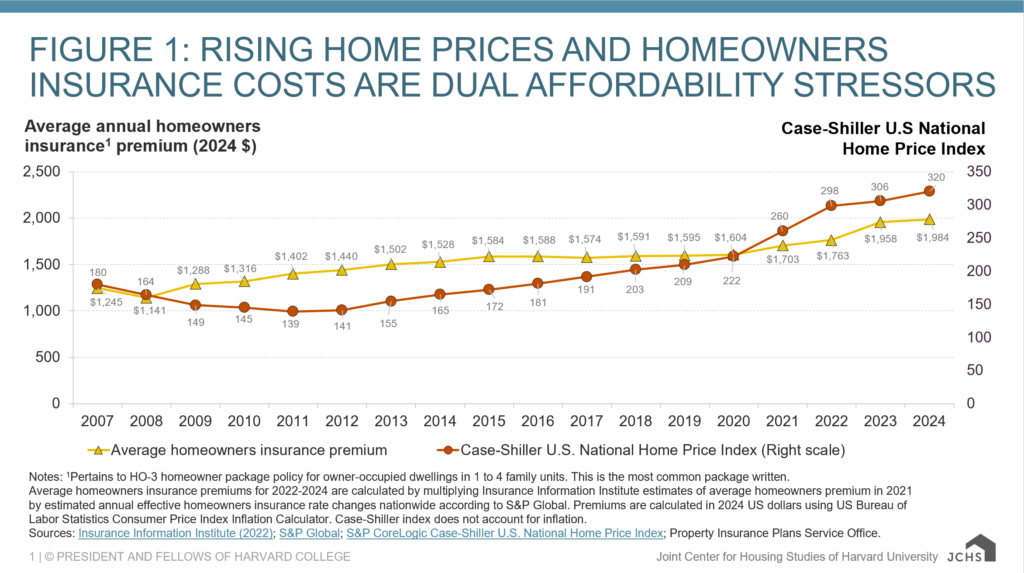

It’s not just home prices that are expensive, as they hover at historically high levels; rising insurance premiums are contributing to the growing costs of homeownership and property management. Homeowners insurance prices have increased 74% from the Great Recession to the present, while home prices have increased more than 40% (even after adjusting for inflation). Between 2020 and 2023 alone, real premiums rose approximately 20%, according to the latest report from Harvard University’s Joint Center for Housing Studies. Premiums are increasing for both homeowners insurance, covering common risks like fire, and for hazard-specific insurance covering things like earthquakes and floods.

Home, rental, and property-related insurance products are ubiquitous and foundational to the health of the U.S. housing market. For instance, homeowners insurance and mortgage insurance facilitate a prospective homebuyer’s access to mortgage credit, and after a disaster, an insurance claim payout can lessen the financial shock and help the homeowner rebuild, preserving hard-earned home equity.

Property insurance underwriting plays an important role in housing markets and the overall economy. It has evolved to become a highly regulated industry at the state level, unlike the housing finance system, which is largely regulated at the federal level. With property insurance, there is a universe of diverse regulatory contexts and rate-setting approaches, and states regulate insurers’ premiums in granular detail, leading to tensions. Income and racial disparities in insurance pricing and coverage have greatly declined over the last half-century, but some financial markers can still be considered (e.g., credit scores). Much of the recent premium growth is due to the increase in hazard exposures, many due to climate change.

And increasing costs mean a growing home equity protection gap. In 2022, an estimated 12% of homeowners did not have homeowners insurance. This occurs at the same time the share of homeowners without a mortgage and associated lender insurance requirements remains above 40%. And keep in mind that these numbers do not take into account the sizable share of renters who simply lack renters insurance.

Most households buy their homeowners insurance from the private insurance market, which may bundle in public hazard insurance policies such as that of the National Flood Insurance Program (NFIP). Due to market conditions, private insurers have faced unprofitability, insolvencies, and/or exited markets altogether in states like California, Louisiana, and Florida. Some industry analysts question whether the homeowners line of business is profitable at all, following years of underwriting losses and rising replacement costs. Because there can be considerable pricing variation in a state, many consumers shop around. Risk-based pricing reflects expected damages from covered incidents, but often leads to unaffordable premiums. On the other hand, underpricing policies relative to true risks can enable risk-seeking behavior such as further development in highly exposed regions.

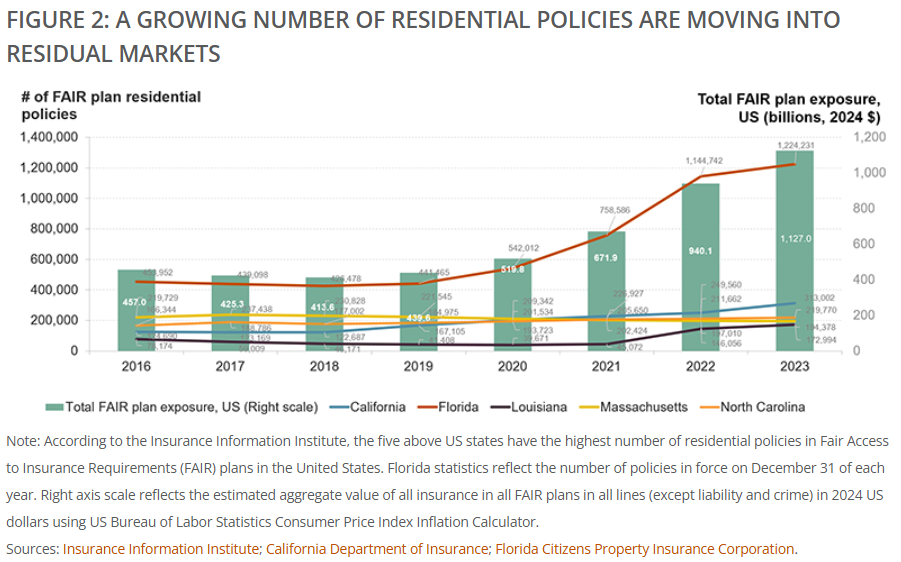

That’s where Fair Access to Insurance Requirements (FAIR) plans come in. More than two-thirds of states have created FAIR as an insurer of last resort. Figure 2 (below) shows the relative changes in the number of residential policies written by the five largest state FAIR plans, as well as aggregate FAIR plan exposures across all states.

The total amount of asset value insured by state FAIR plans has eclipsed $1 trillion, with the number of residential policies in the two largest state programs (Florida and California) has more than doubled since 2018.

According to the Insurance Information Institute, the five above U.S. states have the highest number of residential policies in Fair Access to Insurance Requirements (FAIR) plans in the United States. Florida statistics reflect the number of policies in force on December 31 of each year. Right axis scale reflects the estimated aggregate value of all insurance in all FAIR plans in all lines (except liability and crime) in 2024 U.S. dollars using U.S. Bureau of Labor Statistics Consumer Price Index Inflation Calculator.

While the governance and financial structures of FAIR plans vary, they generally benefit from state-derived authority to levy assessments on firms and policyholders to fund claims in the event of insolvencies. These FAIR plans are often referred to as the residual market, with Florida’s Citizens Property Insurance Corporation as the largest in terms of both the number of residential policies and asset value insured. While state authorities want to depopulate these programs in order to limit their constituencies’ financial exposure, the residual market has continued to grow in recent years, an indicator of private insurance market health and systemic public financial risk. The California Department of Insurance recently approved Allstate’s request to raise the firm’s average homeowners insurance premiums in the state by 34%, underscoring that private firms’ market participation is contingent on financial returns. In some states, relatively financially-precarious “non-admitted” insurance providers are also entering the market, raising concerns about solvency and consumer financial protection.

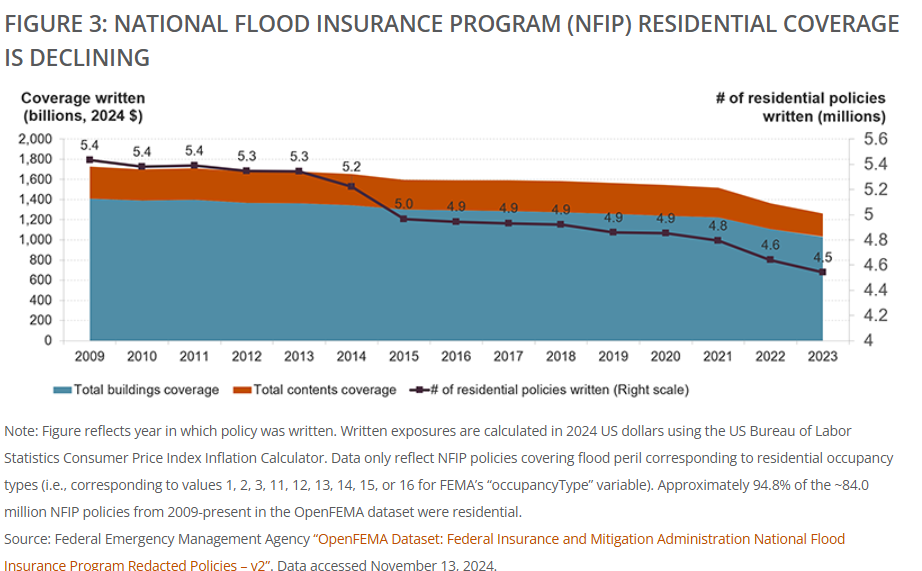

Today, homes located in Federal Emergency Management Agency (FEMA)-defined regulatory floodplains are required to purchase a flood-specific insurance policy, separate from a homeowners insurance policy, in order to access a federally-backed mortgage. Established in 1968, the National Flood Insurance Program addresses limited coverage availability in the private market, functioning like a large federal residual market for flood insurance. Though there has been growth in the private market, recent estimates indicate the majority of flood insurance policies are still written through the NFIP. The number of those residential policies has declined from 5.4 million in 2009 to 4.5 million in 2023, with accompanying decreases in coverage.

Click here for more on the Joint Center for Housing Studies’ report on the insurance crisis.