According to a recent Redfin study, housing prices and mortgage rates are still high, and home sales are at their weakest pace since the pandemic began. Not only are properties selling more slowly, but there are also fewer residences being turned over.

“Prospective buyers have been cautious because they’ve seen homes sitting on the market and they’ve heard interest rates and prices may drop. When the market isn’t competitive, some buyers think they should wait for costs to go down,” said Jordan Hammond, a Redfin Premier agent in Raleigh, NC. “Now it’s pretty clear that sellers aren’t slashing asking prices and mortgage rates aren’t plummeting, so mindsets are shifting. People are starting to believe that if they want or need to move, and they can afford to, they should do it.”

Key findings from the four weeks ending January 26:

- Before the seller accepted an offer, the average U.S. home listing that went under contract stayed on the market for 54 days, which is the longest period since March 2020 and one week longer than it was at this time last year. The average home was selling in 35 days at this point in 2022, during the pandemic-driven surge in home purchases.

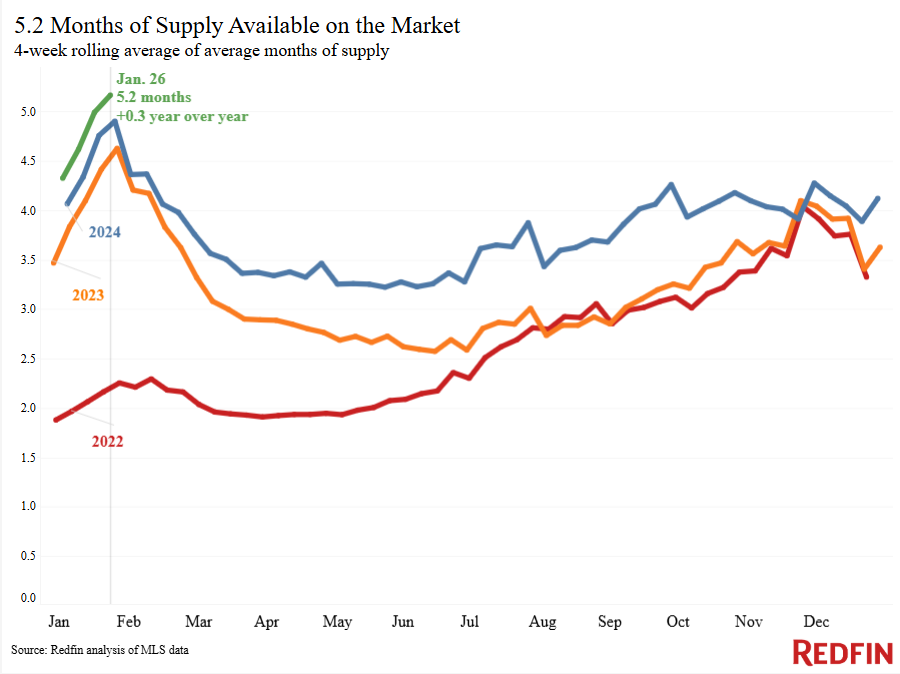

- The market had 5.2 months of supply, which was more than the 4.9 months in the previous year and the most since February 2019. A longer period of time indicates that properties are on the market longer and indicates a buyer’s market. Months of supply is the amount of time it would take for the current supply of homes to be purchased at the current sales rate.

- The largest drop since September 2023 was recorded in pending home sales, which fell 9.4% year-over-year.

U.S. Home Sales Slow as Prices and Inventory Rise

Due to the high cost of purchasing a home—mortgage rates are close to 7%, and housing prices are rising 4.8% annually—sales are slow. At $2,753 per month, the median house payment is slightly below the record high set in April. Extreme weather is also keeping potential buyers at home, including wildfires in Southern California and snow and bitter cold in the Midwest, South, and Northeast.

As new listings increase and mortgage rates decline—at least somewhat—from their peak in early January, the market should pick up steam in the upcoming weeks. Redfin brokers also anticipate that some purchasers may soon leave the sidelines as they become weary of waiting for prices and rates to drop.

Indicators of homebuying demand and activity:

| Leading indicators: | Recent change | YoY change | Source |

| Weekly average 30-year fixed mortgage rate | Down from 7.04% a week earlier, but still near highest level since May | Up from 6.69% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Essentially unchanged (down 0.4%) from a week earlier (as of week ending Jan. 24) | Down 7% | Mortgage Bankers Association |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Lowest level since June (as of week ending Jan. 26) | Down 1% | Redfin Homebuyer Demand Index, a measure of tours and other homebuying services from Redfin agents |

| Touring activity | Up 7% from the start of the year (as of Jan. 26) | At this time last year, it was up 8% from the start of 2024 | ShowingTime, a home touring technology company |

| Google searches for “home for sale” | Up 14% from a month earlier (as of Jan. 26) | Essentially unchanged | Google Trends |

Key Housing-Market Data — National

| U.S. Highlights | Four weeks ending January 26, 2025 | Year-over-year change |

| Median sale price | $377,125 | 4.8% |

| Median asking price | $407,225 | 5.2% |

| Median monthly mortgage payment | $2,753 at a 6.96% mortgage rate | 8% (highest level since April) |

| Pending sales | 59,044 | -9.4% (biggest decline since September 2023) |

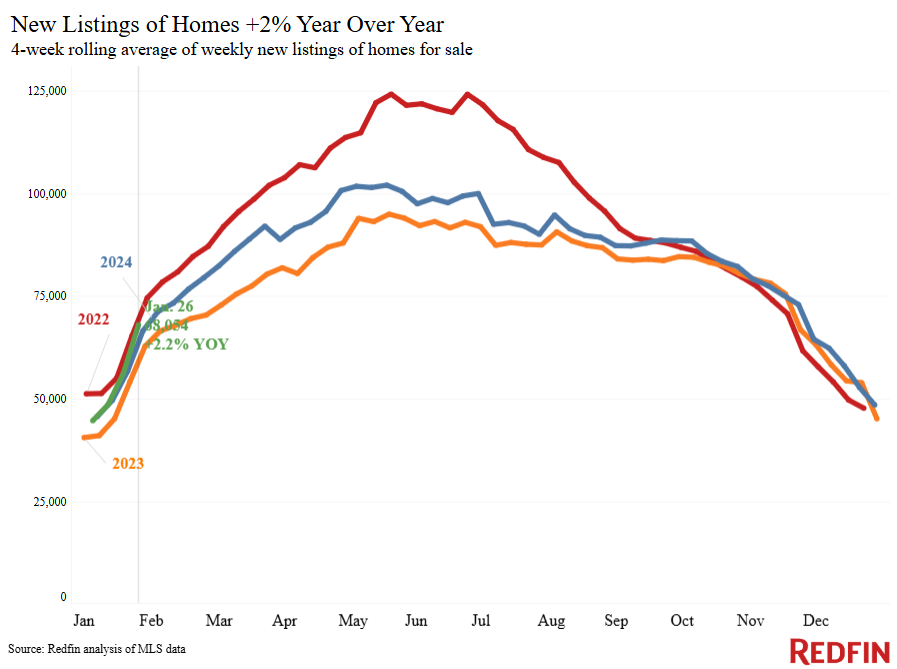

| New listings | 68,054 | 2.2% |

| Active listings | 889,202 | 11.3% (smallest increase in nearly a year) |

| Months of supply | 5.2 | +0.3 pts. to longest span in nearly 6 years (4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions) |

| Share of homes off market in two weeks | 25.7% | Down from 29% |

| Median days on market | 54 | +7 days to longest span in nearly 5 years |

| Share of homes sold above list price | 21% | Down from 23% |

| Average sale-to-list price ratio | 98% | Down from 98.1% |

Overview by Metro: YoY Increases and Drops

Top 5 metros with biggest YoY increases in median sale price:

- Pittsburgh (19.3%)

- Milwaukee (16.7%)

- Fort Lauderdale, FL (14.2%)

- Newark, NJ (13.4%)

- Cincinnati (11.7%)

The U.S median sale price for the average home declined in just three metros YoY: San Francisco (-5.6%), Austin, Texas (-2.6%), and Tampa, FL (-1.5%).

Top 5 metros with biggest YoY increases in new listings:

- San Jose, CA (23.4%)

- Phoenix (19.5%)

- Seattle (15.2%)

- Oakland, CA (14.5%)

- Sacramento, CA (14.2%)

Overall, new listings declined in 18 metros across the nation. The biggest YoY decreases were in:

- San Antonio (-17.4%)

- Detroit (-16.6%)

- Newark, NJ (-14.4%)

- Atlanta (-12.9%)

- Warren, MI (-11.6%)

Pending sales, however, saw a significant drop YoY, increasing in only two metros: Portland, OR (9.7%) and Milwaukee (2.6%).

Top 5 metros with biggest year-over-year increases in pending sales:

- Miami (-24.9%)

- Detroit (-24.5%)

- Atlanta (-22.7%)

- San Diego (-20.1%)

- Houston (-19.8%)

To read the full report, including more data, charts, and methodology, click here.