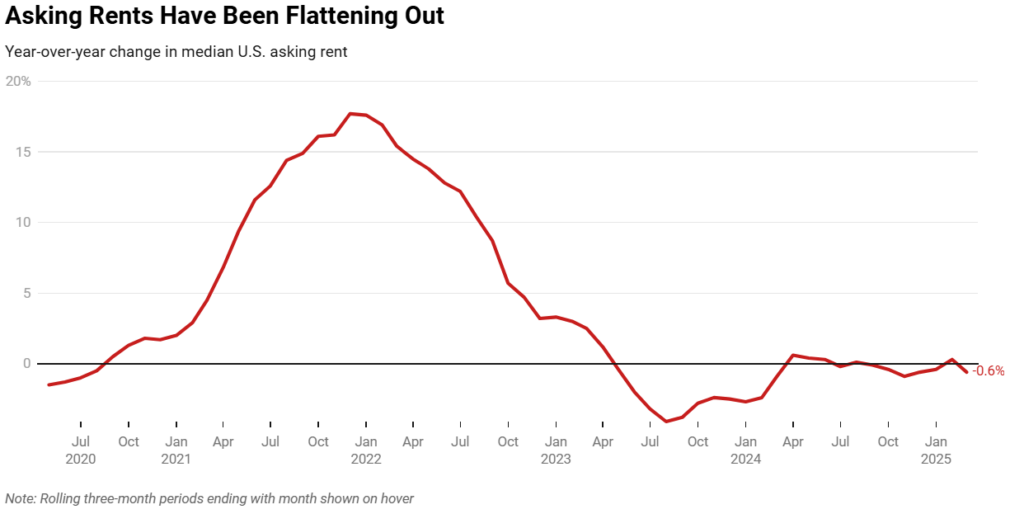

The median U.S. asking price fell 0.6% year-over-year to $1,610 in March, and rose 0.4% month-over-month—according to a new report from Redfin. Asking rents have stabilized below their 2022 record high of $1,705, and March marked the 13th consecutive month in which asking rents barely decreased or increased, with a year-over-year change of less than 1% during each of those months.

Redfin economists have been saying for months that it’s only a matter of time before rents tick up again, as apartment construction slows. This will likely motivate landlords to raise rents due to a lack of supply, meaning they will not be competing as fiercely for tenants. Redfin economists also feel that tariffs imposed by the Trump administration will have an impact on housing moving forward.

“America gets a lot of building materials from other countries, so tariffs will make building apartments more expensive. That could further hamper apartment supply, causing rents to jump,” said Redfin Economics Research Lead Chen Zhao. “Tariffs could also drive up rents by increasing demand. People may opt to rent instead of buy homes because the turmoil around tariffs has fueled widespread economic uncertainty. Tariffs have already caused huge swings in the stock market, and they will lead to higher prices for many goods and services, along with increased unemployment.”

Renters Brace for Economic Headwinds

Redfin agents confirm that some are leaning toward renting because they’re concerned about the economy.

Matt Ferris, a Redfin Premier Real Estate Agent in Northern Virginia, said one of his customers is considering selling their home and renting for a year because they’re worried about losing their job. Federal workers in Northern Virginia and Washington, D.C. have been heavily impacted by mass layoffs instituted by Elon Musk’s Department of Government Efficiency (DOGE).

Tariffs could have a big impact on the rental market partly because nearly one-quarter of America’s softwood lumber—a key material in building apartments—comes from Canada, according to the National Association of Home Builders (NAHB).

According to the NAHB, $204 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2024. Of this share, $14 billion of those goods were imported from outside the U.S., with approximately 7% of all goods used in new residential construction having originated from a foreign nation.

The tariffs announced will hike up the price of imported products, and that price increase is generally absorbed by the importer or passed on to the end consumer of the good, usually in some combination. For most goods, the cost is passed on to consumers. Any tariff on international building materials will inevitably raise the cost of housing, with consumers absorbing those costs in the form of higher home prices.

“President Trump announced a sweeping range of tariffs that have sent the markets recoiling, and the impact of which will be seen in mortgage rates reported in the coming weeks,” observed Realtor.com Senior Economist Joel Berner. “The 10-year Treasury has dipped even further this morning, as investors are exiting the stock market, so it’s likely that mortgage rates will continue to come down in the coming months as a result. This shock to the system will be felt in the housing market for the rest of the year.”

In terms of Canadian and Mexican imports, two essential materials used in new home construction, softwood lumber and gypsum (used for drywall), are largely sourced from these two countries. NAHB reports that of the $8.2 billion worth of sawmill and wood products imported in 2024, nearly 72% of these imports came from Canada. Total imports of sawmill and wood products from Canada totaled $5.9 billion. The U.S. imported $481 million worth of lime and gypsum products in 2024, with 74% of these products originating from Mexico. Imports of lime and gypsum products from Mexico totaled $354 million in 2023. Additional raw materials, from steel and aluminum to home appliances, are sourced from China.

“Tariffs may sound like a strategy to boost U.S. manufacturing, but for working families, they hit like another bill they can’t afford,” said Marisa Calderon, Prosperity Now President & CEO. “A 25% tariff on building materials could raise the cost of a modest home by up to $10,000, which is the difference between qualifying for a mortgage and getting priced out.”

Post-Pandemic Market Recovery

During the pandemic moving frenzy, rents skyrocketed because there weren’t enough apartments to meet surging demand. Builders then ramped up construction, which caused rents to fall in 2023 and early 2024 because landlords were competing for tenants. There are still a lot of newly built apartments coming on the market, which is keeping rent growth at bay. But renter demand is strong due to high homebuying costs, which means rent declines are also limited—for now.

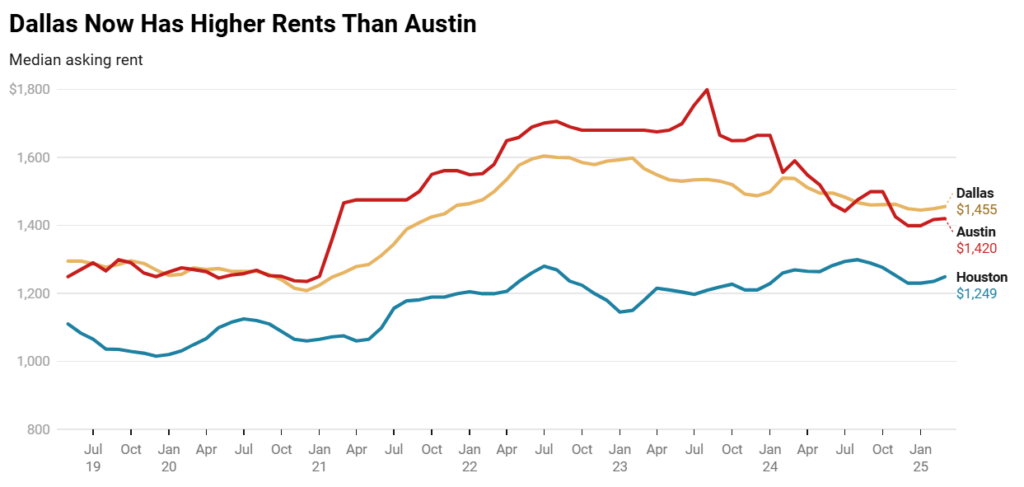

In Austin, Texas, the median asking rent dropped 10.7% year-over-year to $1,420 in March—$379 below its record high. That was the largest decline in percentage terms among the 44 major U.S. metropolitan areas Redfin analyzed. Austion was followed by San Diego (-9.7%); Portland, Oregon (-7.8%); Minneapolis (-7.8%); and Raleigh, North Carolina (-6.8%).

Texas was one of the top homebuilders during the pandemic building boom, which is one reason Austin is seeing such a large decline in rents. The recent declines mean Austin is no longer the state’s most expensive big city for renters. Asking rents rose most in Cincinnati (12.1%); Providence, Rhode Island (11.4%); Cleveland (10.6%); Washington, D.C. (8.5%); and Baltimore (8.4%).

Redfin Premier Agent Cody Brownfield said Cincinnati has seen an influx of new apartments, but not enough to meet demand, which is one reason rents are climbing. Many of those new apartments are also in high-priced buildings, he added.

Click here for more on Redfin’s report on rental trends nationwide.