For many Americans, owning a home signifies independence, stability, and the opportunity to accumulate long-term wealth, among other things. Homeowners, however, are aware that although those advantages are genuine, they are not given away for free.

The “American Dream” has long been considered one of the pinnacles of success, and owning a home remains a popular and important aspiration for tens of millions of Americans—regardless of whether they are renting, living with relatives or friends, or surviving in some other housing situation.

While some homeowners prioritize their mortgage payments, those who are not financially prepared may face significant challenges due to other essential and frequent expenses such as homeowners insurance, property taxes, utilities, repairs, and maintenance. According to new research from Real Estate Witch, a Clever Real Estate publication, the average American homeowner now spends $24,529 annually, or $2,044 monthly, on home expenses in addition to their mortgage—up from $17,958 in 2024.

On top of the entire cost of the mortgage, this comes to an astounding $735,870 over the life of a 30-year mortgage. That represents an estimated $547 monthly increase from 2024 and is almost equal to the average household’s annual mortgage payment of $26,508.00.

These expenses are broken down as follows:

- Utilities: $7,319

- Maintenance: $6,087

- Renovations: $5,762

- Property taxes: $3,057

- Homeowners insurance: $2,304

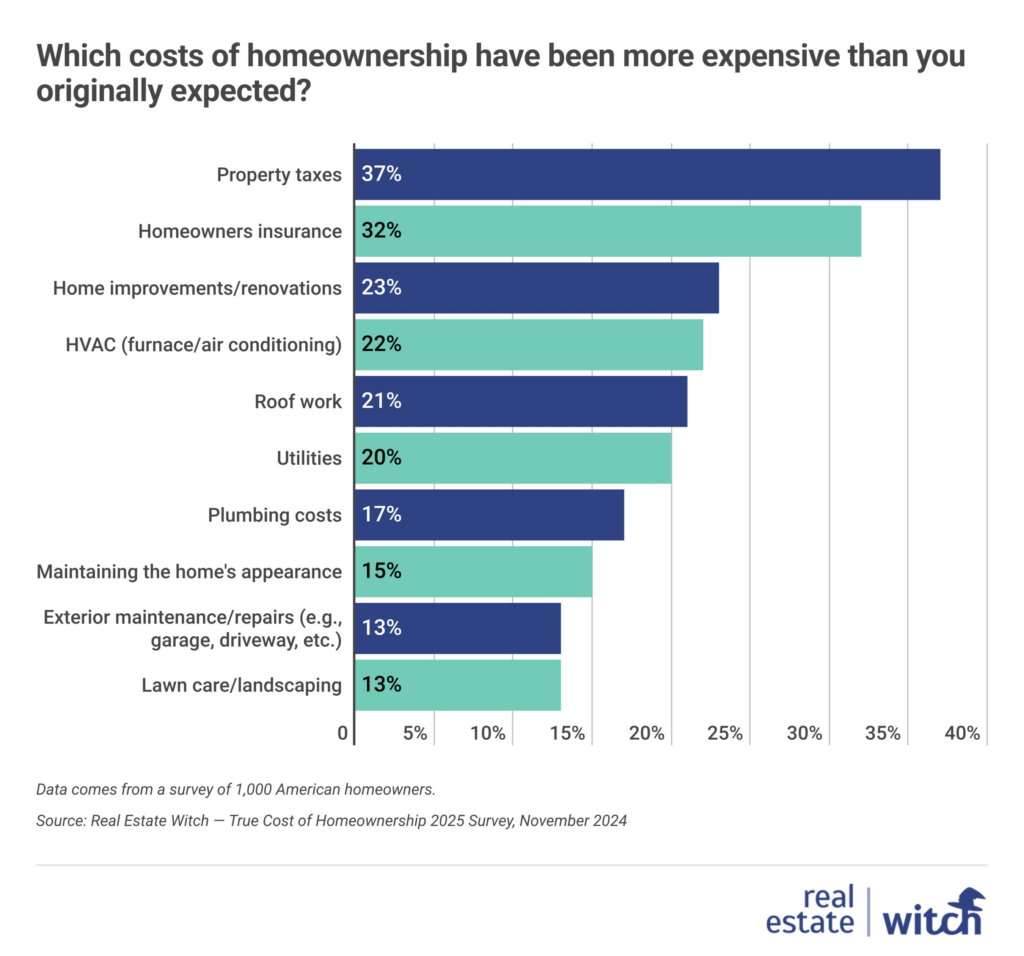

The problem is exacerbated by the fact that approximately 46% of homeowners believe their property taxes do not fairly represent the worth of their home, roughly 13% are concerned they may lose insurance on their property, and 51% of homeowners are disturbed by the rising expense of home insurance.

The typical property tax rate nationwide is $3,057, which is slightly more than 5% higher than it was the previous year, according to the U.S. Census Bureau. It’s sufficient to convince 46% of homeowners that they don’t think their property taxes fairly represent the worth of their house. To add fuel to the fire, Americans who belong to homeowners associations (HOAs) also pay an additional $3,077 in HOA dues annually, bringing their total annual cost to $27,606.00. Some 40% of first-time homeowners said they were shocked by their tax bill, further adding to existing financial woes.

Budgeting, Buyer’s Remorse and Bills

More than two-thirds (69%) of homeowners regret their home and the related costs, and 4 out of 5 (81%) say their spending was higher than they had expected. Before making a purchase, nearly half of homeowners (46%) admit they did not fully evaluate the expense of repairs and improvements. However, a majority (59%) couldn’t afford a $5,000 emergency repair without incurring credit card debt, and 46% also acknowledge that they don’t regularly budget for unforeseen expenditures.

Some 48% of homeowners said they would have approached the purchasing process differently if they had known the full cost of homeownership, and 81% of homeowners would prefer a more expensive property with fewer maintenance expenditures in hindsight.

Some homeowners question whether owning a property is worth the expense. About 1 in 7 (15%) have even thought about renting again, and an estimated 44% believe it’s easier. While homeownership remains obtainable, the majority of U.S. homeowners (56%) think that the typical American cannot afford to own a home in today’s economy.

Over one in five homeowners (21%) have had to cut back on unnecessary spending on large purchases or vacations. One in eight people (12%) have even taken money out of their retirement account, which may cause more serious financial problems in the future. Despite all of these alternatives, 1 in 12 people (8%) still claim they are unable to pay for basic housekeeping.

Generations Weigh in On Non-Mortgage Homeownership Costs

A homeowner’s perspective is heavily influenced by their age and the state of the housing market at the time of purchase, as is the case with many housing-related matters. Generationally speaking, nearly 1 in 4 millennial homeowners (23%) compared to baby boomers (10%) say that the expenses of homeownership have caused them to desire to return to renting.

Nearly two-thirds of millennial homeowners (63%) believe that housing costs are more than they anticipated, which is probably because they bought during the booming late 2010s and early 2020s market. Only 37% of baby boomers share this sentiment, which is a 26 percentage point disparity.

Nearly one in six (15%) millennial homeowners are so overburdened that they are unable to pay for even the most basic maintenance for their homes. Just 5% of boomers are in the same situation.

Supporters have consistently maintained that homeownership is a tried-and-true method of increasing wealth and financial security, notwithstanding the costs, both apparent and hidden. Millennial and Gen X homeowners, however, are roughly twice as likely to report that the expense of home ownership has badly affected their finances (38% and 34%, respectively) as boomer homeowners (19%).

However, their dollars are not the only thing at stake. An estimated 50% of Gen X and millennial homeowners say they experience stress from homeownership, and nearly 1 in 5 millennial homeowners (19%) say owning a home has negatively impacted their mental health. The same is true for some 22% of boomer homeowners.

Overall, 1 in 5 (20%) millennial homeowners feel that owning a home isn’t worth the expense, and 61% of them say it’s too costly. In contrast, 40% and 4% of boomers, respectively, do the same. Even as they mature, younger generations can wind up owning fewer homes than older ones if significant changes are not made to help advance homeownership.

To read the full report, including more data, charts, and methodology, click here.