As the housing market grows more competitive, rental scams are adding financial and emotional strain to renters nationwide. According to Rently’s Rental Scams and Fraud Report, 93% of U.S. renters believe scams are common, and 90% worry about falling victim themselves. The survey, conducted by Pollfish, underscores the growing crisis and calls for stronger fraud prevention measures.

Key Findings from the Survey

Among 500 renters surveyed, the report revealed the following:

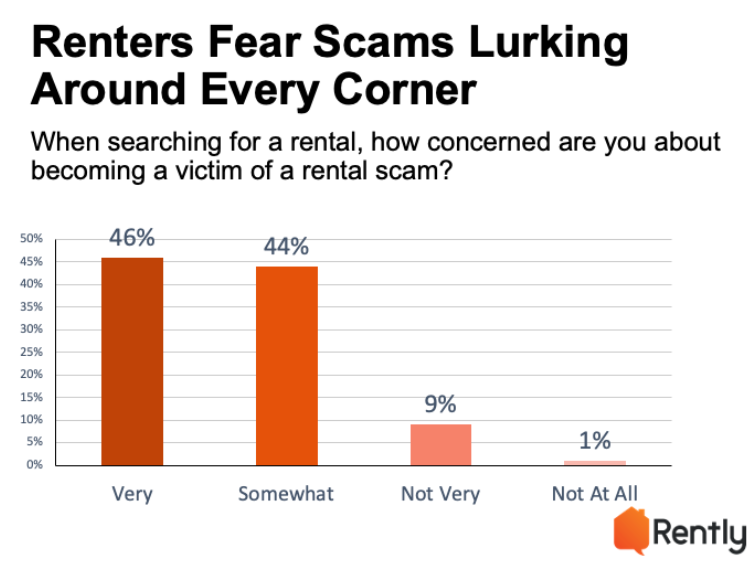

- Prevalence of Concerns: 93% of respondents think rental scams are widespread, while 46% are “very concerned” about falling victim.

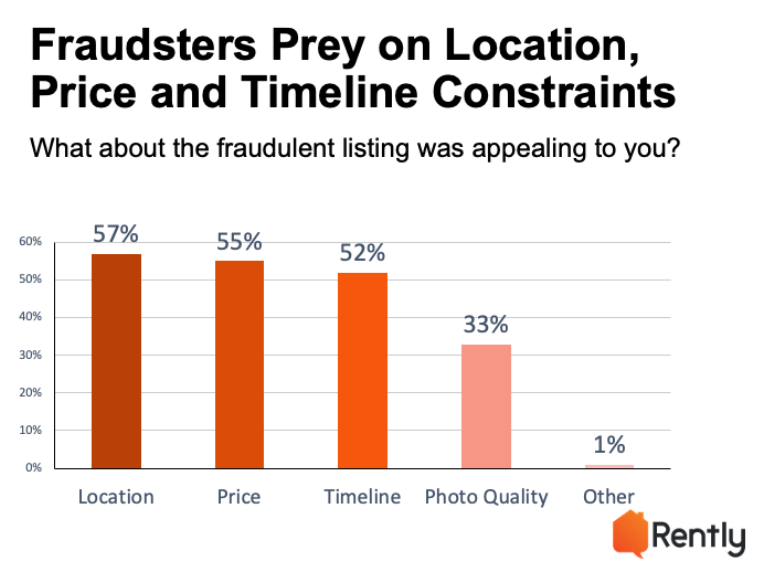

- Top Platform for Scams: Facebook is the leading platform for fraudulent listings, implicated in 88% of scams. Common tactics include promoting desirable locations (57%), below-market prices (55%), and immediate availability (52%).

- Financial Losses: 62% of scam victims reported losing over $500, with 48% losing more than $1,000 and 8% losing over $5,000. Victims often paid security deposits, application fees, or first month’s rent before discovering the scam.

- Distrust in Platforms: 39% of renters distrust online rental platforms, with only 0.6% expressing complete trust. Respondents attributed blame to rental platforms (40%) and landlords (23%), urging better technology to prevent fraud.

Emotional Toll on Renters

Scam victims shared accounts of betrayal and anxiety:

- “I felt betrayed and foolish after realizing the scam. Now, every listing feels like it could be a trap.”

- “I’ve experienced mental health challenges as a result of this scam. It takes longer for me to trust people in new situations.”

- “When I showed up to move in, the locks were changed, and the ‘landlord’ had disappeared.”

Proposed Industry Solutions

The report advocates for:

- Secure Technologies: Tools like identity verification, secure payments, real-time property viewing, and photo verification to deter fraud.

- Public Education: Tutorials, scam alerts, and forums for renters to share experiences and report suspicious listings.

- Transparency: Verifying landlord identities and listing legitimacy to rebuild renter trust.

Industry Call to Action

“As housing demand surges, scammers are exploiting renters’ desperation with alarming precision,” said Merrick Lackner, CEO of Rently. “Beyond the financial loss, these scams create lasting emotional harm, turning an exciting step into a source of stress and heartbreak.”

Lackner emphasized the need for safeguards, transparency, and education to ensure renters can search for homes without fear of exploitation.

Click here for more on Rently’s study on rent scams and fraud.