Despite a recent nationwide fall in first-time purchaser rates, Black homebuyers have seen the most recovery. According to a recent Zillow poll, 62% of Black homebuyers made their first purchase in 2024, a percentage that remained constant from the year before. Overall, first-time purchasers accounted for only 44% of the market, compared to 50% in 2023. After years of historical racial disparities such as redlining or low-balled appraisals, this comes as great news for the Black community as they celebrate Black History Month in February.

The percentage of Black first-time buyers increased to 55% in 2022 and reached a record 63% in 2023, surpassing both the national trend and other racial groupings, following a precipitous decline from 47% in 2019 to 35% in 2021.

“Despite affordability challenges, Black first-time home buyers are demonstrating a strong commitment to homeownership, a key driver of generational wealth,” said Orphe Divounguy, Senior Economist at Zillow. “While income disparities and saving difficulties continue to delay home buying for Black households, programs like down payment assistance, first-time buyer tax credits and flexible lending options have helped increase access.”

Black Homebuyers Pursuing & Attaining Homeownership

Some Black renters now have more freedom to pursue property in more affordable areas thanks to the growth of remote work. Black renters are 29% more likely than other renters to be at a tipping point where working remotely could make homeownership possible, according to Zillow data.

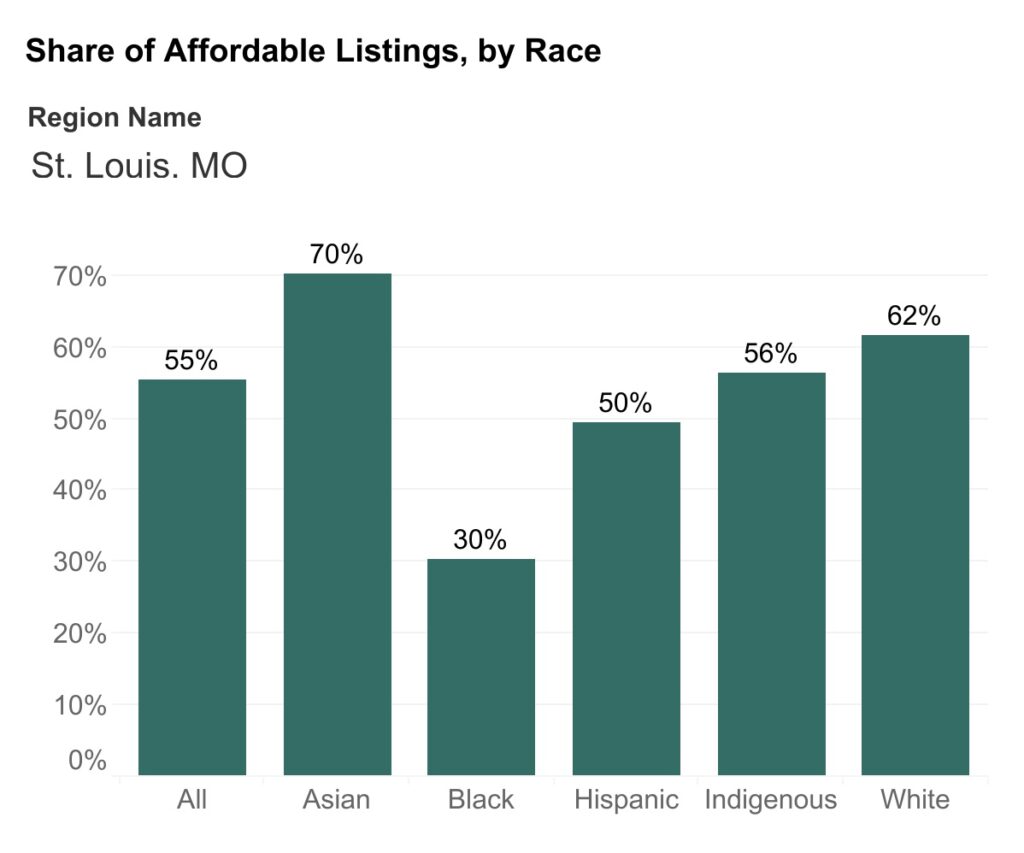

However, in many metropolitan regions, high housing costs and stringent building codes restrict the options available to many buyers nationwide, disproportionately affecting lower-income households, especially Black and other color households. Price increases are frequently caused by supply shortages in these places, and even fewer listings are within the means of the average Black household in markets with harsher building codes.

The monthly housing burden in relation to household income is a crucial indicator of housing affordability. The biggest obstacles are faced by Black households, whose median income of $54,896 is significantly less than the $95,213 required to purchase a typical U.S. home in 2024 without incurring cost-burden (spending more than 30% of income on housing).

Thus, the average Black household can only afford an estimated 17.6% of listings, while Hispanic households can afford 28.2%, White households can afford 37.9%, and Asian households can afford 56.8%, highlighting ongoing disparities in U.S. homeownership.

Southeast Metro Boasts Most Affordable Market for Black Households

So, where is the city where Black homebuyers can find the easiest affordability?

Hint: This metro also boasts a renowned river, monument and a baseball team.

As some may have guessed by the photograph or hint, the most reasonably priced housing market for average Black households is St. Louis. GO CARDINALS!

With 30.3% of listings within reach in 2024, the Mound City gives the typical Black homebuyer, or those earning the median income, a chance to pursue homeownership.

Top 10 Most Affordable Metros for Black Households

- St. Louis (30.3%)

- Birmingham (29.5%)

- Memphis at (29.0%)

- Detroit (28.6%)

- Baltimore (25.8%)

- Pittsburgh (23.7%)

- Cleveland (22.8%)

- Indianapolis (22.0%)

- Atlanta (19.2%)

- Oklahoma City (18.8%)

On the other hand, the West Coast—which includes major California metro areas and Seattle—has the least affordable markets for prospective Black homebuyers.

Additionally, throughout the pandemic, more Black people acquired homes. Despite the difficulties with cost, a growing percentage of Black buyers purchased their first home, indicating that Black households have not given up on becoming homeowners.

Black homeownership rose higher than White homeownership in 2024 compared to 2019, even though the percentage of home listings that were within the median earner’s price range fell more sharply. The percentage rise in homeownership was only larger among Hispanic households.

In conclusion, although financial and racial barriers still exist, Black first-time homebuyers are propelling increases in homeownership.

To read the full report, including more data, charts, and methodology, click here.