According to the Mortgage Bankers Association (MBA), the Mortgage Credit Availability Index (MCAI) indicates that mortgage credit availability rose in February—despite economic changes and housing market uncertainty.

“Mortgage credit availability in February increased for the third consecutive month to its highest level since March 2023,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Both conventional and government credit supply expanded over the month.”

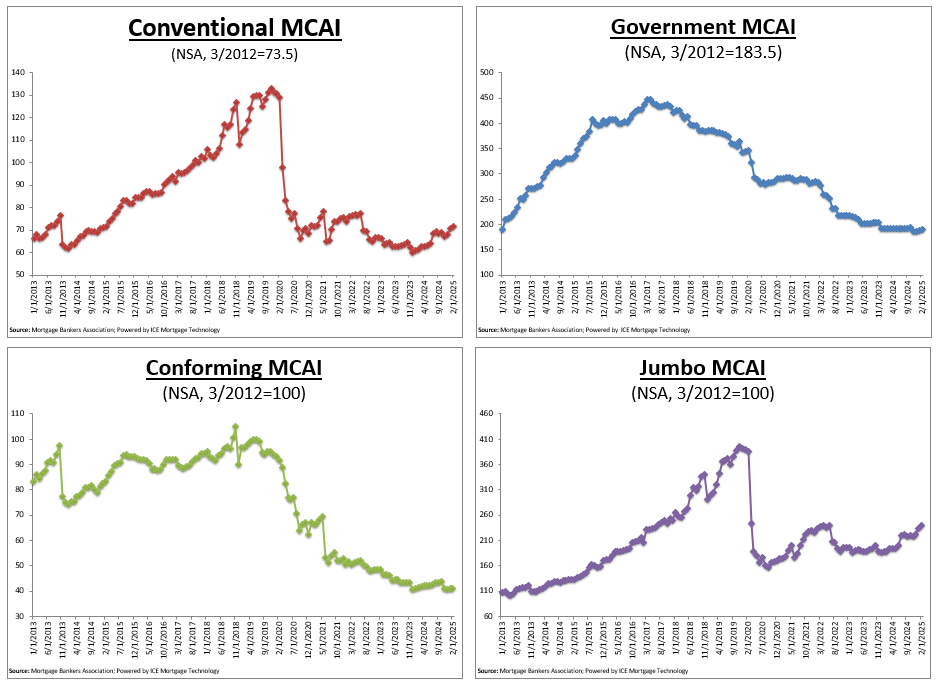

In February, the MCAI increased by 1.4% to 100.4. While an increase in the index signifies loosening credit, a decrease in the MCAI suggests tightening lending rules. In March 2012, the index was benchmarked at 100. The Government MCAI grew by 1.4%, while the Conventional MCAI increased by 1.3%. The Conforming MCAI stayed the same while the Jumbo MCAI, one of the component indices of the Conventional MCAI, rose by 1.9%.

In February, the MCAI increased by 1.4% to 100.4. The Government MCAI grew by 1.4%, while the Conventional MCAI increased by 1.3%. The Conforming MCAI stayed the same while the Jumbo MCAI, one of the component indices of the Conventional MCAI, rose by 1.9%.

“The conventional index reached its highest level since June 2022,” Kan said. “The growth in credit supply was driven by greater investor appetite for ARM and cashout refinance loans. Similar to what we have seen in recent months, the growth of non-QM loan programs pushed the jumbo index higher over the month.”

Using the same technique as the Total MCAI, the Conventional, Government, Conforming, and Jumbo MCAIs are created to demonstrate the relative credit risk and availability for their respective indices. The population of loan programs that are examined is the main distinction between the Component Indices and the entire MCAI. While the Conventional MCAI looks at non-government loan programs, the Government MCAI looks at FHA, VA, and USDA loan programs.

FHA, VA, and USDA loan offerings are not included in the Jumbo and Conforming MCAIs, which are a subset of the standard MCAI. Conventional lending programs that come inside conforming loan limitations are examined by the Conforming MCAI, whereas conventional programs outside of conforming loan limits are examined by the Jumbo MCAI.

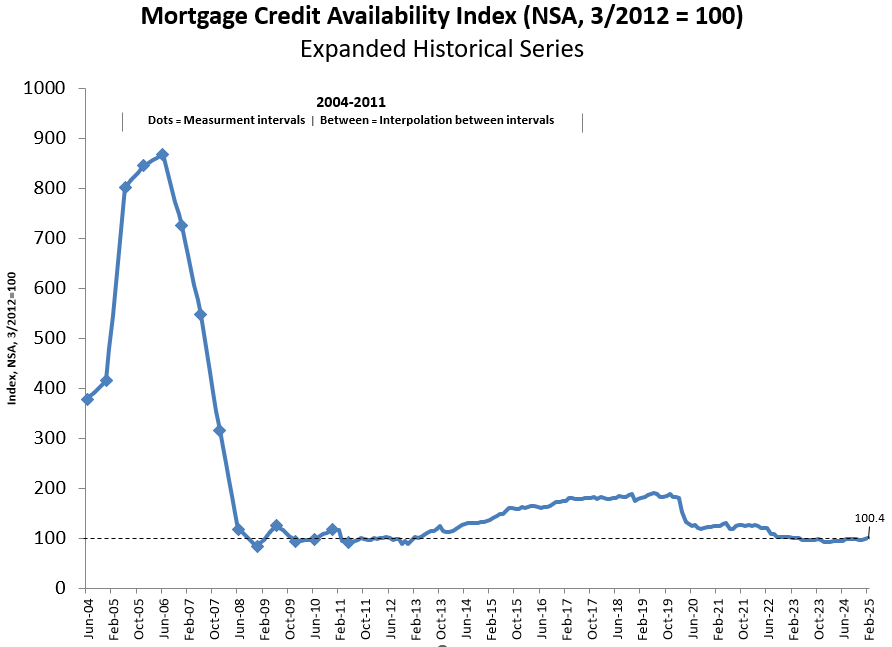

Conventional, Government, Conforming, and Jumbo MCAI are not included in the enlarged historical series of the Total MCAI, which provides perspective on credit availability spanning around ten years. The purpose of the expanded historical series, which runs from 2004 to 2010, is to give the current series historical perspective by illustrating how credit availability has changed over the past ten years, including the housing crisis and the recession that followed.

Less frequent and incomplete data were measured at 6-month intervals and interpolated for charting purposes in the months previous to March 31, 2011. There has been no update to the methodology for the expanded historical series from 2004 to 2010.

Note: The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

To read the full report, click here.