According to a recent UCLA Anderson Forecast analysis, the two biggest disasters that devastated Los Angeles County may have resulted in between $95 and $164 billion in total property and capital losses, with an estimated $75 billion in insured losses. Economists Zhiyun Li and William Yu wrote the research, which projects a 0.48% decline in county-level GDP in 2025, or around $4.6 billion.

The world-renowned city of Los Angeles saw the most devastating wildfires in its history in January 2025. Due to intense Santa Ana winds and extremely dry conditions, a number of wildfires have devastated LA County since January 7, burning 55,082 acres. With 23,400 and 14,000 acres burned, respectively, the Palisades and Eaton Fires caused the most damage. Over 16,240 buildings have been destroyed and at least 28 people have died as a result of the fires thus far. An initial estimate of the massive losses and economic cost of these destructive wildfires is presented in the report.

In their summary of the projected economic effects, the economists noted that their calculations are predicated on a number of assumptions and could be changed in the future.

Key Findings:

- Local businesses and employees in the affected areas could face a total wage loss of $297 million.

- Without substantial and effective wildfire mitigation efforts and investments, Californians will face increasingly higher insurance premiums and growing health risks from wildfire-related pollution.

- LA housing markets, in particular rental units, will become increasingly unaffordable.

- All wildfire mitigation investments will be justified, considering the astronomical costs associated with wildfires.

Navigating Property Damage, Overall Loss

In addition to many cars and personal property, the wildfires immediately burned 16,240 residential and business buildings. Of them, the Palisades Fire destroyed 6,822 buildings in Malibu and Pacific Palisades, and the Eaton Fire destroyed 9,418 in Altadena. The California Department of Insurance’s (CDI) summary of all insurance claims will allow us to ascertain the direct insured losses in the upcoming months. In the meanwhile, we give insured households with initial estimates of economic losses based on data from previous insured losses from California’s most devastating wildfires.

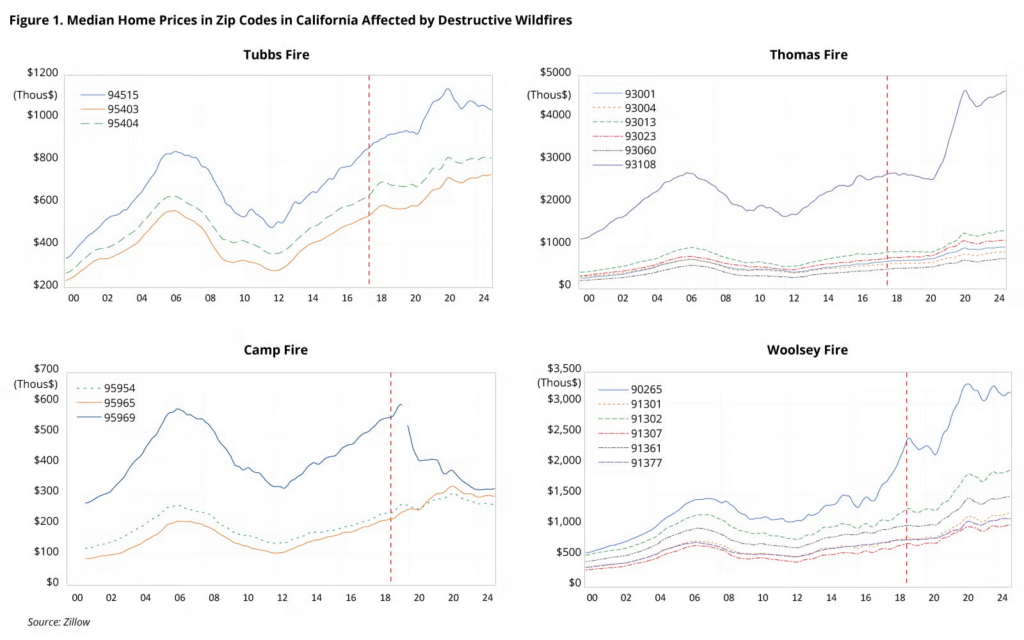

Prior to 2025, the Tubbs and Thomas Fires in 2017 and the Camp and Woolsey Fires in 2018 were the four most destructive wildfires in California history in terms of economic loss, as shown in Table 1. $8.76 billion, $1.52 billion, $8.26 billion, and $1.42 billion were the total insurance claims. Furthermore, prior to the wildfires, we were aware of the median property prices by zip code.

The median home prices multiplied by the number of buildings destroyed in each wildfire yielded the following total losses: $3.67 billion, $0.61 billion, $3.98 billion, and $1.42 billion. The ratio between these two metrics is then computed, and ratios for the insured loss to the overall loss in the median home price range from 2.1 to 2.5.

In addition to uninsured property losses, the wildfires caused damage to electrical lines, sewage systems, roads, bridges, and other infrastructure, all of which need to be repaired. In addition, there are significant cleanup and environmental expenses to take into account. UCLA used data from other large-scale natural catastrophes to estimate the total capital loss from the blaze in LA.

Start by looking at the projected $108 billion in property losses from Hurricane Katrina in 2005: UCLA calculated this amount by multiplying the total number of homes destroyed (217,000) by the median home prices in August 2005 ($175,665), which came to $38.1 billion. The ratio that results is 2.8. In conclusion, an estimated loss of $95 billion was found by applying this ratio to the $33.9 billion estimated loss in LA.

Second, according to Wang et al. (2021), California wildfires caused $27.7 billion in total capital losses in 2018. The ratio between these numbers is 2.2 (27.7/12.36), with the CDI estimating that the overall insured losses for the 2018 California wildfires were $12.36 billion. According to this ratio, the L.A. wildfires may have caused a total capital loss of up to $164 billion ($74.7 billion 2.2). Additional health expenses and other indirect expenditures associated with wildfires are also covered by Wang et al. (2021). The parts that follow will go over these effects.

In conclusion, the anticipated insured losses from the LA wildfires are $75 billion, but the overall property and capital losses could be anywhere from $95 billion to $164 billion. Our estimates should be seen as rough approximations based on a number of assumptions. The dynamic nature of wildfires and regional variations in population density, housing costs, fire suppression efforts, and recovery expenses make these estimates imprecise.

California Blaze Affects LA Home Values, Affordability & Supply

Homes are the biggest source of wealth for the majority of Americans. Insurance companies may pay whole or partial rebuilding costs to homeowners impacted by wildfires. Nonetheless, the possible effect on home prices following wildfires must be taken into account by homeowners and local governments, who depend on property taxes. Compared to comparable properties that are not at risk, properties exposed to natural disasters like wildfires are likely to lose value because of decreased demand and higher insurance rates.

The median home prices in zip codes impacted by the most severe wildfires in California between 2000 and 2024 are shown in Figure 1. Each wildfire’s occurrence is indicated by the vertical dashed line. According to data, after a wildfire, housing prices either fell or stayed low for two to three years in the majority of these places. For instance, typical property prices in Malibu (Zip code: 90265) dropped by 11% from $2.39 million in November 2018, the month of the Woolsey Fire, to $2.15 million in July 2020. After that, prices started to increase, reaching over $3 million by December 2022.

The majority of wildfire-affected communities have eventually witnessed a gain in home values, which is in line with a nationwide trend of rising home prices over the past six years. Home prices in Paradise (95969), which was ravaged by the 2018 Camp Fire, have halved from $600,000 to $300,000.

Pacific Palisades, damaged by the Palisades Fire, is similar to areas affected by the Woolsey and Thomas Fires, which have great positions with breathtaking vistas of the Pacific Ocean and warm weather. As a result, past patterns indicate that Pacific Palisades house values may increase in the future.

Comparing regions damaged by wildfires to nearby metro areas or the state as a whole, however, would not be totally appropriate. It may be argued that California and the entire region are at risk from wildfires, and that all citizens of the state pay insurance payments. In fact, the overall U.S. home price appreciation from 2018 to 2024 is marginally larger (154) than that of the majority of California.

The loss of homes lowers the availability of housing, which could temporarily enhance demand, especially for rental units, in neighboring regions, even if wildfires are expected to reduce housing demand in fire-affected areas due to higher dangers and rising insurance prices. Due to the urgent need for temporary housing for evacuated people, local news sites have reported an increase in rents following the catastrophe. LA County has granted permits for between 20,000 and 25,000 additional housing units per year for the last 10 years. However, two-thirds to three-quarters of the annual housing supply has been destroyed by wildfires in LA.

Moving Forward: Housing Affordability & Rebuilding Homes

In order to satisfy housing affordability goals, LA County must build 812,000 units during the sixth cycle of the California Department of Housing and Community Development’s (HCD) Regional Housing Needs Allocation (RHNA), which runs from October 2021 to 2029. Only 71,000 units have been approved so far in this cycle, meeting just 8.8% of the RHNA goal. The already serious problem of LA’s lack of available housing has been made worse by the flames.

In response, Governor Newsom issued an executive order on January 12 to expedite the reconstruction of homes and businesses destroyed by the fires. The order suspends the California Coastal Act’s and the California Environmental Quality Act’s (CEQA) permitting and review requirements in an effort to protect homeowners and tenants, expedite temporary housing solutions, and speed up the rebuilding and recovery process. In a similar vein, Mayor Bass of Los Angeles has issued a matching executive order to expedite reconstruction work.

The problem of home affordability is predicted to get worse in the near future in spite of these steps. Long-term problems with housing affordability are likely to continue if Los Angeles does not fulfill its RHNA requirements.

Economic Impacts on Local Municipalities

UCLA examined how the budgets of cities severely impacted by the L.A. wildfires—Pacific Palisades, Malibu, Topanga, Altadena, and Pasadena—will be affected. The University cites Liao and Kousky’s (2022) paper, which provides empirical estimates of how wildfires affect local budgets. This study’s reliance on data from 1990 to 2015 is one of its limitations. But compared to other times, the wildfires in California in 2017, 2018, and January 2025 caused significantly greater damage. As a result, the projections in this study probably reflect the least amount of possible impact on municipal budgets that the recent fires in Los Angeles could have.

This paper’s key estimates include:

Negative overall impact:

- Budget surplus: down $97 per capita

- Probability of a budget deficit: up 25 percentage point

- The negative effect is larger when the wildfire is more severe

Higher revenues:

- Total general revenues: up 10.5%

- Property tax revenues: permanently up; this appears due to CA’s Proposition 13 that limits the reassessment of property values until the property is sold. And there are more housing and parcel transactions following wildfires. However, note that State Board of Equalization (BOE) has announced on January 14 that property owners affected by the LA wildfires may qualify for various property tax disaster reliefs. This necessary relief implies that LA’s property tax revenues may be lower than expected in 2025 and 2026.

- Sales tax revenues: temporarily up due to rebuilding activities

Higher expenditures:

- Total expenditures: up 17.3%

- Public safety, such as firefighting: up 18.5%. Note that, even before the January wildfires, L.A. County voters had approved Measure E in November 2024. The measure imposes a 6-cent-per-square-foot increase in parcel tax on certain property projects, aiming to generate approximately $152 million annually for the LA Fire Department.

- Community development: up 40%

- Transportation: up 17.8%

Because they destroy productive capital and cause out-migration, wildfires can also have a detrimental effect on local economic production. Businesses may be forced to close permanently if their capital is destroyed, or temporarily if the area is under evacuation orders. Additionally, personal evacuations, health issues, or transportation difficulties may prevent employees from reporting to work.

Effects on Labor Markets, Businesses, and GDP

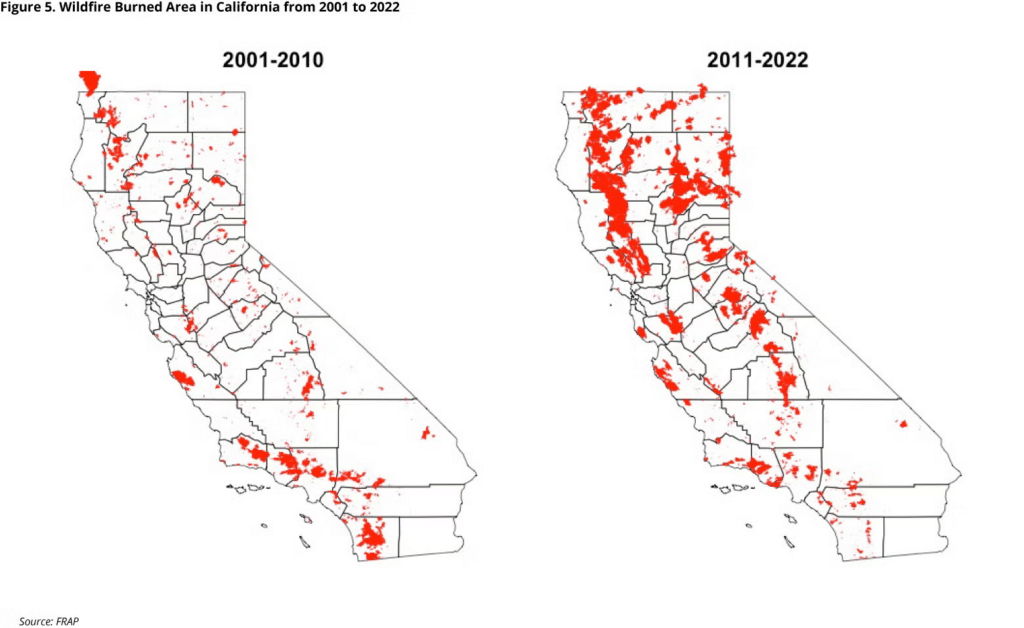

We gathered historical data on wildfire perimeters from the Fire and Resource Assessment Program (FRAP) and county and sectoral level GDP between 2001 and 2022 from the Bureau of Economic Analysis (BEA) in order to examine the effects of LA fires on the city’s GDP. In the same year, we used a reduced-form regression analysis to measure the effects of wildfire exposure on GDP at the county level. We used data on the population of LA County impacted by the Palisade and Eaton Fires to calculate the monetary amount of GDP losses based on these estimates.

Notably, California’s wildfire-burned regions increased dramatically between 2011 and 2022 as compared to 2001 to 2010. Due to longer droughts, warmer temperatures, and the growing effects of climate change, megafires became more common and larger during the latter period. Additionally, there were more wildland-urban interface regions throughout the 2011–2022 period due to population growth and urbanization, which enhanced the size and impact of fires. This development reflects a 20-year trend in California toward more intense wildfire behavior.

UCLA calculates the overall GDP loss caused by wildfires in Los Angeles County. The populations of Altadena, Pacific Palisades, and Malibu are around 76,519 people. Experts predict that around 0.4% (38,260 out of 9.6 million) of the population in LA County is vulnerable to wildfires, assuming that half of them reside in census tracts that are affected by wildfires. According to the findings, a county’s GDP will drop by 1.2% in the same year if a higher percentage of its population is exposed to wildfires. In 2023, LA County’s total GDP will be $962 billion. An estimated $4.6 billion will be lost in LA County’s overall GDP this year as a result of the catastrophic blaze.

Assessing whether out-of-county migration will result from wildfires in Los Angeles is crucial. In comparison to estimates without the wildfires, it is anticipated that the 2025 LA wildfires will probably result in a minor scale of out-migration from the impacted communities and a decline in job growth in the ensuing years, according to evidence from previous wildfires in California.

Note from the author: I send my sincerest consolations to everyone affected by the LA fires and hope for timely and sufficient relief.

To read the full report, including more data, charts, and methodology, click here.