For the seventeenth straight month, the median asking rent in the U.S. decreased month-over-month in December 2024. Across the 50 largest metro areas in the nation, the median rent was approximately $1,695 in December 2023, down $18 (1.1%) from December 2023 and $8 (an estimated 0.5%) from November 2024. This is according to new research from Realtor.com.

Despite being steady over the last year and a half, the rent decreases haven’t significantly reduced the peak level attained in July 2022. The December number is still 16.0% higher than the December 2019 number and only 3.7% down from that record high. Compared to the for-sale market, where listing prices only took their first notable decline this month, the rental market has stabilized after the sharp increases of 2021–2022.

Rents Fall Again, Further Below the 2022 Peak Nationwide

All sizes of rental apartments had a decline in rent in December, although studios saw the largest drop at 1.3%, while rates for one- and two-bedroom units dropped by 0.9%. Although the difference in rents between studios and apartments with designated bedrooms has begun to narrow, this breakdown has not changed much from November. In the 50 largest metro areas, the median rent for a studio apartment was $1,419, while single-bedroom apartments and two-bedroom apartments were $1,579 and $1,880, respectively.

Rents for two-bedroom units have increased the greatest since before the COVID-19 epidemic, rising 19.8% over December 2019. Studio rents have increased by 11.3% and one-bedroom rates by 15.9%. The renter of a studio apartment is most on the verge of being an independent household. During the pandemic, many studio renters moved in with relatives or roommates to save money, which caused studio rentals to fall. Many of those same studio renters returned to their original one-bedroom apartments after the pandemic’s height, and because of the comparatively high demand, studio rentals increased for a longer period of time than rents for bigger apartments.

Despite this, studio rent increase from the pre-pandemic era to the present is slower than that of bigger units, indicating that the supply of these smaller rents has not kept up with the demand. Realtor.com experts anticipate seeing tighter rent growths across rental sizes, similar to what was seen in December, as the gap has closed in previous months.

| Unit Size | Median Rent | Rent YoY | Rent Change – 5 Years |

| Overall | $1,695 | -1.1% | 16.0% |

| Studio | $1,419 | -1.3% | 11.3% |

| 1-Bedroom | $1,579 | -0.9% | 15.9% |

| 2-Bedroom | $1,880 | -0.9% | 19.8% |

Absorption Rates for Newly Completed Apartments See Extensive Decline

For the seventeenth consecutive month, median asking rents decreased year-over-year in December. As we noted in our earlier analysis, the rise in multi-family building, which keeps moving forward through the pipeline and increasing the total supply, is a major factor for the rental market to become softer. The absorption rate for new units declined within the first three months of construction, which is not surprising given the increased number of rental possibilities.

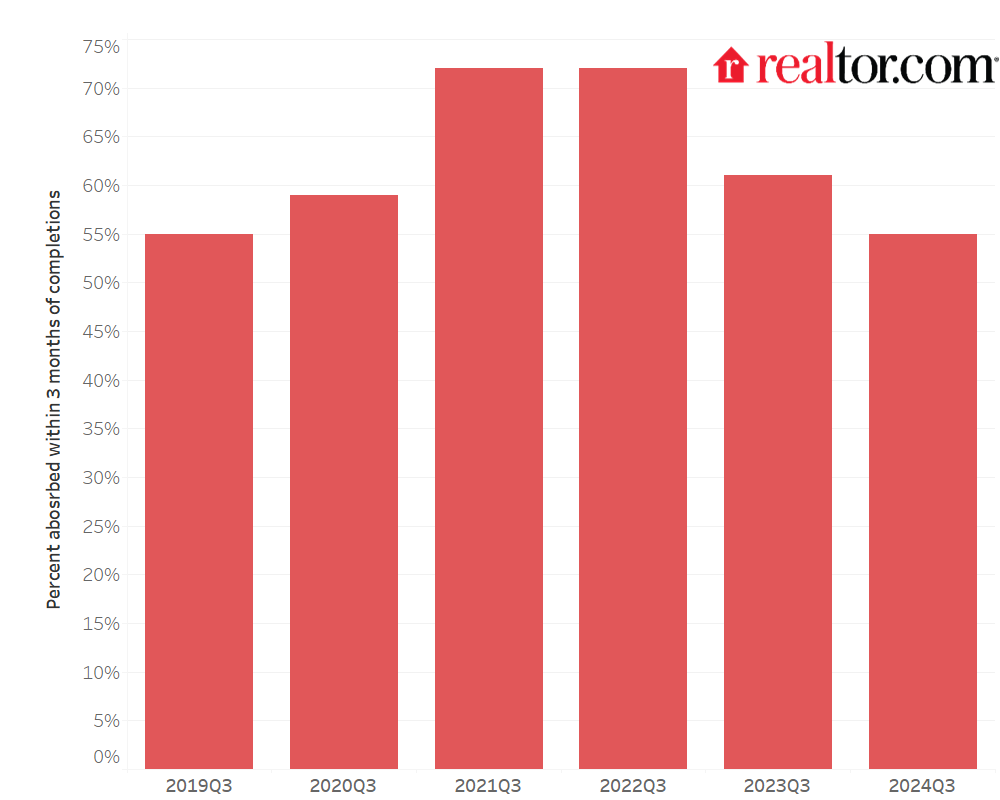

Q2 of 2024 saw the completion of 118,600 apartments in structures with five or more units, according to the Census Survey of Market Absorption of New Multifamily Units (SOMA). Fifty-five percent of these new units were rented in Q3 of 2024 during the first three months after completion. Although more than half of the apartments were absorbed during this time, the rate is slower than it was between 2020 and 2023, but it is still comparable to the 2019 level. The Housing Vacancies and Homeownership Survey, meanwhile, indicates that the rental vacancy rate in Q3 of 2024 was the highest since 2020.

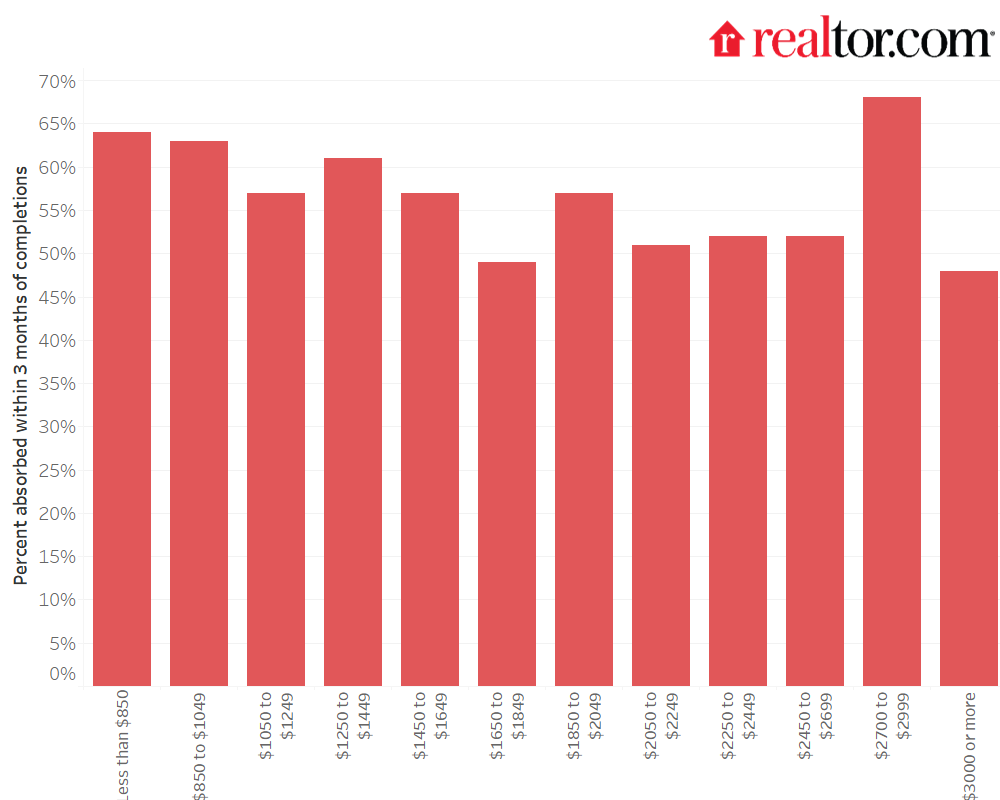

Interestingly, absorption rates were comparatively higher for units with asking rents under $1,450 in 2024Q3, and the highest absorption rate was observed for apartments priced between $2,700 and $2,900. We determine an affordability threshold of roughly $1,897 for monthly rents by capping rent at 30% of the 2024 median monthly household income ($6,323). The weighted average absorption rates within three months of completion were 56.3% for the affordable apartments and 53.8% for the more expensive units, indicating a comparatively stronger demand for affordable rental options. Realtor.com categorizes the recently completed units with asking rents below $1,850 as affordable rental units and those priced above $1,850 as less affordable apartments.

In terms of regional absorption rates, Q3 of 2024 is highest in the Northeast. It also stands out as the only region where the absorption rate increased from 58% to 67% in Q3 of 2024as compared to the same time the previous year. In areas like New York City, where rental costs are still rising, this tendency is consistent with yearly rent increases.

However, during the first three months of completion, absorption rates in the West fell the most, from 72% in Q3 of 2023 to 58% in Q3 of 2024. The rise in the number of new rental properties is the cause of this slowdown. A lower absorption rate in Q3 of 2024 resulted from the completion of 25,910 apartments in buildings with five or more units in Q2 of 2024, as opposed to merely 19,320 units in the same period last year. Due to the increased availability of rental options, 8 out of 11 Western markets had a decrease in rent from the previous year.

The most notable of these were:

- Denver (-5.9%)

- Riverside, CA (-4.8%)

- San Francisco (-4.3%)

Indicating a weaker rental market in both the Midwest and the South, the absorption rate for new completions also declined in these regions.

Notably, the Midwest markets with the biggest year-over-year rent drops were in:

- Cleveland (-3.4%)

- Chicago (-2.8%)

- Milwaukee (-1.2%)

Nashville, TN (-4.4%), Austin, Texas (-5.0%), and Memphis, TN(-6.7%) had the biggest yearly rent declines among Southern markets.

To read the full report, including more data, charts, and methodology, click here.