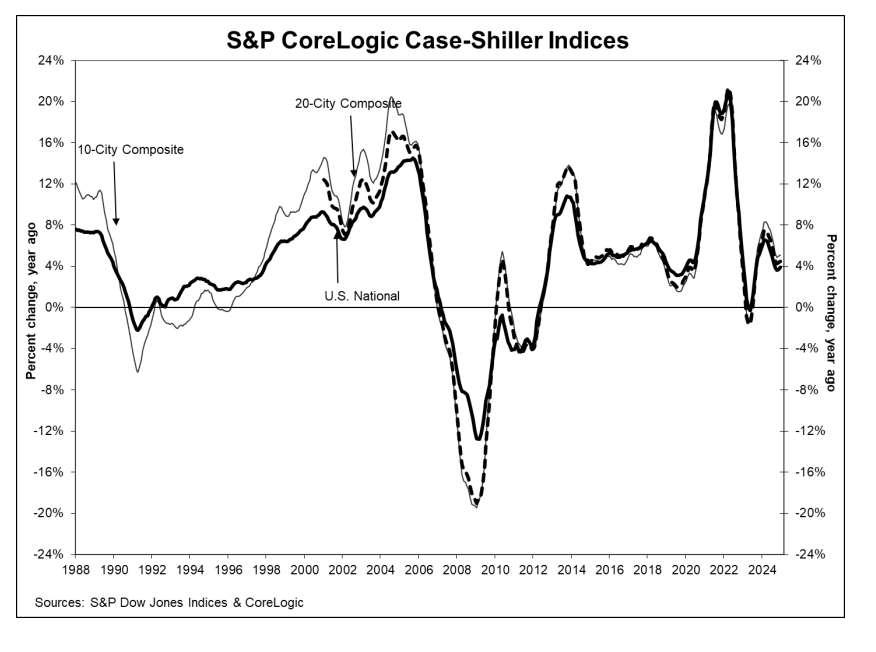

S&P Dow Jones Indices (S&P DJI) has released the December 2024 results for the S&P CoreLogic Case-Shiller Indices, which found that U.S. home prices recorded a 3.9% annual gain in December 2024, a slight increase from the previous annual gains in 2024.

“It has been five years since the Covid-19 outbreak took hold of the global economy, sparking unprecedented volatility, massive fiscal and monetary stimulus, and a housing market that responded to national migratory changes in how we work and where we live,” said Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “National home prices have risen by 8.8% annually since 2020, led by markets in Florida, North Carolina, Southern California, and Arizona. While our National Index continues to trend above inflation, we are a few years removed from peak home price appreciation of 18.9% observed in 2021 and are seeing below-trend growth over the history of the Index.”

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.9% annual return for December, up from a 3.7% annual gain in the previous month. The 10-City Composite saw an annual increase of 5.1%, up from a 5% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.5%, up from a 4.3% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.2% increase in December, followed by Chicago and Boston with annual increases of 6.6% and 6.3%, respectively. Tampa posted the lowest return, falling 1.1%.

“Home prices stalled during the second half of the year with markets in the West dropping the fastest,” added Luke. “San Francisco, the worst performing market since 2020, dropped 4.5% during the last six months of the year, followed by Seattle with a 3.0% decline. San Francisco is now 11.0% lower than its post-pandemic peak reached in May 2022. Previous strongholds like San Diego and Tampa experienced declines of 2.9% and 2.7%, respectively, during the second half of the year. After accounting for seasonal adjustments, our National Index pushed forward to achieve a 19th consecutive all-time high. The longest such streak occurred for over 12-years, notching 153 consecutive all-time highs from July 1993 to March 2006.”

Realtor.com Senior Economic Research Analyst Hannah Jones added, “Stifled buyer demand does not typically imply climbing home prices. In fact, listing prices have eased in recent months as sellers look to attract buyers and more small, affordable homes come up for sale. However, despite trends towards lower listing prices, higher priced homes continue to sell, driving sales prices higher. The divide in the housing market persists as buyers in the low-to-mid price range largely keep to the sidelines while buyer activity in the high-to-luxury price range carries on, skewing sale prices higher. Lower mortgage rates are not likely going to be achieved in the short-term, meaning affordability challenges are likely to persist in the coming months.”

Regional Trends and the Peak Home Buying Season

As the spring home buying season approaches, pockets of the nation are still in recovery from a number of natural disasters which have impacted local housing markets.

According to CoreLogic, January’s wildfires in Los Angeles left their mark on nearly 20,000 properties within the perimeters of the Palisades Fire and the Eaton Fire causing an estimated $35 to $45 billion in insured damages.

“Localized events are increasingly going to impact home price growth across the country,” said Bright MLS Chief Economist Lisa Sturtevant. “Wildfires in Los Angeles have already driven rents higher, and home prices also likely will be pushed up in the metro itself and the surrounding area as displaced homeowners search for new homes. In December, the Case-Shiller index for Los Angeles shows a gain of 3.6% year-over-year which is similar to November’s reading.”

While area of residents pick up the pieces and figure out their next steps, those displaced by the fires are dealing with landlords gouging rent prices as they capitalize on the disaster.

To deter violators, Los Angeles City Councilwoman Traci Park has proposed increasing fines for rent-gouging violations from $10,000 to $30,000. This proposal highlights ongoing efforts to hold bad actors accountable and protect displaced families from exploitation.

“Raising rents beyond legal limits during a declared state of emergency is illegal and unconscionable,” said Tom Bannon, CEO of the California Apartment Association. “The actions of a few bad actors tarnish our entire industry and exploit vulnerable families struggling to rebuild. We support efforts to strengthen penalties for violators and encourage strict enforcement of the law.”

Other less tragic forces impinging on the housing market, specifically in the D.C./Virginia/Maryland region, is President Trump’s February 11 Executive Order implementing the President’s Department of Government Efficiency (DOGE) workforce optimization initiative designed to significantly reduce the size of government.

Homes.com has issued a new report detailing the home buying and selling trends in the Washington-area housing market after a number of changes amongst the federal workforce, including roughly 75,000 accepting buyouts offered by the Trump administration, and an additional number of employees being laid off, which continues to be in flux. According to USA Today, nearly 75,000 federal employees accepted President Donald Trump’s buyout offer in mid-February. That figure, confirmed by an Office of Personnel Management official, represents approximately 3.3% of the federal government’s 2.3 million workers.

“The Washington, D.C., region is disproportionately impacted by cuts and return-to-the-office mandates,” added Sturtevant. “In December, the Case-Shiller index shows home prices up 5.6% year-over-year in the region, down slightly from November. Although it is still too early to tell the extent to which layoffs will impact the region’s housing market, Bright MLS’ weekly market tracker shows signs of a bump in new listing activity in the Washington D.C. area at the end of February. An increase in the number of available homes for sales and weaker demand likely will lead to much slower home price appreciation—or even year-over-year price drops—this spring.”