affordable homeownership nationwide.”

Ginnie Mae’s operations are still anchored by its emphasis on governance, internal controls, and modernization, which guarantees stability and preparedness to handle changing problems.

“For five consecutive years, Ginnie Mae has maintained an unmodified audit opinion—an extraordinary achievement for a small agency managing such a large portfolio,” said Erica Johnson, Director and Audit Liaison Officer at Ginnie Mae. “Our robust internal controls and modernization initiatives enable us to adapt to evolving market conditions, maintain transparency, and ensure we remain well-prepared to meet future challenges.”

Learn more about Ginnie Mae’s strategic aims, accomplishments, and vision for bolstering housing financing by reading the full Fiscal Year 2024 Annual Financial Report here.