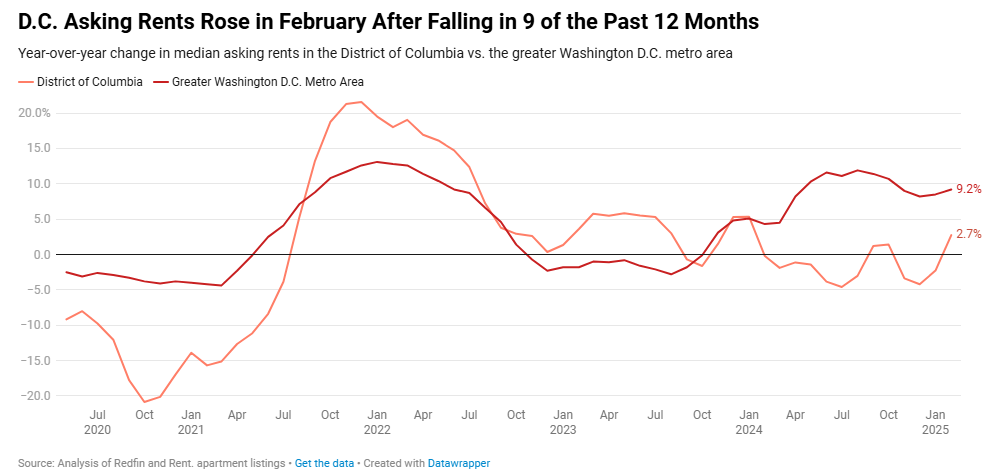

Rents in the District of Columbia fell during most of 2024 due to an increase in new construction, yet the median rent increased 2.7% year-over-year to $2,325 in February 2025 after three months of declines, all per a new report from Redfin. It’s too early to tell how the expected mass federal layoffs will impact the D.C. market; if a significant number of workers move away, expect rents to drop.

The Washington, D.C. metro area has seen some of the biggest rent increases in the country, even as asking rents have fallen in nine of the past 12 months. The District’s median asking rent peaked at $2,463 in July 2023, since falling to between $2,265 and $2,350 in 2024 as apartment construction boomed—a boom now ending, as permits for new apartments buildings are slowing.

Only Time Will Tell

Between return-to-office mandates and job cuts across multiple agencies, the federal workers who make up a significant portion of the District’s workforce face ongoing uncertainty.

“The District is always in transition, especially when a new administration takes office, with people moving in and out of the city for both government and private sector work opportunities,” Redfin Senior Economist Sheharyar Bokhari said. “Rents will be impacted if laid-off workers move away in droves, but also by workers who want to live closer to where they work, now they are required to be in the office.”

Bokhari also noted that the slowing apartment construction will lead to less new supply in the foreseeable future. The District approved permits for 11 apartment units per 1,000 people in 2022, but that number dropped by more than half in 2023 (four per 1,000 people) and half again in 2024 (two per 1,000 people).

Measuring D.C. Area Hot Spots

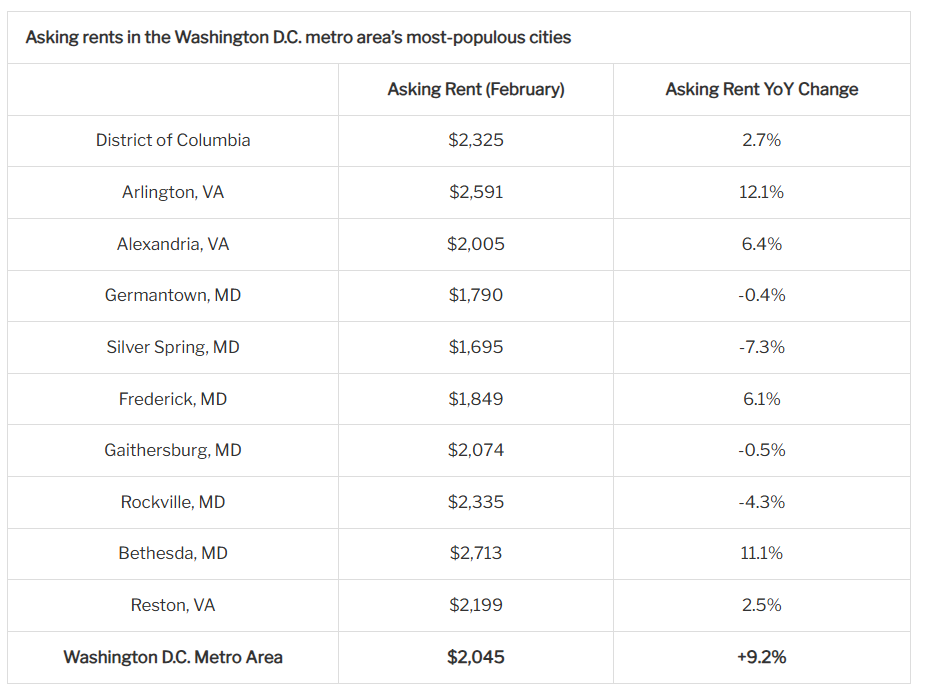

Looking at the 10 most populous cities surrounding the District, Arlington, Virginia saw the biggest year-over-year jump in asking rents in February, rising 12.1% to $2,591. They were followed by Bethesda, Maryland (+11.1%) and Alexandria, Virginia (+6.4%).

Arlington County, where Arlington is located, has seen construction slow considerably in the past two years, with county approvals dropping over 90%: from 13 apartment units per 1,000 people in 2021 to just one apartment unit per 1,000 people in 2024.

Montgomery County, where Bethesda is located, saw a relatively big jump in building permit approvals in 2024, even as it’s had little apartment construction activity recently. Those new buildings may help meet the demand that is causing rents to rise quickly.

Silver Spring, Maryland posted the biggest year-over-year decline, with the median asking rent falling to $1,695 (a 7.3% drop). Centreville, Virginia (-5.3%) was next, followed by Rockville, Maryland (-4.3%).

Overall, the median rent in the greater Washington, D.C. metro area (including the District and surrounding counties in Maryland and Virginia) rose 9.2% year-over-year in February to $2,045.

Click here for more on Redfin’s report on the D.C. metro rental market.